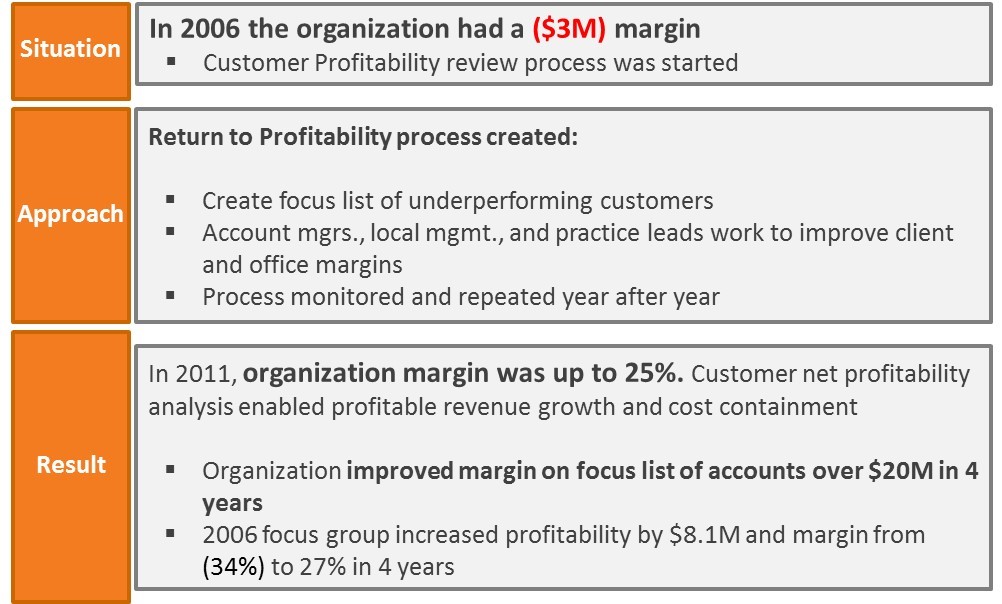

Case Study 1 – Customer Return to Profitability

This is a case study from the study Net Profitability Analysis and Benefits for Financial Services Companies.

The organization focused specifically on their lowest net profit clients by helping account managers understand their net profitability and develop action plans to improve it. At the same time local management took actions to ensure that client level changes resulted in improved business operations and increased profitability across the organization.

Finance Responsibilities: Manage “Return to Profitability” step-by-step process

Plan for Improvement

Identify revenue threshold and bottom net profit accounts

Create scorecards & supporting documents

Review with Account Managers and create “Return to Profitability” plans

– Reduce service levels or remove excess resources

– Re-assign senior and other high-cost resources to high-value accounts

– Increase fees or charge for additional service

Manage Progress

Track & manage client-level plans on a quarterly basis

Monitor time that is being spent with each client and plan initiatives

Validate progress quarterly and with year-end scorecards

Local Management Responsibilities: Develop protocols and take action to ensure client level changes result in improved operations and increased profit margin

Protocols

– Establish regular account profitability reviews

– Establish pre-renewal revenue meetings

– Ensure time tracking compliance

Tracking

– Assess and manage non-client facing time by person by month

– Monitor changes in client resourcing based on client-specific action plans

– Estimate capacity that is or will be freed up and create plan to reduce

Actions

– Reassign resources to drive higher utilization

– Drive new business opportunities (redeploy)

– Reduce headcount (remove)

To read a case study on client level actions, Click Here!

To find out how ImpactECS can help your company gain visibility and become more profitable, Click Here!