Why You Should Use an Operational Income Statement for Analytics and Planning

The income statement is one of the three essential financial statements, providing a detailed accounting of the revenues earned and expenses paid during a specific accounting period. Basically, it reports the company’s financial success or failure and is a valuable tool for CFOs primarily focused on improving profitability and increasing cash flow.

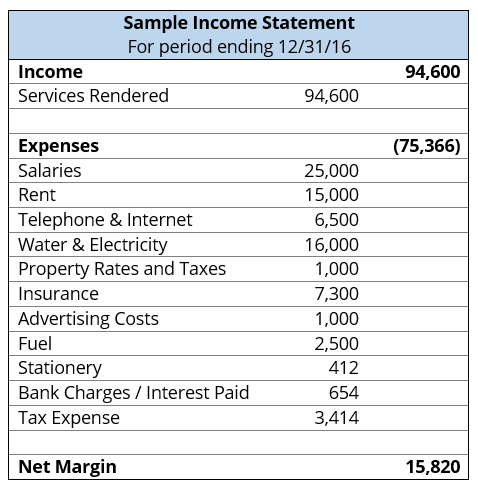

Typical income statements provide a financial view, not an operational one. So, as a business leader responsible for growing the business, your ability to see where revenues and expenses originated and the root cause is limited using a traditional income statement. A quick example in Figure 1 shows line items for Rent and Water & Electricity, but there is no way to pinpoint where these expenses were incurred. Without visibility into the root cause of the expenses generated, it is nearly impossible to confidently predict the effect of changing conditions on the company’s net margin.

Figure 1. Sample Financial Income Statement

Operational Income Statement Capabilities

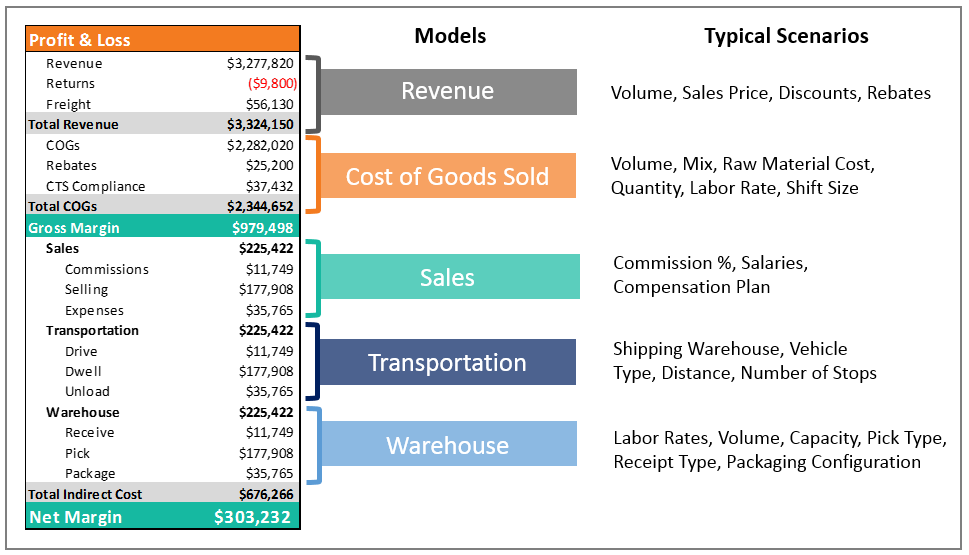

With an operational view of the income statement, you have access to additional detail not available with a traditional view. The data is separated by activities with the amounts calculated using cost drivers. The operational view segments the additional detail into several areas like revenues, cost of goods sold, sales, transportation, and warehouse and ends with a net margin amount (Figure 2). The net margin calculation is specific to the type and quantity of products manufactured and sold, the terms of the contracts signed, and the methods used to get the product to the customer.

While understanding past period performance is important for CFOs, exposing how anticipated changes benefits or impedes net margin growth in future periods is more valuable in order to make more informed decisions faster.

Figure 2. Operational Income Statement

Using an integrated costing and profitability approach and tools that provide centralized data and shared logic, you can spring-board into expanded simulation capabilities using your income statement. Figure 2 shows the operational income statement grouped into five areas along with typical cost drivers that CFOs are most interested in testing. Adjust any variable and recalculate the income statement to see the restated net margin. Then compare the simulation to actual income statements, other accounting periods or other simulations to see the variances.

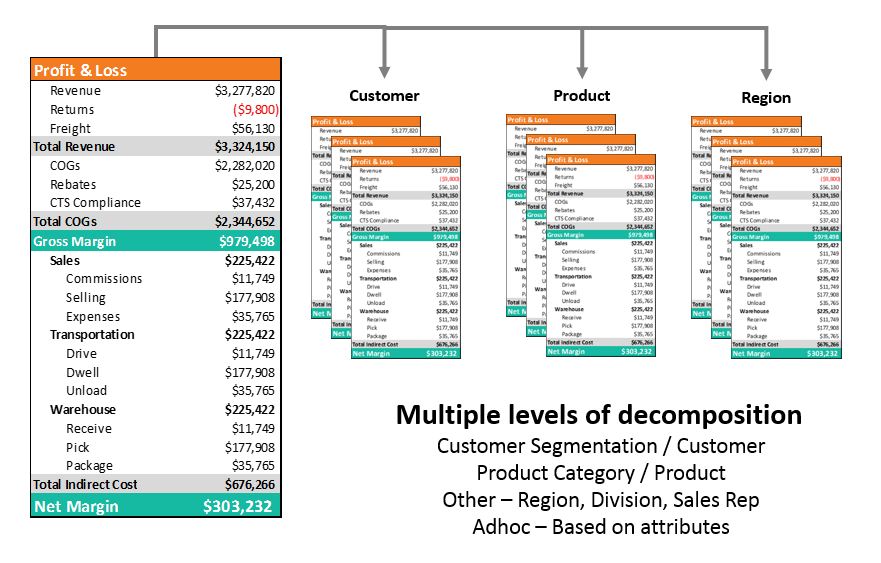

While a company-wide view of the operational income statement is valuable for analysis and simulations, these capabilities are equally valuable at lower levels of the company. You can decompose the income statement customers, products or any relevant business dimension creating a powerful analytics tool for business and line managers (Figure 3). Giving managers the ability to immediately see the direct impact of changes to their future profits empowers them to make the best possible operational decision that also boosts net margins.

Figure 3. Decomposition View of Operational Income Statement

Building Your Own Operational Income Statement

Operational income statement analytics requires data from all corners of the company. Many companies turn to cfo outsourcing services to ensure their financial information is kept up to date. But for larger and more complex companies or business processes, spreadsheets bring a host of problems (data and logic integrity, sharing and scalability of spreadsheets, limited security and no auditability) that make it fairly impossible to generate accurate results in a timely manner. Using planning and forecasting applications can provide more visibility and robust capabilities, but their results are appreciably limited by the lack of true cost detail.

By incorporating an enterprise-level cost and profitability platform, companies can build, manage, and simulate each segment of the income statement using the same data and logic to provide true apples-to-apples comparisons. At 3C Software, we help companies gain true insight into their costs and profits. With our platform ImpactECS, companies build sophisticated accounting and finance models like Operational Income Statements that places authentic analytical power in the hands of business leaders.

Learn more about the companies we help establish robust costing and profitability practices with ImpactECS.

Author: Rich LaSalle, Director of Professional Services at 3C Software