Better Together – Connecting Costing, Quoting, and Pricing

In the realm of business, the ultimate goal is to generate profit, and one of the simplest ways to achieve this is by selling products at a price that exceeds the costs of production and delivery. While the concept might be straightforward, the execution is far from simple. Achieving profitability requires a deep understanding of costs, a strategic approach to pricing, and the ability to align these crucial elements seamlessly. In this article, we explore the critical connection between costing, quoting, and pricing and how technology can streamline these processes to optimize profitability.

At its core, profitability hinges on a straightforward principle: make sure that the price at which you sell your products exceeds the cost of sourcing, making, and delivering them. Sounds simple, right? However, the reality is that determining these costs accurately and setting appropriate prices involves complexities that are far from easy to navigate.

Diverse Pricing Approaches: Finding the Right Fit

When considering pricing strategies, businesses are presented with a range of approaches that are tailored to suit specific circumstances and goals. These diverse pricing methods encompass three primary strategies, each offering a distinct perspective on how to determine the right price point for products and services.

The first approach is the Market/Regulatory-Based strategy. This method places less emphasis on direct cost considerations and instead draws heavily from the fluctuations and dynamics of the market itself. It is particularly valuable for analyzing post-sales profitability and understanding how market conditions impact pricing decisions. By aligning pricing with market trends, businesses can make informed choices that reflect the current demands and competitive landscape.

The second commonly used approach is Cost Plus Pricing. In this method, meticulous calculations of costs associated with production, sourcing, and delivery are performed. These costs are then augmented by adding a predefined margin to determine the final price. While this approach is often perceived as fair due to its transparency in accounting for costs, it’s essential to recognize that it might not always maximize overall profitability. Careful consideration is required to strike the right balance between fair pricing and optimal financial outcomes.

Lastly, the Value-Based Pricing approach offers a different perspective. This strategy is tailored to cater to specific customer segments by aligning pricing with the perceived value that the product or service provides to customers. In essence, the price is set based on what customers are willing to pay for the unique benefits and value they receive. This approach is especially relevant for products that offer distinct advantages over competitors or cater to a niche market.

In choosing between these strategies, businesses need to weigh their unique context, goals, and the expectations of their target audience. The decision ultimately hinges on understanding the interplay of costs, market dynamics, and perceived value in order to arrive at a pricing strategy that not only ensures profitability but also resonates with the market and drives sustained business success.

Understanding the Costing Challenge

Costs go beyond the tangible expenses of production. In addition to direct costs like materials and labor, there are customer-driven costs, behavior-related costs, competitive market costs, and market condition costs. Understanding and calculating these multifaceted costs is crucial for an accurate pricing strategy.

The journey of calculating costs from sourcing raw materials to delivering the final product might appear straightforward, but there are several challenges that hinder precision:

- Communication and Data Silos: Different teams in an organization often operate in isolation, leading to fragmented information and misaligned expectations.

- Misaligned Expectations: Decision-makers’ expectations might not align with established business processes, leading to inaccurate cost projections.

- Effort vs. Time vs. Accuracy: Balancing the effort invested in calculating costs with the time available and the need for accuracy can be complex.

The Nexus of Costing, Quoting, and Pricing

To unravel this complexity, organizations need to embrace a comprehensive approach that integrates costing with your quoting and pricing processes. By doing so, they can create a strategic framework that not only calculates costs accurately but also leverages this data for informed pricing decisions. A robust system should enable the analysis of various pricing models and even the creation of custom models tailored to the organization’s goals.

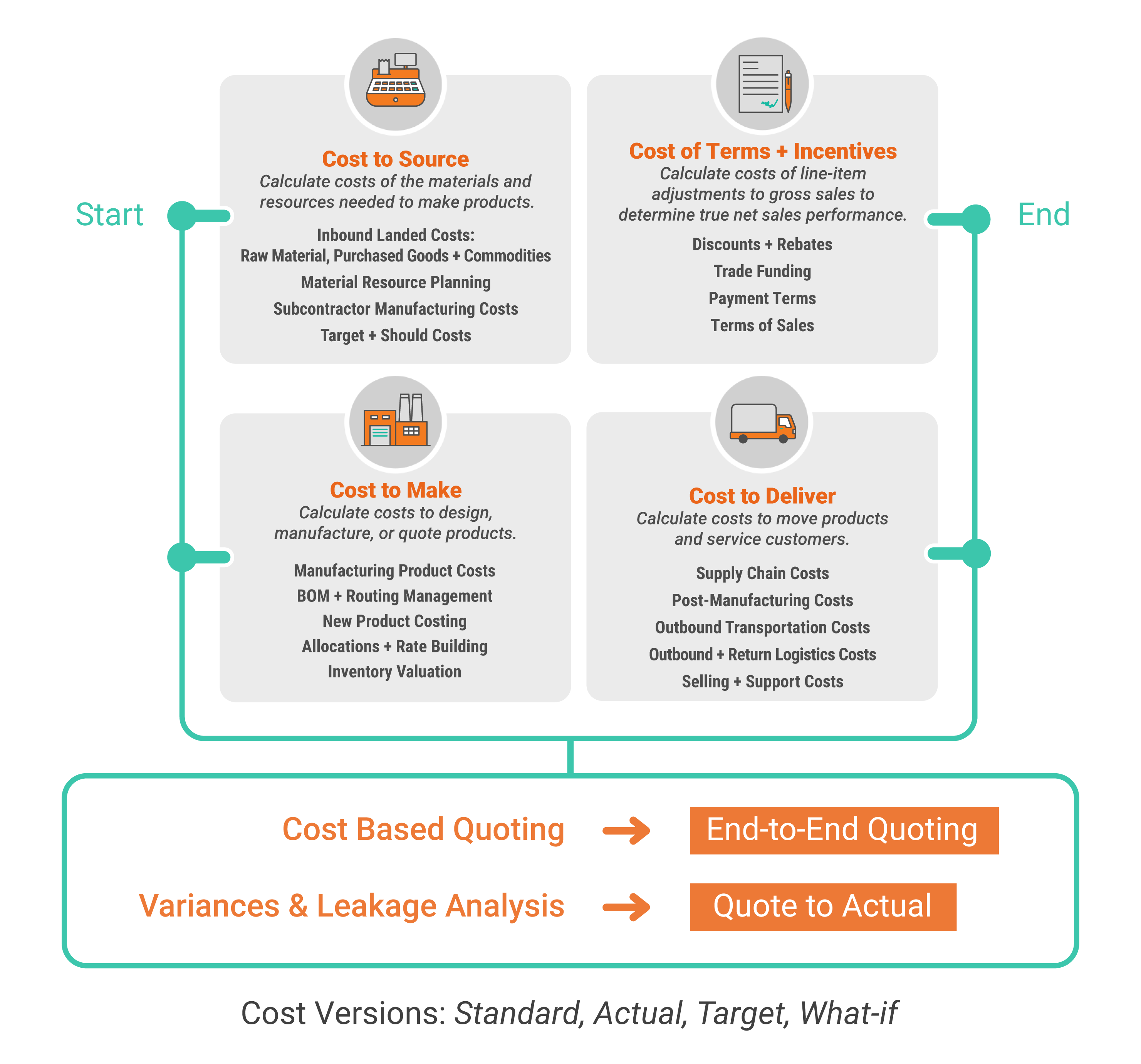

A critical component of this approach is the Cost and Profit Framework, which encompasses four essential areas: Cost to Source, Cost to Make, Cost to Deliver, and Cost of Terms and Incentives. Innovative solutions like ImpactECS provide the means to calculate costs within each of these areas while maintaining multiple cost versions for comparison and simulation.

You can leverage the Cost and Profitability Framework to enable key processes are critical to understand and optimize quote performance. The first, Cost-Based Quoting, involves integrating a comprehensive end-to-end costing process within the quoting function. This approach ensures precise calculation of all costs, from raw materials to overhead, resulting in pricing that accurately reflects your anticipated operational expenses.

The second, Quote to Actual, involves comparing initially quoted costs with actual expenditures during production and delivery. This analysis reveals the accuracy of quoting practices, enabling your company to determine the true profitability of every quote you win.

How is Cost-Based Quoting different from CPQ

The Cost-Based Quoting (CBQ) process is a game-changer for organizations where a traditional CPQ process falls short. The traditional CPQ approach entails assembling a predetermined set of product options or attributes (Configure), aggregating the associated prices for each selected element (Price), and subsequently furnishing the finalized pricing to the customer (Quote).

However, the foundation of traditional CPQ applications rests on the assumption that all conceivable options and features for novel products are already developed, cost-assessed, and assigned prices. This presumption becomes untenable within the context of engineer-to-order scenarios. Effectively generating quotes for new projects necessitates the preliminary tasks of conceptualizing, evaluating costs, and determining pricing for the product before presenting a quote to the customer.

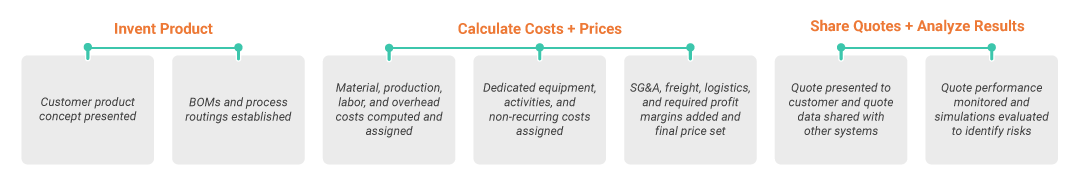

CBQ involves three primary phases, each influenced by stakeholders, data requirements, and evaluation activities. This process covers:

- Inventing the Product: Customer-presented product concepts are turned into structured Bills of Materials (BOMs) and process routings.

- Calculating Costs and Prices: Detailed costs, including material, labor, overheads, dedicated equipment, and non-recurring costs, are computed. Strategic elements like SG&A, freight, logistics, and profit margins are incorporated to determine the final price.

- Sharing Quotes and Analyzing Results: The quote is presented to the customer, and the data is shared across systems. Ongoing monitoring and simulations are used to identify potential risks.

Designing your CBQ process

To establish a state-of-the-art Cost-Based Quoting (CBQ) process, keep these key attributes in mind. First, make sure your process helps you manage the process of creating quotes and managing the quoting process. Next is the ability to perform dynamic cost calculations leveraging detailed bill-of-materials (BOM) and routing configurations to perform accurate and timely cost and price version analyses. Third, the process should support what-if simulations, giving you the tools to assess various scenarios and their potential impact on costs and pricing, enhancing the ability to make informed decisions. Data integration and the consolidation of tribal knowledge into systems can ensure cost calculations and pricing strategies are based on a holistic understanding of all relevant factors. Lastly, decision-making views driven by data provide insights and analytics to allow for agile adaptability to external changes and your business can respond swiftly to market fluctuations, customer demands, and other variables. Overall, a well-rounded CBQ platform equips businesses with the tools needed to navigate the intricacies of cost-based quoting with efficiency and precision.

Conclusion

The alignment of costing, quoting, and pricing is a strategic move that holds the key to sustained profitability. As businesses navigate competitive markets, customer requirements, and fluctuating market conditions, the ability to accurately calculate costs and strategically set prices becomes paramount. By leveraging technology and embracing comprehensive platforms like ImpactECS, organizations can master this intricate interplay and position themselves for a future of informed decisions and enhanced profitability.