The Ledger

Curated content foranalytical business leaders

Tag Archives: activity based costing

SF Magazine: ABC and Value-Stream Costing in Tandem

“Like in most areas of life, it’s generally good to have a lot of choices in accounting. Take, for instance, activity-based costing (ABC) and value-stream costing (VSC), which can be viewed as two alternative approaches to obtaining accurate cost information in complex production and sales environments. You would think that companies that adopt VSC aren’t likely to also have ABC systems. But that isn’t necessarily the case: A 2012 survey of 368 facilities employing Lean production found that 62 of them—or roughly one in six—reported a relatively high use of both ABC and VSC. Those same companies also reported the highest level of performance improvement from Lean initiatives. Clearly, these organizations weren’t treating ABC and VSC as alternatives: They were using the systems in tandem.”

Is Activity-Based Costing Worth It?

Manufacturing companies need to understand product costs accurately and in detail. This kind of information is essential for planning operations, pricing, and evaluating business margins. Activity-based costing helps manufacturers identify what products are truly profitable, the true costs of products for pricing, and what activities are driving costs. However, activity-based costing is known for being difficult to apply and labor-intensive due to the extensive data needs of the process. The trick to knowing if activity-based costing is worth the trouble is first finding a tool that can compute accurate product costs and has the capabilities to take the labor and data needs off your hands.

Read More at The Business Case >

Understand Your Customer to Understand Your Costs

Finance professionals are always focused on how much they are profiting from their customers, but only a few companies accurately report profit and loss statements for each individual customer. Why is that? If finance professionals do not have a solid understanding of the complete costs generated by each customer, it’s an impossible task. In order to deliver unique customer profit and loss statements, they must first understand their customer. In a recent article in Industry Week, Why Measure Channel and Customer Profitability, Gary Cokins discusses how understanding your customers through activity based costing will lead to more strategic business decisions.

Unfortunately, many companies do not take advantage of business events like customer contact week Australia. This creates flawed and misleading costs that don’t give sufficient visibility which ultimately leads to poor decision making for their organization.

Why do customer costs matter? In the past, most companies focused on developing standard products and services and put their efforts to buy guest posts, advertising, and selling these products to existing customers and prospects. These days companies need think outside the box and create innovative and different products to sell to not only their customers and prospects, but also to their competitor’s customers and prospects. In today’s market, companies are able to replicate their competitors’ products much faster than before. Because of this, the focus shifts to the importance of customer service in order to gain a competitive advantage, instead of only focusing on product differentiation. To have a good customer service you may need to use a business phone just like the Mitel business phones to deliver the best customer experience. You may need the help of a company like the JabberComm’s structured cabling Dallas that can provide you with innovative phone systems for better communication with your customers.

Another piece of the puzzle is that each supplier has a vast range of high and low demand customers. High-demand customers are defined as “customers that might regularly change delivery schedules, require special treatments, return goods, or frequently phone the customer service help desk.” Low-demand customers do not engage in any of these activities. The extra expenses from the high-demand customers makes them less profitable because the company is spending more money to maintain them as customers. This means that the objective is now not only about increasing market share and growing sales, but also about how to become more profitable with your existing customers and prospects. The challenge for companies is to use ABC costing with all of these aspects to calculate valid customer profitability data for strategic decision making.

Customers who purchase similar items at similar prices are still not considered the same when it comes to profitability because it is based on how demanding their behavior is to the supplier. This information provides cost visibility and transparency and shows how different variables, such as business processes and work activities, affect the cost drivers. In industries like real estate, a focus on real estate seo can help identify and target the most profitable customer segments, optimizing marketing efforts to reach the right audience and drive conversions more efficiently. If you are launching a SaaS company, you may need to create the best SaaS copy to generate leads and reach potential clients.

Source: Why Measure Channel and Customer Profitability?

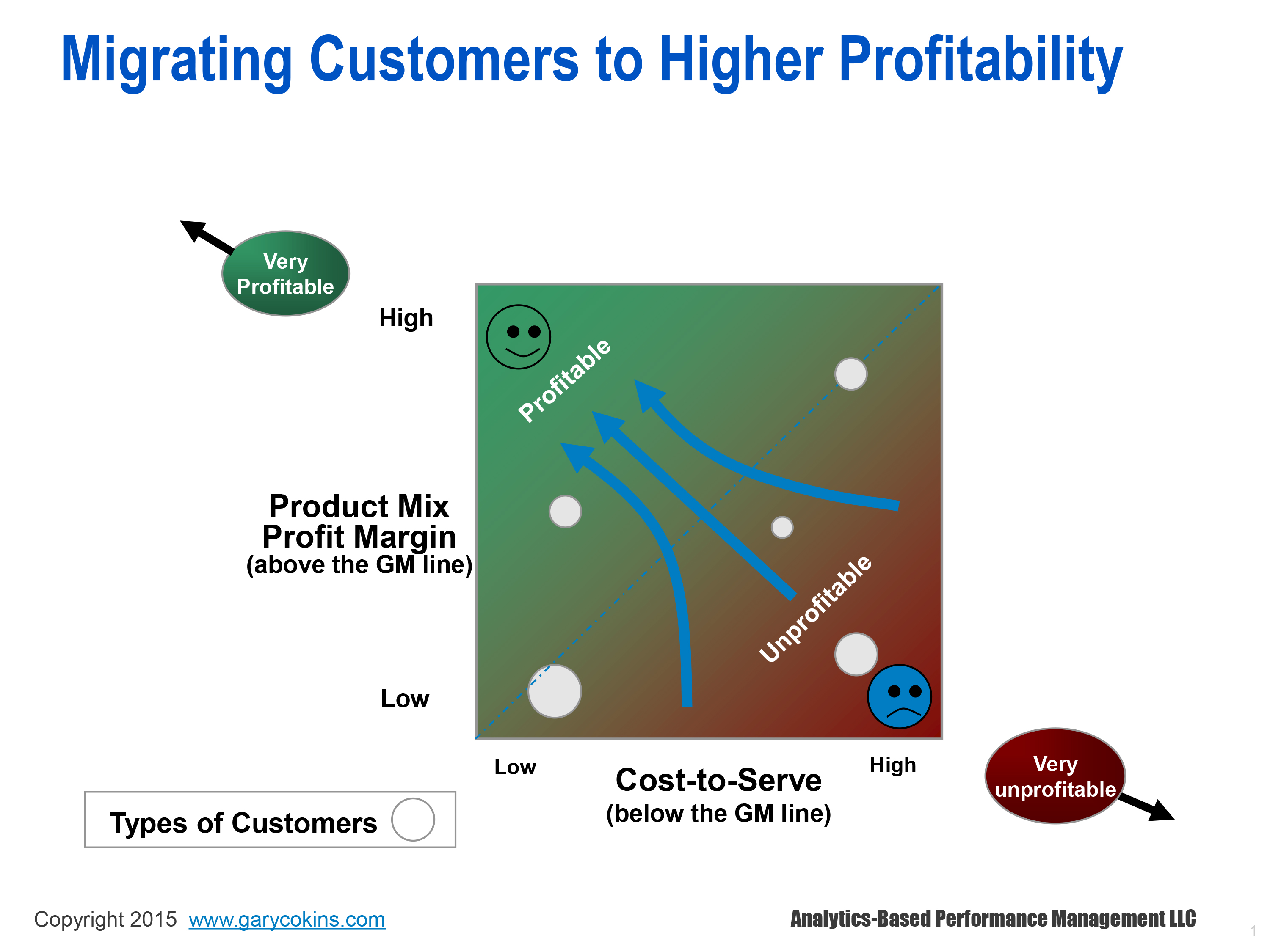

There must always be a balance between customer loyalty and continuing to increase customer profitability. The mix of products and service lines purchased and the non-product “cost to serve” are the two major layers of profit margin that must be reported in a company’s P&L. The image above combines these two layers in the graph. Any customer(s) can be found at an intersection where size of the circle reflects each customer’s revenues. This picture disproves the idea that customers with the highest sales volume are also generating the highest profits. The objective for most companies is to drive customers with the potential to spend more to the upper left corner by ways of up-selling, cross-selling and even surcharge pricing. This data also helps suppliers identify what customers are actually unprofitable. With this information, the suppliers can get SEO services to turn them into profitable customers, or decide to not waste any further efforts on them. To help you capture your own potential customers, you can also consider hiring someone with WordPress experience.

One critical reason for knowing where each customer is located on the profit matrix is to protect your most profitable customers from your competitors.

It is important that customer profitability reporting supports both sales and marketing. Management accounting helps the sales and marketing functions to satisfy shareholder desires and helps close the gap between the CFO and the needs of these teams.

A company needs to know which types of customers are important to retain, grow and win back, and the ones that aren’t worth it, this is why reading information from companies like https://www.qualtrics.com/customer-experience/closed-loop-followup/ is so important. Using this information with the Salesforce tool will help them decide how much they should be spending to retain each customer, which will in turn lead them to more strategic decision making.

For companies using an ABC methodology, ImpactECS offers a wide range of capabilities including the ability to drill-down to see how cost accumulates for each activity, identify unprofitable or under-performing activities and simulate the effect of changing drivers on cost.