The Ledger

Curated content foranalytical business leaders

Tag Archives: costing

CFO Journal: Tap Indirect Procurement as a Source of Savings

“Before they can make strategic decisions about indirect purchases—such as standardizing all cost-related policies—CFOs need to arrange the fragmented pieces into a full picture. Working with the chief procurement officer (CPO), they need to assemble and consolidate data from the many internal, non-procurement functions that have been making their own deals.”

FP&A Trends: How to Manage Profitability in Uncertain Times

“Profitability is more than revenue minus cost…For example, along with revenue, costs/expenses, it also is important to know the life cycle of the product, or the entire product portfolio and its business drivers. Macro concepts like the business sector and economy also play part in arriving at profitability holistically.”

CFO Dive: 5 CFO trends to watch in 2022

“But few issues that CFOs can expect to deal with in 2022, from pricing goods and services to setting wages and salaries to managing taxes, will be addressed without the specter of inflation hanging over them.”

CFO Journal: Supply Chain Snarls Throw a Double Punch to Costs and Sales

“Among surveyed CFOs, 44% report that supply chain shortages or delays increased their companies’ costs by 5% or more. Nearly one-third (32%) note that their 2021 sales have fallen due to delays or shortages, with 28% expecting future sales this year to suffer. More than two-thirds of respondents (69%) indicate that their supply chains would become more diversified over the next three years, with 23% expecting greater vertical integration of their supply chains.”

The Wall Street Journal: Rising Shipping Costs Are Companies’ Latest Inflation Riddle

Manufacturing and supply chain professionals: How are you taking control of costs in your business during this volatile time?

“Transportation costs—typically a fraction of a finished product’s price—are emerging as another supply-chain hurdle, overwhelming some companies already paying more for raw materials and labor.”

The Value of Providing More Accurate Costing- Part 3

This is the final blog in the series on how management accountants can become more strategic advisers based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

In the first two blogs, we focused on five areas of management accounting practices that concern business professionals. Now, we are going to focus on what changes can be made to solve some of these concerns so business leaders can focus on making the best strategic decisions for their organization using the best data.

Do Emphases In The Discipline Need To Change?

Where should the emphases be in the business? Managers should be shifting from reacting to “after-the-fact” reports to anticipating the future with predictive data analysis and being proactive with their decision making.

To do this, management accountants will need to communicate internally to adequately understand what the company’s customers want and how they behave.

“They have to open their eyes, focus clearly on the customer, and become familiar with what the customer needs and wants.”

Management accountants need to remember the most important thing: their customers. To provide the best possible service to their customers, accountants must focus on providing the best and most accurate information. Putting the customer relationship first while having strong communication internally is imperative to changing the way management accountants operate.

Finance professionals won’t evolve from “bean counters” to “bean sprouters” if they continue to use outdated accounting practices. Using the wrong methods, ignoring bad data, and using several different styles of accounting will create more issues for the business. Big Data and business analytics are becoming the focus for marketing and operational professionals, so if management accountants don’t learn to apply advanced and accurate analytics, their jobs will soon be irrelevant.

The widening gap between the data that management accountants provide and what decision makers need creates a shift from analyzing what happened in the past to predicting the future. This shift is in response to a change in executive management taking a more proactive approach in their decision making. Business leaders are starting to take advantage of the best-of-breed technology available to them, and it is important that management accountants make it a priority to keep up with the new accounting practices that come with the changes.

To read the article in its entirety, Start Here.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

The Value of Providing More Accurate Costing- Part 2

This is the second blog of three on how management accountants can become more strategic advisors based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

In the first blog, we focused on the first two areas of management accounting practices that concern business professionals. Now, we will cover the next three areas that management accountants can work on to become more strategic within their organization.

Do Management Accountants Hide Information?

Many times, management accountants will come across calculations and practices that are flawed and do not represent the true financial value of the company. There are a few reasons why a management accountant may not communicate this information such as not wanting to take the time to explain the accounting side of the equation, or not wanting to burden the decision makers with a problem. Regardless of the issue, communication is imperative when this happens in an organization because without knowledge of incorrect information, major decisions are made based on incorrect information. A great company will fail if it is run on poor information.

Are Management Accountants Creators of Their Dysfunction?

What is the reason for dysfunction in management accounting? For one, some believe that inaccurate costing will not affect the business. Some also have the mindset that the extra effort to go back and fix misinformation will not benefit the company’s decision making process. Cost accuracy is determined by properly modeling activity costs with their drivers, so it is important that management accountants recognize the value of their position and the need for accurate information within the organization. The value of timeliness is also important for management accountants to understand. The most strategic decisions can be made with the right information in the quickest time.

Are The Methods Wrong?

Now that we have seen the clear value of providing accurate costing, we can take a deeper look into the methods used and how management accountants need take accountability for how their work affects major decisions in their organization.

It is important to note that some companies are not using and activity-based costing method when their conditions call for it. Not using the appropriate method provides inaccurate and misleading information to their decision makers who are making strategic decisions based on that flawed information.

“If decision makers don’t trust the information or don’t get the right amount of detail in the information with the right level of accuracy at the right time, they probably won’t use the information.”

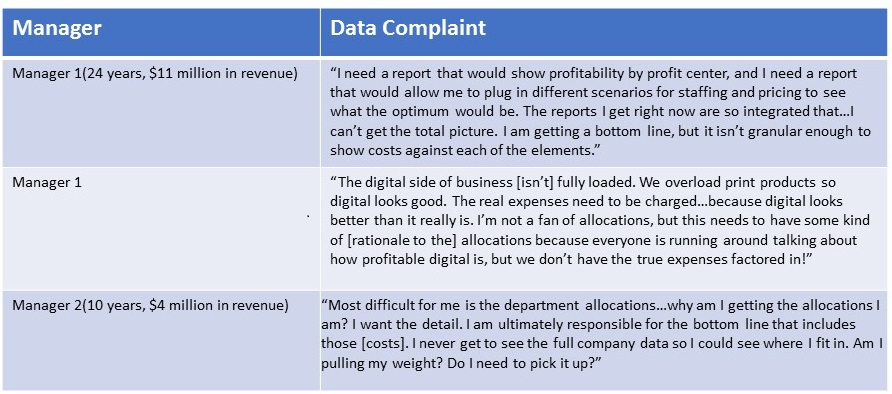

The article gives these examples of data not having the right detail, right accuracy, and/or right timeliness:

How can they solve some of these complaints? Today, anyone with an enterprise modeling tool, such as ImpactECS, would be able to combat these issues because these tools help finance professionals achieve accurate, detailed costing at a very granular level in a timely fashion.

To continue reading on to Part 3 of this blog, Click Here!

To read the article in its entirety, Start Here.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

The Value of Providing More Accurate Costing- Part 1

This is the first blog of three on how management accountants can become more strategic advisers based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

The main goal of management accounting is to understand the past, present and future of the business in order to help make strategic decisions. How can they understand their organization at such a granular level needed to make truly strategic decisions with outdated practices? A recent article in Strategic Finance magazine, Don’t Be Stuck in the Last Century, examines six areas of management accounting practices that concern business professionals, as well as ways to resolve these concerns. We’ll cover the first two areas in this post.

It is 2016 and many companies are still using accounting techniques that were used decades ago.

This image shows three different finance managers, all with different experience and different issues they are dealing within their particular organizations. The manager on the left is the most experienced and struggles with visibility of his company’s profitability. He needs real-time accurate profitability numbers so he can make more strategic decisions and make his organization more profitable. The middle manager wants more detailed allocations and company data so he knows if he is pulling his weight. The manager on the right does not like their accounting formats because she can’t manage them. She struggles to see the COGS and the value chain in the numbers and doesn’t understand the cost allocations. We want to explore how these managers can go about solving these issues so they can make the most strategic decisions for their companies.

Source: Don’t Be Stuck in the Last Century

Do Management Accountants Know What Their Internal Clients Want?

It is important that CFO’s understand the decision making needs of each department they serve because not all departments are the same. With the increasing use of technology and the internet, competitors are making faster business moves. Businesses need to realize how important it is to keep up with the changes in finance and technology to get to the forefront of the competition. Some of these changes include the timing of information and the level of detail and accuracy in their information. These are critical factors when it comes to strategic decision making.

The central issue is that CFO’s and other business leaders in the same organization see how to business should run differently. Some of these differences include the timing of decisions and how these decisions are made. Management accountants should learn how the business works and have open communication with all levels of the business so they are on the same page. Once the accountants and all internal parties know what to expect from each other, there can be an open line of communication which will aid in the strategizing for the company.

Do Management Accountants Care About Giving The Right Information to Internal Clients?

Now that we know that an open line of communication is necessary in order to know what each level of the business expects from one another, we need to make sure the right information is getting to the right people at the right time.

In some companies, CFO’s know that their management accounting data that is used internally for decision making is severely flawed, yet they do not do anything about it. Management accounting data is only useful if the data helps finance leaders make good decisions. If the data is flawed, it makes it much more difficult to make those strategic decisions. Every department has different data needs and it is important that management accountants recognize this and share correct data with the appropriate department so the business can make the best decisions.

These were the first two of the six areas of management accounting practices that concern business professionals. Stay tuned for part two in this blog series!

At 3C Software, we strive to help our customers be as strategic with their finances as possible. One of our main goals is to keep our customers up to date with the best of breed technology by using our enterprise modeling tool.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!

To continue reading to Part 2 of this blog, Click Here!