The Ledger

Curated content foranalytical business leaders

How Endries International Unlocked Customer-Level Profitability with ImpactECS

In the world of industrial distribution, visibility into customer profitability can be the difference between growth and stagnation. For Endries International, a global distributor of industrial components, understanding which customers generate the most value—and why—was a strategic imperative.

In the world of industrial distribution, visibility into customer profitability can be the difference between growth and stagnation. For Endries International, a global distributor of industrial components, understanding which customers generate the most value—and why—was a strategic imperative.

But like many companies, Endries faced a challenge: their existing systems didn’t provide the level of detailed, trustworthy insight they needed to analyze performance at the customer level.

The Problem: Insights Buried in Spreadsheets

Endries’ ERP system provided solid insight into customer profitability at a direct margin level, but it lacked the ability to incorporate cost-to-serve factors needed to see true profitability. Data was dispersed across reports and spreadsheets, making it difficult to:

- Analyze profitability by customer with complete accuracy

- Understand how service, freight, and delivery costs affected margins

- Align pricing and sales strategies with overall profitability

Without a unified view, teams spent more time assembling data than using it to uncover the full picture of customer performance.

The Solution: A Targeted Deployment of ImpactECS

To overcome these limitations, Endries turned to ImpactECS by 3C Software, choosing a focused deployment strategy that would deliver rapid and actionable insights. Together, we designed a profitability model that combined financial and transactional data to analyze individual customer performance—revealing margin contributions, revenue patterns, and EBITDA drivers.

Seamless integration with existing financial systems ensured consistency and accuracy, while a structured training program empowered Endries’ internal analysts to take ownership of the model from day one.

What’s in the Customer Profitability P&L?

A central outcome of the deployment was a customized Customer Profit & Loss Statement—a clear, data-rich tool that transforms rows of transactions into actionable insight. Each line in the P&L represents a customer and includes a comprehensive view of financial and operational performance. Key elements include:

- Revenue: Total invoiced sales to the customer over the analysis period, including both direct purchases and any program-based revenue. This provides a baseline for evaluating each customer’s overall economic value to the business.

- EBITDA: A critical measure of the customer’s profitability, EBITDA reflects net earnings after factoring in cost-of-goods-sold and cost-to-serve components. This gives a clearer picture of operational contribution without accounting distortions.

- Margin %: Calculated as EBITDA divided by revenue, this metric helps compare profitability across customers of different sizes. It highlights high-revenue, low-margin customers that may appear valuable on the surface—but underperform relative to their peers.

EBITDA Contribution %: Shows how much each customer contributes to total EBITDA across the portfolio. This helps prioritize top profit drivers and identify accounts that may warrant special attention, investment, or protection.

EBITDA Contribution %: Shows how much each customer contributes to total EBITDA across the portfolio. This helps prioritize top profit drivers and identify accounts that may warrant special attention, investment, or protection.- Tier Classifications: Customers are segmented into categories—such as High Revenue / High Margin, Low Revenue / High Margin, or High Revenue / Low Margin—allowing for targeted strategies based on financial performance. These tiers help drive differentiated pricing, service levels, and sales focus.

These enhanced metrics empower the Endries team to answer questions like:

- Who are our most profitable customers—and what makes them different?

- Which accounts drive top-line growth but underdeliver on margin?

- Are there overlooked customers with strong margins and growth potential?

- Where can we adjust pricing, service levels, or terms to improve profitability?

By surfacing these insights, the Customer P&L becomes more than a financial report—it’s a strategic lens that helps the business make smarter decisions across pricing, sales, and account management.

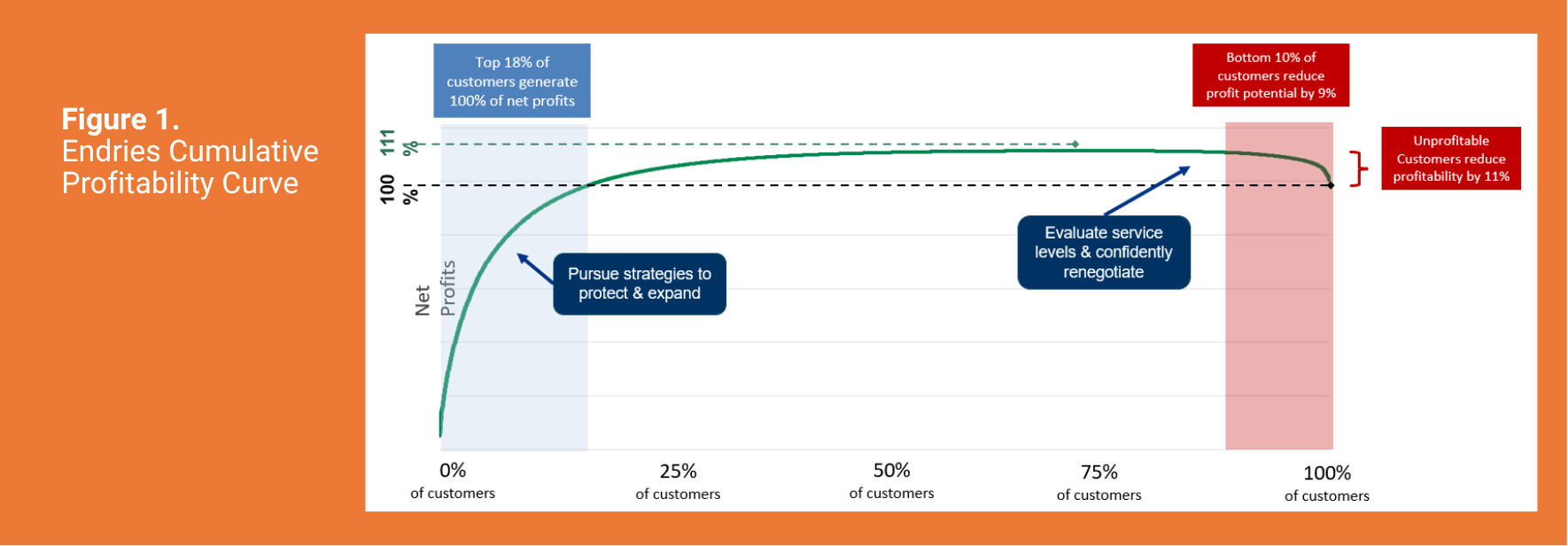

In addition, the ImpactECS model enables Endries to generate a cumulative profitability curve (Figure 1) that ranks customers from most to least profitable. This visual analysis highlights the small percentage of customers responsible for the majority of total profit, as well as those that contribute little—or even negative—value. With this insight, Endries can prioritize high-performing accounts, reassess unprofitable relationships, and guide strategic decisions with a clearer understanding of overall customer impact.

The Results: Better Decisions, Powered by Better Data

With ImpactECS in place, Endries International has a trusted system that delivers consistent, customer-level profitability insights across the organization. The finance team now spends less time compiling data and more time analyzing it—enabling a deeper understanding of what drives profit at the account level. Sales and pricing teams can make smarter, data-backed decisions around customer strategies, service levels, and contract negotiations. And because the model is fully owned and operated by internal analysts, Endries can adapt and scale their insights without relying on IT. The result is a more aligned, proactive organization—where every team has access to the same profitability data, speaks the same financial language, and is focused on driving margin improvements and long-term customer value.

Learn more about Cost-to-Serve Analytics at www.3csoftware.com/solution/cost-to-serve

From Trade Uncertainty to Cost Clarity: Tariff Scenario Planning at Plexus

As global trade dynamics shift and tariffs continue to reshape supply chains, electronics manufacturing service providers like Plexus are under pressure to respond quickly, quote competitively, and maintain margins in a volatile cost environment. With operations across multiple geographies and a complex bill of materials for each product, understanding how trade policies affect cost-to-serve is no small task.

Understanding the Impact of Tariffs in Electronics Manufacturing

In recent years, electronics manufacturing service providers have faced increasing tariff pressures—particularly from U.S.-China trade tensions, shifting free trade agreements, and region-specific duties on key components and raw materials like semiconductors, aluminum as well as finished goods. For companies like Plexus, which sources components globally and assembles products across a global manufacturing network, even small changes in tariff structures can have a ripple effect on product cost.

Tariffs not only raise direct costs but also force decisions about where to manufacture, how to source components, and how to price final assemblies for customers in different regions. To navigate this complexity, Plexus turned to ImpactECS, a cost and profitability modeling platform, to bring clarity to these cost drivers and integrate tariff scenarios directly into their quoting process.

Cost-Based Quoting with ImpactECS: A Strategic Foundation

Cost-based quoting allows companies to build price proposals using real operational and financial data—factoring in materials, labor, overhead, logistics, and now, trade-related costs like tariffs. Unlike market-based or margin-back pricing approaches, cost-based quoting ensures prices reflect the true economics of delivering the product, providing both internal confidence and external transparency.

Plexus uses ImpactECS as the engine for this process, modeling every cost component that goes into their assemblies. The system allows them to simulate changes in input prices, regional labor differences, and external cost drivers, like tariffs, with precision.

How Plexus Enhanced Their Quoting Model for Tariff Visibility

- Regional Labor Cost Simulator: Plexus developed a labor cost simulator to evaluate how different manufacturing locations impact unit cost. For example, if relocating production from Southeast Asia to Mexico increases unit costs by 15%, they can compare this to the tariff-inclusive landed cost of importing from the original location. This analysis supports strategic decisions on plant utilization, sourcing, and customer pricing.

- Tariff-Adjusted Landed Cost Calculation: Tariffs often apply to specific components rather than finished goods. Plexus enhanced their model to calculate revised landed costs by applying tariff rates at the raw material or component level. This level of granularity enables accurate costing—even when a single component in a multi-part assembly is subject to a new duty.

- Configurable Tariff Presentation in Customer Quotes: Customers often have different preferences when reviewing pricing proposals. To accommodate this, Plexus added functionality to customize how tariffs appear in quotes—whether bundled into the material cost or broken out as a separate line item. This flexibility supports transparent communication and builds trust.

Strategic Outcomes: Visibility, Agility, and Confidence in a Shifting Cost Landscape

With the enhancements to their ImpactECS cost-based quoting model, Plexus isn’t just reacting to tariffs—they’re building a proactive strategy that strengthens customer relationships, improves operational decision-making, and protects profitability. These capabilities matter now more than ever, as manufacturing leaders are called to respond faster and smarter to a constantly changing global trade environment.

- Simulate and compare sourcing scenarios with tariff exposure included: Plexus can evaluate “what-if” scenarios across different manufacturing regions, factoring in both operational costs and tariff implications. This is critical for assessing the full landed cost, not just labor or material expenses, when considering new production locations or suppliers. These simulations help the team make confident, data-backed decisions on where and how to build products without compromising margin targets.

- Quickly adjust quotes as trade policies shift: When tariff rates change or new duties are introduced, Plexus doesn’t have to rebuild models from scratch. Instead, they can update inputs and generate revised quotes in real time. This speed and flexibility is essential in today’s environment, where price agility is often the difference between winning and losing a bid.

- Provide transparent and defensible pricing to customers: With the ability to show tariff impacts as a separate line item or embed them into material costs, Plexus can tailor price proposals to meet customer expectations. This transparency builds trust, reduces pricing disputes, and positions Plexus as a strategic partner.

- Align global manufacturing decisions with real cost and margin data: By connecting tariff implications to actual cost structures across regions, Plexus ensures that operational decisions like shifting production to a new site are grounded in financial reality. It’s not just about minimizing cost; it’s about optimizing for profitability across the entire supply chain.

- Strengthen internal cost governance and quoting consistency: With a centralized model inside ImpactECS, Plexus ensures that all quoting teams across geographies and product lines operate from a common data foundation. This reduces errors, eliminates version control issues, and ensures consistency in how tariff-related costs are applied across the organization.

In the face of evolving global trade policies and rising tariff pressures, Plexus leveraged ImpactECS to enhance their cost-based quoting capabilities and gain clarity into the true cost of doing business across their global supply chain. By integrating tools to simulate regional labor costs, apply tariff rates at the component level, and flexibly present pricing to customers, Plexus transformed a traditional quoting process into a strategic advantage. These capabilities enable faster, more informed decisions—supporting both competitive pricing and long-term profitability in a complex manufacturing landscape.

Learn more about Cost-Based Quoting at www.3csoftware.com/solution/cost-based-quoting

Mastering Program Profitability: Why Accurate Costing is Critical for Automotive Brands and Suppliers

The automotive industry in 2025 is more dynamic than ever, characterized by rapid technological evolution, shifting regulations, and the continued transition toward electric and autonomous vehicles. As brands and suppliers navigate this complex environment, program profitability remains a top priority—but achieving it has never been more challenging.

From geopolitical uncertainties and rising tariffs to shorter product lifecycles and heightened customer demands, companies across the automotive supply chain are facing increasing pressure to manage costs effectively while delivering quality and innovation. This makes accurate program costing a critical function—not just for maintaining margins, but for identifying opportunities, mitigating risks, and ensuring long-term success.

The Evolving Automotive Landscape: A Perfect Storm of Challenges

Automotive companies face a multifaceted set of challenges that directly impact program profitability. These include:

- Rising Costs of Materials and Components: The costs of raw materials like steel, aluminum, and lithium (essential for EV batteries) continue to climb. Additionally, supply chain disruptions and increased shipping costs exacerbate the financial burden on suppliers and OEMs alike.

- Tariff Uncertainty and Geopolitical Pressures: Proposed U.S. tariffs on goods from various countries are creating instability in global supply chains. These measures drive up costs for imported components and materials while exposing exporters to retaliatory tariffs, limiting access to international markets.

- The Shift to EVs and New Technologies: As automakers move toward electrification and autonomous driving, suppliers must invest heavily in R&D, retooling, and advanced manufacturing processes. This transition increases upfront costs and reduces margins, especially when combined with fluctuating consumer demand for hybrid, EV, and ICE vehicles.

- Sustainability Requirements: ESG (Environmental, Social, and Governance) compliance is no longer optional. OEMs are demanding sustainability from their suppliers, requiring significant investments in green materials and carbon-neutral manufacturing processes.

- Shorter Program Lifecycles: Vehicle programs are evolving faster than ever, driven by changing technology and market preferences. This reduces the time suppliers have to recover their investments, increasing the importance of precise cost management.

The Role of Accurate Program Costing in Addressing These Challenges

Accurate program costing is a cornerstone of managing these challenges effectively. Without a clear understanding of the financial impact of every decision—from sourcing materials to final assembly—companies risk eroding margins and losing competitiveness. Here are several ways accurate costing contributes to program success:

Improved Pricing and Profit Margin Management

Accurate costing allows automotive companies to set realistic pricing that reflects the true cost of production. This ensures margins are protected, even in the face of external pressures like tariffs or rising material costs. By understanding cost breakdowns, companies can also identify opportunities to negotiate better supplier contracts or optimize production processes.

Enhanced Forecasting and Risk Mitigation

Fluctuations in demand, regulatory changes, and supply chain disruptions make it difficult to plan for the future. A robust costing process enables companies to run scenario analyses and assess the financial impact of different risks. For example, a supplier can model how a proposed tariff would affect profitability and proactively adjust sourcing strategies.

Better Supplier Collaboration

Automotive programs often involve collaboration across a network of suppliers. Accurate costing facilitates transparent communication about pricing, enabling more productive partnerships. Suppliers and OEMs can work together to identify cost-saving opportunities and align with program goals.

Alignment with Sustainability Goals

Many suppliers are investing in sustainable materials and processes to meet ESG requirements. While these investments can be costly upfront, accurate costing allows companies to evaluate their long-term financial viability and identify where sustainability initiatives might generate cost savings or enhance customer value.

Faster Decision-Making

In a fast-paced industry, decision-makers must act quickly. Accurate program costing provides the data needed to make informed choices—whether it’s selecting a new supplier, adjusting production volumes, or deciding whether to pursue a specific program.

The Impact of U.S. Tariffs on Program Profitability

One of the most pressing issues in the automotive industry today is the potential impact of U.S. tariffs. As companies grapple with rising costs and shifting trade policies, accurate costing has become even more essential. Here’s why:

- Quantifying Tariff Costs: Tariffs add a variable cost to imported goods, which must be accounted for in program budgets. Companies without a clear understanding of these costs risk underestimating program expenses and over-committing to unprofitable programs.

- Identifying Alternatives: A robust costing process enables companies to evaluate alternatives, such as reshoring production, diversifying suppliers, or sourcing from tariff-exempt regions. Each option has financial implications that must be carefully assessed.

- Protecting Margins: With margins already under pressure, suppliers must determine whether to absorb tariff costs, pass them on to customers, or find cost-saving opportunities elsewhere. Accurate costing provides the insights needed to make these decisions.

Case Study: A Supplier’s Journey to Cost Optimization

Consider a Tier 1 automotive supplier specializing in powertrain components. Facing rising material costs and a proposed 20% tariff on steel imports, the company’s margins were under threat. By implementing a dedicated costing process, the supplier was able to:

- Analyze the Tariff’s Impact: The company modeled how the tariff would affect its cost structure and identified which programs were most at risk of becoming unprofitable.

- Evaluate Alternative Suppliers: Using cost data, the company compared the feasibility of sourcing steel from domestic suppliers versus suppliers in tariff-exempt countries.

- Collaborate with OEMs: Armed with accurate cost data, the supplier engaged OEM customers in discussions about potential price adjustments and opportunities to co-invest in cost-saving measures.

- Optimize Internal Processes: The company identified inefficiencies in its production line, reducing scrap rates and improving labor productivity to offset increased material costs.

As a result, the supplier maintained profitability across its programs while strengthening relationships with key OEM customers.

The Path Forward: Building a Dedicated Costing Process

In today’s complex automotive market, companies cannot afford to rely on outdated or ad-hoc costing methods. A dedicated, data-driven costing process is essential for identifying hidden opportunities and pitfalls, ensuring profitability from quote to program completion.

Key Features of a Robust Costing Process:

- Comprehensive Data Integration: Combining data from multiple sources, such as material prices, labor costs, and tariffs, ensures accurate cost calculations.

- Scenario Analysis: The ability to model different scenarios (e.g., tariff changes, supplier shifts) helps companies make proactive decisions.

- Performance Tracking: Ongoing monitoring of program costs allows companies to identify and address deviations from budget early.

- Collaboration Tools: Costing systems that facilitate communication between suppliers and OEMs streamline decision-making and improve transparency.

Why It Matters:

A dedicated costing process doesn’t just help companies avoid costly mistakes; it also uncovers opportunities to improve profitability. For example, it can highlight high-margin programs that deserve additional investment or reveal inefficiencies that can be corrected to reduce costs. Moreover, accurate costing enables companies to evaluate customer relationships—identifying which customers are consistently profitable and which may require renegotiated terms or a shift in strategy.

Conclusion

The automotive industry in 2025 presents both challenges and opportunities for brands and suppliers. Rising costs, shifting regulations, and evolving technologies make program profitability a moving target. However, companies that prioritize accurate program costing—from the initial quote to program completion—will be better equipped to navigate this complex landscape.

By adopting a dedicated costing process, automotive companies can gain the insights needed to manage risks, identify opportunities, and make informed decisions that drive long-term success. In a world where every penny counts, the ability to evaluate cost performance is not just a competitive advantage—it’s a necessity.