The Value of Providing More Accurate Costing- Part 2

This is the second blog of three on how management accountants can become more strategic advisors based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

In the first blog, we focused on the first two areas of management accounting practices that concern business professionals. Now, we will cover the next three areas that management accountants can work on to become more strategic within their organization.

Do Management Accountants Hide Information?

Many times, management accountants will come across calculations and practices that are flawed and do not represent the true financial value of the company. There are a few reasons why a management accountant may not communicate this information such as not wanting to take the time to explain the accounting side of the equation, or not wanting to burden the decision makers with a problem. Regardless of the issue, communication is imperative when this happens in an organization because without knowledge of incorrect information, major decisions are made based on incorrect information. A great company will fail if it is run on poor information.

Are Management Accountants Creators of Their Dysfunction?

What is the reason for dysfunction in management accounting? For one, some believe that inaccurate costing will not affect the business. Some also have the mindset that the extra effort to go back and fix misinformation will not benefit the company’s decision making process. Cost accuracy is determined by properly modeling activity costs with their drivers, so it is important that management accountants recognize the value of their position and the need for accurate information within the organization. The value of timeliness is also important for management accountants to understand. The most strategic decisions can be made with the right information in the quickest time.

Are The Methods Wrong?

Now that we have seen the clear value of providing accurate costing, we can take a deeper look into the methods used and how management accountants need take accountability for how their work affects major decisions in their organization.

It is important to note that some companies are not using and activity-based costing method when their conditions call for it. Not using the appropriate method provides inaccurate and misleading information to their decision makers who are making strategic decisions based on that flawed information.

“If decision makers don’t trust the information or don’t get the right amount of detail in the information with the right level of accuracy at the right time, they probably won’t use the information.”

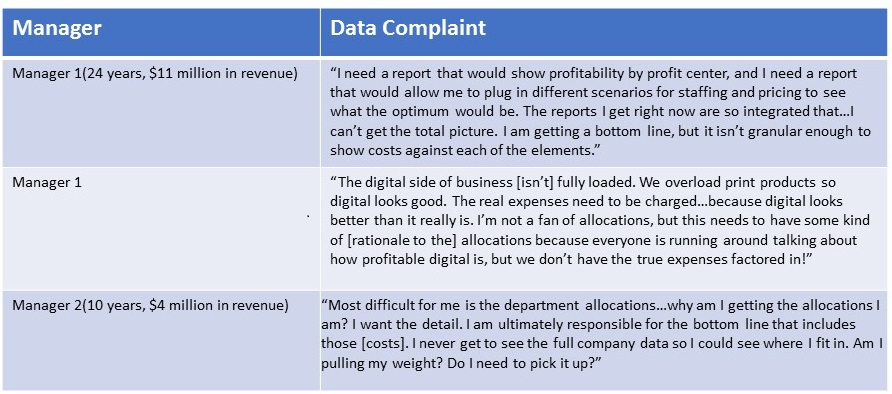

The article gives these examples of data not having the right detail, right accuracy, and/or right timeliness:

How can they solve some of these complaints? Today, anyone with an enterprise modeling tool, such as ImpactECS, would be able to combat these issues because these tools help finance professionals achieve accurate, detailed costing at a very granular level in a timely fashion.

To continue reading on to Part 3 of this blog, Click Here!

To read the article in its entirety, Start Here.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!