The Ledger

Curated content foranalytical business leaders

Tag Archives: Transfer Pricing

A Quick Review of Transfer Pricing

One of the most challenging issues our manufacturing customers face managing intercompany transactions when one department, division or subsidiary sells goods to another entity within the organization. These companies employ transfer pricing methodologies to account for the movement of goods and revenues.

While these intercompany transactions are impactful to any organization that has more than one entity or located in multiple jurisdictions, large, multi-national companies that have thousands of transactions each period need a robust way to track, analyze and report the movement of goods and dollars. Additionally, these companies need the ability to effectively set transfer prices that are appropriate to the needs of each entity of the business.

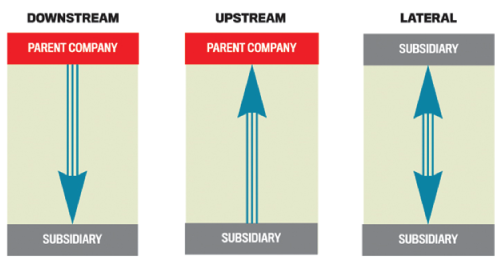

According to “Intercompany Transactions Snowball” in this month’s publication of Strategic Finance, there are three types of intercompany transactions: Downstream, Upstream and Lateral. During consolidation, it is critical to understand the transfer relationship in order to effectively report performance which has a direct impact on the company’s tax exposure.

[caption id="attachment_5985" align="aligncenter" width="500"] Source: “Intercompany Transactions Snowball”, Strategic Finance, 04/15[/caption]

Source: “Intercompany Transactions Snowball”, Strategic Finance, 04/15[/caption]

After determining the relationships between each entity, the next step is to determine exactly how the transfer prices are set. The AccountingTools blog chronicles each way a company can determine transfer prices:

Market rate transfer price – The transfer prices are set at the market rate.

Adjusted market rate transfer price – Market rate pricing with adjustments for reduced risks

Negotiated transfer price – If the market price is unavailable, entities can established through negotiations.

Contribution margin transfer price – Create a price based on the contribution margins.

Cost-plus transfer price – Determine the price by adding a margin on top of the cost of the transferred items.

Cost-based transfer price – Each entity transfers products to the next at cost leaving the final entity with all the costs and ultimately recognizing all of the profit.

Each company has to weigh the benefits and challenges of these approaches to determine the best approach for their business. But one thing is certain. A flexible, robust system is a requirement to efficiently and accurately track all of the moving parts to any transfer pricing scheme.

ImpactECS is an integrated solution that provides the tools to both accurately calculate transfer prices and clearly reconcile transfer price transactions on one platform. By linking with directly with ERP and other data sources, transfer pricing analytics can become one component of an end-to-end cost and profitability approach supported by ImpactECS regardless of the methodology selected.