The Ledger

Curated content foranalytical business leaders

Tag Archives: profitability analysis

FP&A Trends: How to Manage Profitability in Uncertain Times

“Profitability is more than revenue minus cost…For example, along with revenue, costs/expenses, it also is important to know the life cycle of the product, or the entire product portfolio and its business drivers. Macro concepts like the business sector and economy also play part in arriving at profitability holistically.”

Improving Unit Margins

“Pricing to maintain margin is difficult when customer demand is unpredictable, raw material costs are rising and you’re being hit with unforeseen expenses like retrofitting locations for safety. Maintaining an appropriate utilization across the organization and tracking project-by-project profitability helps ensure that your overall gross profit margin as a company stays on track.”

Gartner: Build Cost Strategy Around Differentiating Factors, Not Competitive Trends

“Our research shows that CFOs are often blown off course by external targets that prioritize growth over profitability. Their targets, because they are externally focused, are routinely disrupted by changes to the macro picture. […] CFOs who model costs on differentiators are much more likely to stay on track with their long-term plans, avoid hasty cost-cutting in response to a change in the macro picture and realize value through principled and focused reinvestments built around their differentiators.”

Profitability Analytics: A New Perspective on FP&A

FP&A professionals are all generally focused on two things: (1) examining current performance and the immediate past for lessons learned and changes to replicate positive performance or change negative performance and (2) making projections and planning for the future with forward-looking scenarios, analyzing risks and opportunities, and mapping possible responses.

Advances in digital technologies increase the potential for businesses to use powerful tools to improve and expand their FP&A function. Modern organizations need a robust definition of their FP&A practices that will support the entire organization, looking well beyond finance and accounting’s traditional scope and embracing all the value creation and performance goals throughout an organization. Profitability analytics enables FP&A leaders to understand the past while focusing on developing areas of nonfinancial and financial data analytics and modeling that causally support building robust forward-looking scenarios and analyses.

Read More at Strategic Finance Magazine >

Net Profitability Analysis and Benefits for Financial Services Companies

Most companies lack visibility into the net profit contribution of their individual customers and products. Without a strong understanding of how and why every customer and product contributes to the overall profitability of the organization, decisions are made based on personal bias, miss-aligned incentives, and “gut feel”. While often (though not always) these decisions are made with the best intentions – they are rarely fully informed.

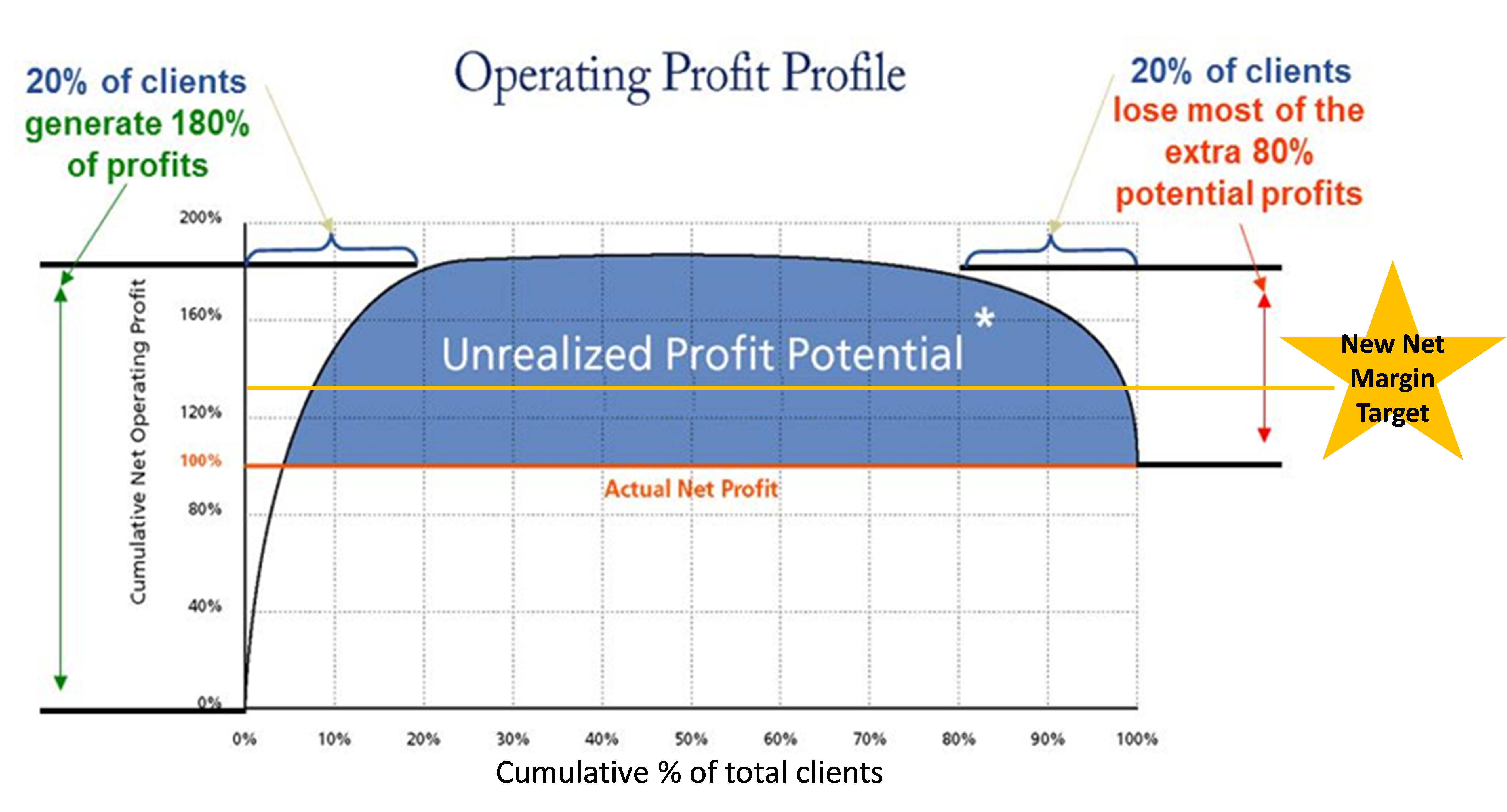

The result is a business environment where just as many customers lose money as make money. The top 20% of your clients are likely generating over 180% of your total net profits, while the lowest performing 20% of clients are unprofitable – losing 80%. That’s not even mentioning the majority of clients that simply break even. All of this creates a large opportunity to improve profitability by shifting the curve.

In order to shift the curve and improve net margin, insurance brokers need to understand not only the net profit contribution of each client and product, but the underlying causes – and couple that knowledge with an organizational plan that centers both tactical and strategic decision-making around the impact on net profitability.

Net Profitability Enables a Range of Profit Improvement Initiatives

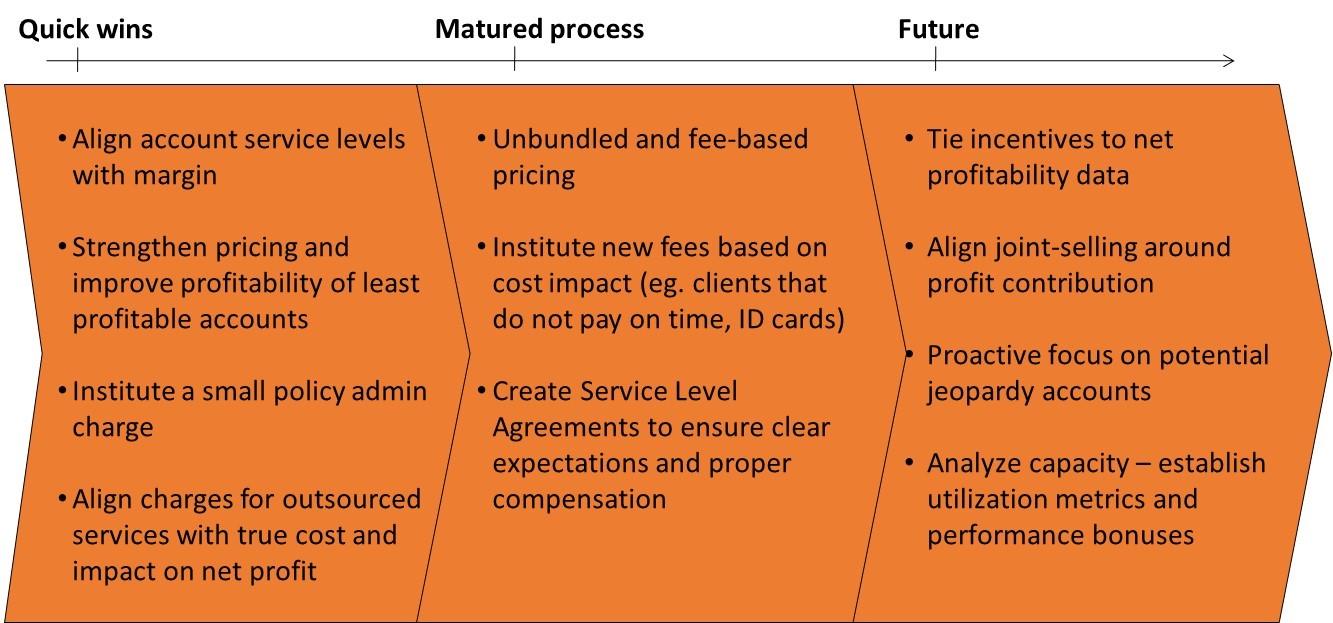

Any net profitability solution is only as valuable as the actions taken once the new information is available. No matter how accurate or insightful the new profitability information is, a sound action plan and commitment to execution are critical to achieving value and improving profitability.

Fortunately, the value of these types of net profitability solutions is not just theoretical. Financial services organizations have, for a number of years now, embraced net profitability analysis to better understand their business, create organizational change, and drive incredible net profit growth through a range of initiatives and best practices.

While each of these initiatives can provide value to any organization, every company varies in their appetite for change. Therefore the overall approach to capturing value will be unique to every company. There are, however, a few best practices that are universal

- 1. Strong executive leadership & commitment

- 2. Organizational buy-in (developed through business engagement and training)

- 3. Incremental approach to enacting change and capturing value (see below for example)

Success breeds confidence and buy-in, which in turn brings greater success. It’s important to gauge the organizational readiness for change and implement accordingly. The most important aspect is a readiness and willingness to execute on this powerful information.

To read a case study on customer return to profitability, Click Here!

To read a case study on client level actions, Click Here!