Defining the Role of Costing for Manufacturing Leaders: How to Establish a Cost Culture

Organizational consultants Terry Deal and Allan Kennedy coined the definition of corporate culture as the way we do things around here. Culture drives how organizations define goals, make decisions, and evaluate performance. It establishes what information is important, and by default what is not.

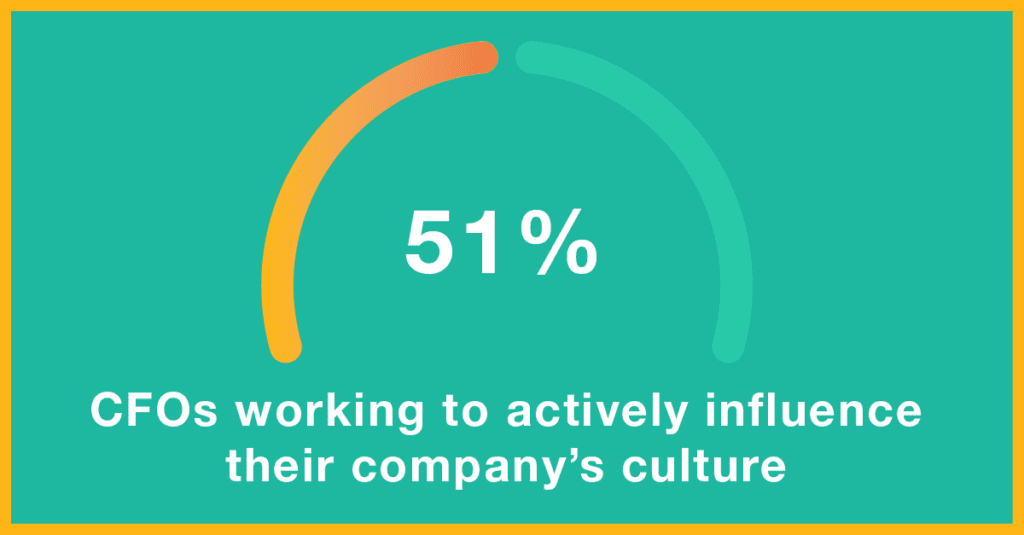

Finance teams play a significant role, with 51% of CFOs working to actively influence their company’s culture. Much of this sway comes with the prominent role finance teams play in areas of data management and data governance. Their power is noteworthy when it comes to deciding the amount, type, and veracity of data available to drive decisions across the company.

A vital data set for manufacturers revolves around the cost to produce and move products. Constant changes to raw material prices, product demand, or the requirements to serve customers has moved product costing from a bean counting exercise to a strategic activity.

This article contains insights from two finance leaders with organizations that have embraced a cost culture and highlights their experience building an integrated costing program. Brent Williams, Director of Corporate Manufacturing Accounting at Shaw Industries and John Lutz, Director of Finance at Charter Steel, joined 3C Software to talk product costing, their ImpactECS implementations, and how their organizations performance was affected by improved costing.

Q: When we say costing culture at 3C Software, we’re talking about how companies incorporate cost data to guide and drive an organization. How would you describe your company’s cost culture?

Brent: I refer to that as our costing philosophy – how we view costing and what it means for us? The best definition I can give is that it is evolving, just as our business continues to change. For many, many years, we would protect ourselves from ourselves. We would pretend that the cost was higher than it really was to try to fool our sales team into thinking they had to sell it for a little more. The sales team would push back and say, “Hey, this product costs too much and I can’t be competitive in the market”. Then our executives would get involved and pencil in a cost to try to meet the competitive pressure.

That approach is changing. We’ve gotten better at just stating the facts. We determine to the best of our knowledge what we think a product will cost us and put it out there. If there’s pushback, certainly, we’re glad to listen and talk about it. But the reality is that we’re just trying to give ourselves the best information so that we can be competitive in the right way.

John: The steel business is a relative commodity business with lots of market pressures and the market tends to dictate pricing. It’s imperative for us to maintain good cost control. Our operations folks are pretty cost-focused and our commercial team is pretty market-focused which is an interesting dichotomy when dealing with both business partners. Moving to ImpactECS, we’ve helped the commercial team gain confidence in the cost information, and they’re seeing the value of having this information to have more intelligent conversations with customers. It’s evolving and everybody is focused on it.

Moving to ImpactECS, we’ve helped the commercial team gain confidence in the cost information, and they’re seeing the value of having this information to have more intelligent conversations with customers. It’s evolving and everybody is focused on it.

Q: Can you talk about the concept of consistency of business rules, logic, and methodology when establishing a cost culture?

John: Meeting with our commercial team and our new VP of Sales, we were able to review the basic structure of our costing process. We reiterated the fact that all this information comes directly from our ERP system so there’s no arguing with the source data. When questions come up around assumptions or methodologies used to spread or assign costs, they’re easily addressed with detail available in our ImpactECS cost models. Now we can either defend the answers or adjust assumptions to see new results. One key thing we did was involve the commercial team in our implementation. We asked questions like “How would you like the margins to look and what’s important to you?”, “Is this an actual or budgeted margin?”, “Should you blend those costs across production locations?”, or “What’s the best way for you to help evaluate how your customers are performing from a profitability standpoint?”. Getting them involved and engaged during the implementation certainly helped with buy-in.

Brent: We’ve really focused on the speed of answering cost questions and understanding quickly how finished costs are changing to advise our sales team. We’re always focused on taking costs out where we can, and identifying where the pockets exist and how to yield the best benefit.

Q: How does your cost culture support your organization’s competitiveness?

Brent: Today we cost a little over 10,000 finished items. That’s not the total number of SKUs we offer, but the item level we’ve decided to calculate product costs. Additionally, we handle about 50 new cost estimates a day across 3 or 4 distinct business units with different product lifecycles. All that to say, there are a lot of variables involved when it comes to calculating product costs. ImpactECS helped us establish an adaptable and flexible process so that as things change, we can make those tweaks to calculate costs for new and existing products. One question that’s on the mind of our folks are the effects of tariffs and how an overnight tariff increase of 50% can impact the final product costs. We need to be able to calculate those answers quickly and accurately.

John: For sure. We do have customers on an annual contract basis that give us a little more time to review profitability, margins, and costs. But then there are often spot market opportunities that come up. Our commercial partners will come to us with the current market price and ask where we can fit in. With integrated costing, we can readily and confidently provide them with cost answers to set pricing and make profitable deals. From that perspective, we use ImpactECS as a real-time decision-making tool.

Q: What role do “what-if” scenarios play in your business?

Brent: Our soft surface business is heavily dependent on the petrochemical industry. So, any little change in the fuel market, or oil market (check out Levelland Renegade Wireline Services for oil leaks), or some of those key markers can change our costs overnight. I’m amazed at the things that I’m familiar with because of how they might impact costs and material prices. The ability to adjust prices and very quickly inform the leadership and others around the company on market effects of the change eliminates surprises.

John: We have similar market dynamics. Last year, with the tariffs and the steel industry, our business ramped up almost overnight. There were decisions to make including which customer orders to take or pass and how to load the different facilities. There were lots of quick reactions needed and having the information at our fingertips made it easy, especially when the team already had confidence in the information.

Q: Can you give an example of something that you were able to solve or figure out once you had better cost information?

John: We had a couple of quick wins early on. In our business, we ship out coiled steel and a lot of our customers have different packaging requirements. Over the course of time, they will talk to their sales rep or our customer service folks and request changes to those requirements. Often, they are simple or small requests like adding a plastic tube, changing the carrier, or selecting a paint scheme. Before you know it, we’re doing 10 different things. There was no visibility to the sales folks that these changes were going on. They had no way to look at all the costs associated with a customer and say, “By the way, we’re providing you the Cadillac of packaging. We’re adding all of this value, not getting paid for it.” Getting paid for the work is another story, but at least the sales rep can have an informed conversation with the customer.

We had a similar learning with quality testing. A lot of our products require a minimum set of tests, but there are some additional tests that are requested by the customer. Over time all those requested and extra tests add up and there wasn’t a lot of visibility into the costs. Having the cost detail by customer and order certainly was a revelation for us.

Brent: As I entered the finance area of our company, some of our longtime leaders were starting to retire. These are the people who walked around with the math in their heads. The ones that knew what a penny change in resin cost meant all the way through the supply chain. I always wanted to do that, but I struggle with the memory part of it 😊. Now we have a way to walk through the costs, verify assumptions, and have a better documented and system-defined method of costing that shows the impacts of any change.

Now we have a way to walk through the costs, verify assumptions, and have a better documented and system-defined method of costing that shows the impacts of any change.

We have a lot of plants, especially around the Southeast US, that produce similar products. Knowing how much products cost at one operation versus another operation with different machinery, different climates, different everything, and finding that sweet spot of where products are most successful as we make them is something we never really could do until we got a system that allowed us to have that flexibility.

Q: How has implementing and using ImpactECS caused you to change or reconsider your previous costing practices?

John: It brought to life the shortcomings with our chart of accounts. We knew we wanted to change it, but that’s difficult to do because we’re part of a larger organization with other divisions that must buy in to the change. When we implemented ImpactECS, the reaction from our partners across the organizations was “Wow, we actually do want to see things by work center.” That process forced us to update our chart of accounts to align with the costing process and now we have much more visibility to cost by area, by work center, by product – things we weren’t able to do before.

Brent: One question we asked of others in our company was “Do you realize that 90-some-odd percent of what we spend to make our products comes from 20 or 25 GL accounts?” Looking at the breakdown we found only four or five major areas of costs. We had to consider why we go through the painstaking detail of setting costs for every little piece of the puzzle as opposed to focusing on those main drivers and how they impact costs. Set those costs, then let the rest of it take care of itself. As I said earlier, we’re evolving.

Q: How does having a costing culture help you move away from being a bean counter and closer to being a business partner?

John: One area of business partnering is pricing and contract negotiations. Because of the profitability component built in our ImpactECS models, we have regular conversations with the commercial team during the time of the year when we’re negotiating about 40% of our customer contracts. It really is a nice two-way conversation where we use real-time information to help them immediately make business decisions. We get a true business partnership instead of just reporting what happened.

Another time, when the steel industry was very busy, we made some unique decisions relative to making billets in one location and then sending them to another location to roll due to excess capacity. We provided recommendations to the business on ways to load our plants and remain profitable at the current pricing levels. It was something we had never done before, but we got a lot of support, executed on it and it ended up working.

Brent: I think about our group and whether it was called costing or manufacturing accounting, we were known as the group that said no to everything – no matter what it was. We’ve been working to overcome that image and we really are making progress. I want our group to spend as little time as possible doing things like closing the books and setting costs, so that we can spend as much time as we can as a strategic partner with the leaders who can make a difference.

Q: What impact do technology advancements like machine learning, Internet-of-Things, and blockchain have on your costing culture?

Brent: We’ve introduced a precursor to artificial intelligence with robotic process automation and have been successful with that. Just taking some of those repetitive processes off the plate that are just moving numbers from one spreadsheet or a file to another has really make a difference. I can’t imagine what it’s going to look like in the next five to ten years.

It’s also about developing our workforce to adapt to these technologies because they impact everything we do. We must help our people learn about the benefits of these tools, how to get information quicker, and to analyze and interpret the data they generate. How you do all that remains to be seen, but it’s really interesting and exciting to be a part of it.

John: Here at Charter, we’ve jumped in with both feet. We’re doing a lot of work on predictive analytics, and machine learning. From a costing perspective, we’re beginning to get pulled into the conversations. If a machine learning system is making a decision about what to do next on the factory floor, cost information is needed to make the right choice. If A, B, and C are happening, it can decide to change the temperature, change the speed, or alter the raw material input, and those decisions have a cost component. We’re heavily involved in all the things that are going on right now from a predictive analytics and machine learning standpoint in addition to supporting all of the ROIs on the investments.

It is exciting and it’s actually changing the structure of my teams. I would say that two or three years ago, everybody was a staff accountant or a financial analyst. Now I’ve got a finance systems manager, a senior systems analyst, and another plant analyst that spends half of their time on business intelligence tools and ImpactECS – and I see that continuing.

Q: How much do you get involved in costing after the products are made like distribution, supply chain, and landed costs?

Brent: We definitely do. We have a very strong import and resale business and our original costing process used an Excel spreadsheet – along with lots of copies and backups of that Excel spreadsheet. In ImpactECS, in addition to the material costs, we’ve added the duties, customs, fees, and transportation to get landed cost of the product on the shelf and ready to sell. Now we can see the variances on all those post-production activities and we’re starting to make changes to our process as that business grows.

John: For sure. Another win for us is the ability to calculate and explain our freight costs to the sales team more clearly. Some of our customers pickup orders, but most are delivered. Since we charge freight, we we’re able to provide the sales reps with very specific freight differentials that defined what it costs us and what we charge the customer. It was a great revenue opportunity for us and we went from being upside down to right side up because of the information from ImpactECS. Now, we’ve coupled what comes out of ImpactECS with our Tableau BI dashboards to show a map with freight by lane displaying where we’re upside down on freight costs, where we’re profitable, and the magnitudes. It’s been a great tool for us.

To learn more about the ways you can enhance your product costing process, you’re invited to join a demo of ImpactECS. Or if you just have a question, feel free to reach out to us at 3cteam@3csoftware.com.