The Ledger

Curated content foranalytical business leaders

Tag Archives: cost accounting

You have an ERP system. Why do you still struggle with product profitability?

Many manufacturing ERP systems are built to handle day-to-day transactions to ensure that products are purchased, inventoried, consumed, and WIP & Finished Goods are produced and shipped to customers.

These systems track direct labor, allocate indirect labor, and allow standard costs to be set up and variances calculated and reported to report progress against them.

At month end, these systems generate common reports designed to fit the needs of all customers in all industries.

However… what ERP systems don’t do is the challenge… and opportunity.

For all they do, ERP systems don’t, accurately and with true traceability, tell you what each product sold actually costs to produce. They don’t integrate all the data points, processes, and activities to represent the production chain. Many organizations aggregate purchasing, production, and other data into general buckets and spread those costs evenly over everything.

Many organizations need improved insights to confidently make informed decisions, especially in turbulent times like these. Leaders seek to gain deep, actionable insights into the areas of cost that impact your ability to grow profits. Still, the systems and processes at hand just aren’t delivering.

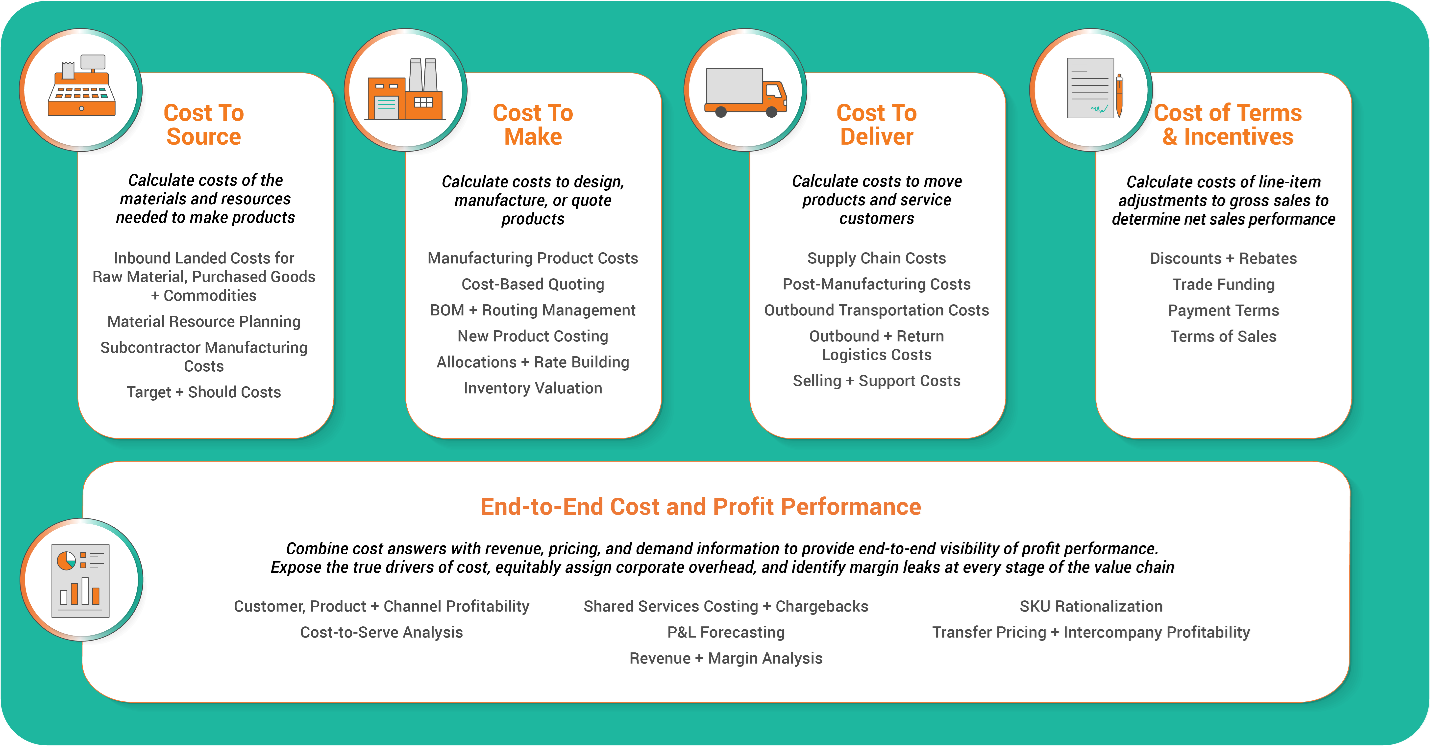

Fortunately, there is a solution that builds upon the data and processes in your ERP and any other systems you use to report costs and profits. This technology helps you focus on five critical areas: Cost to Source, Cost to Make, Cost to Deliver, Cost of Terms & Incentives, and End-to-End Cost and Profit Performance.

Cost and Profit Analysis Framework

ImpactECS by 3C Software has been built, tested, and trusted by manufacturing organizations to expose the true drivers of cost and identify profit opportunities at every stage of the value chain.

Here is what organizations must focus on and get right to be consistently profitable.

Cost to Source

Cost to Source means calculating the end-to-end costs of the materials and resources used to make the items you sell, no matter when you sell them or to whom.

Way before your product is manufactured, sourcing decisions can have a significant effect on the overall cost. Organizations often lack access to detailed cost answers at the pre-production stages, leading to decisions about products, suppliers, or orders that risk your company’s profits.

You must identify ways to protect profits through improved procurement processes, smarter designs for your products, and effective negotiations with vendor and supplier partners.

ImpactECS calculates the costs of materials, supplies, and other sourced items for the goods you expect to make.

Cost to Make

Cost to Make means fully understanding the granular activities and costs involved in designing, quoting, and manufacturing the items you sell.

Calculating product costs is a cornerstone activity for every manufacturing organization.

The best Cost to Make programs combine the financial and operational data needed to create a clear picture of this critical metric. To establish a modern costing practice, you need processes in place to calculate, maintain, compare, and simulate multiple cost versions for every unique way your products are made.

ImpactECS calculates the standard, actual, simulated, or estimated costs of your conversion processes, products, valuations, and post-production activities on one connected platform.

Cost to Deliver

Calculating the costs means understanding the costs of moving products and serving customers.

The costs of moving products and serving customers are critical to determining the profitability of customers, products, or channels.

Cost to Deliver programs give you visibility into the costs of post-production activities like special packaging or shipping requirements, distribution centers, transportation, third-party logistics costs, and service and support activities.

ImpactECS calculates the costs of your distribution and logistics network and associated support activities to unlock the cost drivers through the lens of your products or customers. Payment service providers offer comprehensive solutions for businesses to manage their payment processing needs.

Cost of Terms & Incentives

Calculating the costs of line-item adjustments means getting a complete view of gross sales to true net sales performance.

Costs of Terms & Incentives are incurred because of the decisions made when marketing and selling your products.

- You need transparency into the cost of your incentive programs offered by customers, products, or channels to know the real impact of the discounts, rebates, and other trade funding activities.

- Secondly, you must calculate the real costs of payment terms, returns, and negotiated terms to actively work to shift customer behaviors and enable more profitable relationships.

ImpactECS allows you to analyze these costs to improve net profit performance.

What Industries Does ImpactECS Serve?

Many organizations have heard promises of revolutionary tools and solutions before, only to be let down by overhyped promises of what is still in development. Or worse, just sold another ERP system.

Fortunately, ImpactECS has worked with manufacturers, distributors, and services organizations who struggle with getting access to the detailed information needed to make informed decisions.

The list of customers is well-known; Tyson, Coca-Cola, iRobot, Energizer, Micron, and WestRock, to name just a few.

3C Software’s ImpactECS platform has proven itself. It is trusted because it delivers results and answers by connecting data from across the enterprise with your defined business rules to deliver accurate, actionable, and timely results.

What are the components of the ImpactECS platform?

Forward-looking finance organizations understand it is impossible to know your profits without an accurate way to calculate and analyze the costs associated with delivering your goods or services. 3C Software has decades of experience helping companies understand their costs and delivering real business value insights from ImpactECS.

Tools

Knowing how the data connects across the enterprise is great. But realizing the impact of those connections throughout the organization requires a robust technology approach. The ImpactECS platform offers both Enterprise and Software-as-a-Service (SaaS) tools to quickly calculate, analyze, share, and maintain cost or profitability answers that are detailed, accurate, and actionable. When designing a SaaS solution, one of the primary considerations is ensuring a scalable SaaS architecture. A scalable architecture allows your platform to grow seamlessly with the increasing demands of users, ensuring consistent performance and reliability. Another key aspect of a successful SaaS strategy is evaluating SaaS pricing models. Understanding the various pricing structures available and choosing the one that aligns with your business goals can significantly impact your platform’s profitability and user satisfaction. By analyzing factors such as subscription tiers, usage-based pricing, and additional feature costs, you can make informed decisions that balance cost-effectiveness with the value delivered to users.

Insights

The Cost and Profitability Framework provides a way to evaluate an organization’s finance, accounting, operations, and other data to make better decisions at the department, business unit, or company level. The Framework helps you and your team focus on the areas of cost analysis that are critical to your company’s success.

Expertise

Our team works exclusively on solving costing and profitability analysis challenges for companies large and small. We work shoulder-to-shoulder with you to establish a costing and profitability program that delivers long-term value to your company. If you’re in the cannabis industry, you can get Cannabis Payment Processing solutions here.

How do I learn more or get started?

There is only so much that reading can do- as the saying goes, “seeing is believing.” If you want to see more, learn more, and think through how a better tool to complement, not replace, what you already have in-house, may increase your profitability, you can reach out with the button below to schedule a no-obligation demo. Visit 3csoftware.com/request-a-demo/ or email us at sales@3csoftware.com anytime, and we’ll get the ball rolling toward better costing.

CFO Magazine: 5 Accounting ‘Turnarounds’: How Manufacturing Fends Off Credit Squeeze

“For example, cost accounting takes into consideration fixed and variable costs. If a manufacturer’s operations team is only considering the cost of materials to make a widget — and leaving out the associated labor and overhead — that’s going to be a problem. It’s very difficult to make a profit when you sell something at an unknown cost.”

SF Magazine: ABC and Value-Stream Costing in Tandem

“Like in most areas of life, it’s generally good to have a lot of choices in accounting. Take, for instance, activity-based costing (ABC) and value-stream costing (VSC), which can be viewed as two alternative approaches to obtaining accurate cost information in complex production and sales environments. You would think that companies that adopt VSC aren’t likely to also have ABC systems. But that isn’t necessarily the case: A 2012 survey of 368 facilities employing Lean production found that 62 of them—or roughly one in six—reported a relatively high use of both ABC and VSC. Those same companies also reported the highest level of performance improvement from Lean initiatives. Clearly, these organizations weren’t treating ABC and VSC as alternatives: They were using the systems in tandem.”

The Value of Providing More Accurate Costing- Part 1

This is the first blog of three on how management accountants can become more strategic advisers based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

The main goal of management accounting is to understand the past, present and future of the business in order to help make strategic decisions. How can they understand their organization at such a granular level needed to make truly strategic decisions with outdated practices? A recent article in Strategic Finance magazine, Don’t Be Stuck in the Last Century, examines six areas of management accounting practices that concern business professionals, as well as ways to resolve these concerns. We’ll cover the first two areas in this post.

It is 2016 and many companies are still using accounting techniques that were used decades ago.

This image shows three different finance managers, all with different experience and different issues they are dealing within their particular organizations. The manager on the left is the most experienced and struggles with visibility of his company’s profitability. He needs real-time accurate profitability numbers so he can make more strategic decisions and make his organization more profitable. The middle manager wants more detailed allocations and company data so he knows if he is pulling his weight. The manager on the right does not like their accounting formats because she can’t manage them. She struggles to see the COGS and the value chain in the numbers and doesn’t understand the cost allocations. We want to explore how these managers can go about solving these issues so they can make the most strategic decisions for their companies.

Source: Don’t Be Stuck in the Last Century

Do Management Accountants Know What Their Internal Clients Want?

It is important that CFO’s understand the decision making needs of each department they serve because not all departments are the same. With the increasing use of technology and the internet, competitors are making faster business moves. Businesses need to realize how important it is to keep up with the changes in finance and technology to get to the forefront of the competition. Some of these changes include the timing of information and the level of detail and accuracy in their information. These are critical factors when it comes to strategic decision making.

The central issue is that CFO’s and other business leaders in the same organization see how to business should run differently. Some of these differences include the timing of decisions and how these decisions are made. Management accountants should learn how the business works and have open communication with all levels of the business so they are on the same page. Once the accountants and all internal parties know what to expect from each other, there can be an open line of communication which will aid in the strategizing for the company.

Do Management Accountants Care About Giving The Right Information to Internal Clients?

Now that we know that an open line of communication is necessary in order to know what each level of the business expects from one another, we need to make sure the right information is getting to the right people at the right time.

In some companies, CFO’s know that their management accounting data that is used internally for decision making is severely flawed, yet they do not do anything about it. Management accounting data is only useful if the data helps finance leaders make good decisions. If the data is flawed, it makes it much more difficult to make those strategic decisions. Every department has different data needs and it is important that management accountants recognize this and share correct data with the appropriate department so the business can make the best decisions.

These were the first two of the six areas of management accounting practices that concern business professionals. Stay tuned for part two in this blog series!

At 3C Software, we strive to help our customers be as strategic with their finances as possible. One of our main goals is to keep our customers up to date with the best of breed technology by using our enterprise modeling tool.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

To continue reading to Part 2 of this blog, Click Here!