The Ledger

Curated content foranalytical business leaders

Tag Archives: strategic accounting

Accounting Today: 3 Steps to Improving Your Accounting Data Analytics Results

“Descriptive and diagnostic analytics ranging from inventory availability to variance analysis have been performed since Luca Pacioli created double-entry accounting. Long before user-friendly dashboards existed, we used Excel spreadsheets and charts. And before Excel? We did it by hand.

Thankfully modern accountants can leverage advanced technologies to perform analysis at scale and speed, dramatically increasing the amount of accounting and non-accounting data available to shape our analysis.”

SF Magazine: Facing the Fourth Industrial Revolution

“The FIR will require leadership to ensure members of the profession develop the skills necessary to grow into the next generation of accounting leaders. This is the opportunity to embrace the benefits of new technology and to step away from some of the early-career tedious mechanical tasks.”

Accounting Today: Companies Still Revamping Financial Processes for COVID-19

““Many companies are grappling with rapid changes and in some instances may be trying to retrofit new technologies into complex legacy system environments””.

Understand Your Customer to Understand Your Costs

Finance professionals are always focused on how much they are profiting from their customers, but only a few companies accurately report profit and loss statements for each individual customer. Why is that? If finance professionals do not have a solid understanding of the complete costs generated by each customer, it’s an impossible task. In order to deliver unique customer profit and loss statements, they must first understand their customer. In a recent article in Industry Week, Why Measure Channel and Customer Profitability, Gary Cokins discusses how understanding your customers through activity based costing will lead to more strategic business decisions.

Unfortunately, many companies do not take advantage of business events like customer contact week Australia. This creates flawed and misleading costs that don’t give sufficient visibility which ultimately leads to poor decision making for their organization.

Why do customer costs matter? In the past, most companies focused on developing standard products and services and put their efforts to buy guest posts, advertising, and selling these products to existing customers and prospects. These days companies need think outside the box and create innovative and different products to sell to not only their customers and prospects, but also to their competitor’s customers and prospects. In today’s market, companies are able to replicate their competitors’ products much faster than before. Because of this, the focus shifts to the importance of customer service in order to gain a competitive advantage, instead of only focusing on product differentiation. To have a good customer service you may need to use a business phone just like the Mitel business phones to deliver the best customer experience. You may need the help of a company like the JabberComm’s structured cabling Dallas that can provide you with innovative phone systems for better communication with your customers.

Another piece of the puzzle is that each supplier has a vast range of high and low demand customers. High-demand customers are defined as “customers that might regularly change delivery schedules, require special treatments, return goods, or frequently phone the customer service help desk.” Low-demand customers do not engage in any of these activities. The extra expenses from the high-demand customers makes them less profitable because the company is spending more money to maintain them as customers. This means that the objective is now not only about increasing market share and growing sales, but also about how to become more profitable with your existing customers and prospects. The challenge for companies is to use ABC costing with all of these aspects to calculate valid customer profitability data for strategic decision making.

Customers who purchase similar items at similar prices are still not considered the same when it comes to profitability because it is based on how demanding their behavior is to the supplier. This information provides cost visibility and transparency and shows how different variables, such as business processes and work activities, affect the cost drivers. In industries like real estate, a focus on real estate seo can help identify and target the most profitable customer segments, optimizing marketing efforts to reach the right audience and drive conversions more efficiently. If you are launching a SaaS company, you may need to create the best SaaS copy to generate leads and reach potential clients.

Source: Why Measure Channel and Customer Profitability?

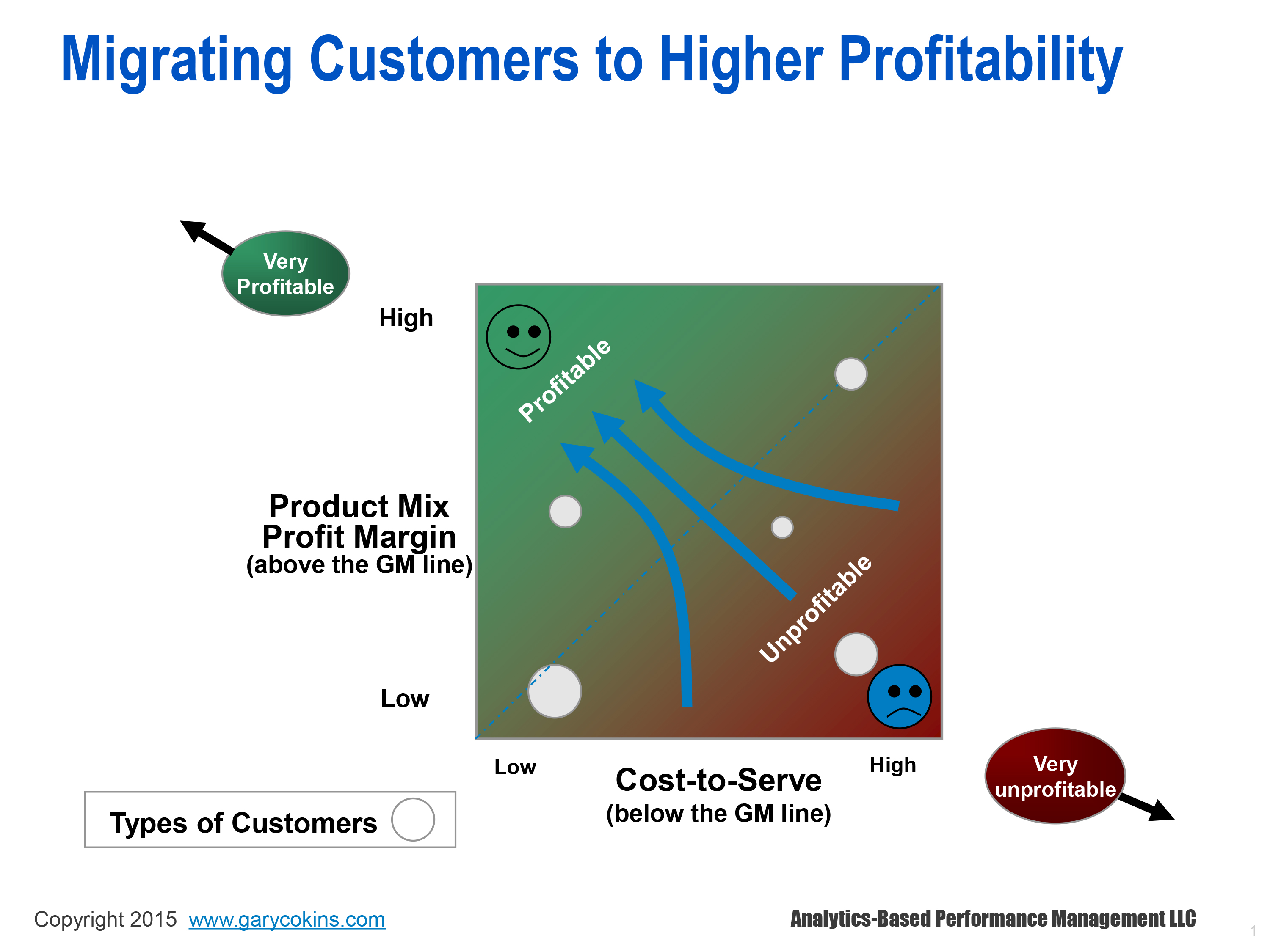

There must always be a balance between customer loyalty and continuing to increase customer profitability. The mix of products and service lines purchased and the non-product “cost to serve” are the two major layers of profit margin that must be reported in a company’s P&L. The image above combines these two layers in the graph. Any customer(s) can be found at an intersection where size of the circle reflects each customer’s revenues. This picture disproves the idea that customers with the highest sales volume are also generating the highest profits. The objective for most companies is to drive customers with the potential to spend more to the upper left corner by ways of up-selling, cross-selling and even surcharge pricing. This data also helps suppliers identify what customers are actually unprofitable. With this information, the suppliers can get SEO services to turn them into profitable customers, or decide to not waste any further efforts on them. To help you capture your own potential customers, you can also consider hiring someone with WordPress experience.

One critical reason for knowing where each customer is located on the profit matrix is to protect your most profitable customers from your competitors.

It is important that customer profitability reporting supports both sales and marketing. Management accounting helps the sales and marketing functions to satisfy shareholder desires and helps close the gap between the CFO and the needs of these teams.

A company needs to know which types of customers are important to retain, grow and win back, and the ones that aren’t worth it, this is why reading information from companies like https://www.qualtrics.com/customer-experience/closed-loop-followup/ is so important. Using this information with the Salesforce tool will help them decide how much they should be spending to retain each customer, which will in turn lead them to more strategic decision making.

For companies using an ABC methodology, ImpactECS offers a wide range of capabilities including the ability to drill-down to see how cost accumulates for each activity, identify unprofitable or under-performing activities and simulate the effect of changing drivers on cost.

The Value of Providing More Accurate Costing- Part 2

This is the second blog of three on how management accountants can become more strategic advisors based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

In the first blog, we focused on the first two areas of management accounting practices that concern business professionals. Now, we will cover the next three areas that management accountants can work on to become more strategic within their organization.

Do Management Accountants Hide Information?

Many times, management accountants will come across calculations and practices that are flawed and do not represent the true financial value of the company. There are a few reasons why a management accountant may not communicate this information such as not wanting to take the time to explain the accounting side of the equation, or not wanting to burden the decision makers with a problem. Regardless of the issue, communication is imperative when this happens in an organization because without knowledge of incorrect information, major decisions are made based on incorrect information. A great company will fail if it is run on poor information.

Are Management Accountants Creators of Their Dysfunction?

What is the reason for dysfunction in management accounting? For one, some believe that inaccurate costing will not affect the business. Some also have the mindset that the extra effort to go back and fix misinformation will not benefit the company’s decision making process. Cost accuracy is determined by properly modeling activity costs with their drivers, so it is important that management accountants recognize the value of their position and the need for accurate information within the organization. The value of timeliness is also important for management accountants to understand. The most strategic decisions can be made with the right information in the quickest time.

Are The Methods Wrong?

Now that we have seen the clear value of providing accurate costing, we can take a deeper look into the methods used and how management accountants need take accountability for how their work affects major decisions in their organization.

It is important to note that some companies are not using and activity-based costing method when their conditions call for it. Not using the appropriate method provides inaccurate and misleading information to their decision makers who are making strategic decisions based on that flawed information.

“If decision makers don’t trust the information or don’t get the right amount of detail in the information with the right level of accuracy at the right time, they probably won’t use the information.”

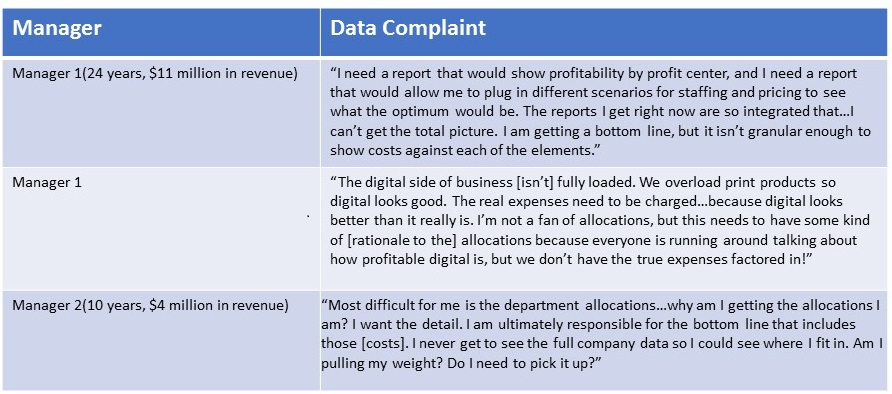

The article gives these examples of data not having the right detail, right accuracy, and/or right timeliness:

How can they solve some of these complaints? Today, anyone with an enterprise modeling tool, such as ImpactECS, would be able to combat these issues because these tools help finance professionals achieve accurate, detailed costing at a very granular level in a timely fashion.

To continue reading on to Part 3 of this blog, Click Here!

To read the article in its entirety, Start Here.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

The Value of Providing More Accurate Costing- Part 1

This is the first blog of three on how management accountants can become more strategic advisers based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

The main goal of management accounting is to understand the past, present and future of the business in order to help make strategic decisions. How can they understand their organization at such a granular level needed to make truly strategic decisions with outdated practices? A recent article in Strategic Finance magazine, Don’t Be Stuck in the Last Century, examines six areas of management accounting practices that concern business professionals, as well as ways to resolve these concerns. We’ll cover the first two areas in this post.

It is 2016 and many companies are still using accounting techniques that were used decades ago.

This image shows three different finance managers, all with different experience and different issues they are dealing within their particular organizations. The manager on the left is the most experienced and struggles with visibility of his company’s profitability. He needs real-time accurate profitability numbers so he can make more strategic decisions and make his organization more profitable. The middle manager wants more detailed allocations and company data so he knows if he is pulling his weight. The manager on the right does not like their accounting formats because she can’t manage them. She struggles to see the COGS and the value chain in the numbers and doesn’t understand the cost allocations. We want to explore how these managers can go about solving these issues so they can make the most strategic decisions for their companies.

Source: Don’t Be Stuck in the Last Century

Do Management Accountants Know What Their Internal Clients Want?

It is important that CFO’s understand the decision making needs of each department they serve because not all departments are the same. With the increasing use of technology and the internet, competitors are making faster business moves. Businesses need to realize how important it is to keep up with the changes in finance and technology to get to the forefront of the competition. Some of these changes include the timing of information and the level of detail and accuracy in their information. These are critical factors when it comes to strategic decision making.

The central issue is that CFO’s and other business leaders in the same organization see how to business should run differently. Some of these differences include the timing of decisions and how these decisions are made. Management accountants should learn how the business works and have open communication with all levels of the business so they are on the same page. Once the accountants and all internal parties know what to expect from each other, there can be an open line of communication which will aid in the strategizing for the company.

Do Management Accountants Care About Giving The Right Information to Internal Clients?

Now that we know that an open line of communication is necessary in order to know what each level of the business expects from one another, we need to make sure the right information is getting to the right people at the right time.

In some companies, CFO’s know that their management accounting data that is used internally for decision making is severely flawed, yet they do not do anything about it. Management accounting data is only useful if the data helps finance leaders make good decisions. If the data is flawed, it makes it much more difficult to make those strategic decisions. Every department has different data needs and it is important that management accountants recognize this and share correct data with the appropriate department so the business can make the best decisions.

These were the first two of the six areas of management accounting practices that concern business professionals. Stay tuned for part two in this blog series!

At 3C Software, we strive to help our customers be as strategic with their finances as possible. One of our main goals is to keep our customers up to date with the best of breed technology by using our enterprise modeling tool.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

To continue reading to Part 2 of this blog, Click Here!