Overcoming Static Planning in a Dynamic World

Annual planning is becoming a thing of the past. Today, organizations are stepping away from traditional planning activities and investing more time in maximizing productivity and maintaining flexibility. Dynamic planning allows business leaders to focus on crucial management functions individually and prepares them for any unexpected wrench that falls into their plans. A recent CFO Research study discussed in the eBook, The Hidden Costs of Static Planning That CFOs Need to Know Now highlights how finance’s inability to provide insights on a timely basis restricts good decision making across their organization.

The Elements of Static Planning

One benefit to static planning is stability. FP&A professionals can create a plan at the beginning of the year and follow that strategy until the end of the year. Unfortunately, the current business environment can no longer support the luxury of stability, and flexibility and agility are required to adapt to increasing uncertainty.

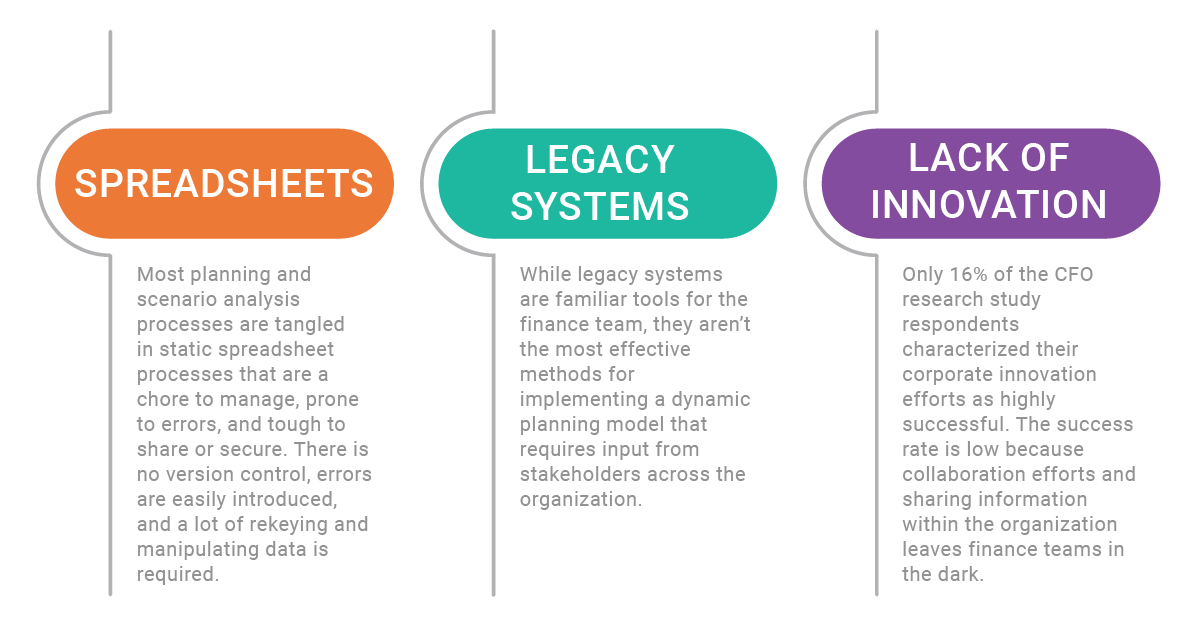

The big challenges with static planning is that it creates complex reporting, slow decision-making, and places a huge strain on resources. To shift from static planning will require finance teams to focus on three primary areas – their dependence on spreadsheets, the existence of legacy systems, and the lack of innovation that hampers collaboration and sharing.

Static planning environments are inflexible and brittle, limit collaboration, and fail to deliver important insights that drive decision making. Instead of complex legacy applications and spreadsheets popping up across the organization, finance teams need to leverage new innovative planning solutions.

Dynamic planning still requires the organization to create longer-term plans and goals, but also leaves room for unforeseen events. While the traditional, or static, planning process is focused on predicting, or essentially guessing, what will happen in the future year or more. Dynamic planning focuses on short-term periods with a foundation rooted in the longer term plans. The point of this strategy is to focus on a step-by-step process with the ability to adjust plans along the way based on current happenings.

Building Flexible Plans

As a rule, things constantly change, and adapting to those changes is a critical component for success. The definition of dynamic planning is planning with a balance of strategy and flexibility. It attempts to take the big picture into account to make a broad, intelligent plan for the year ahead. It also requires FP&A professionals to revisit their plans regularly to ensure the business is in the right place.

The goal of dynamic planning is not just about minimizing the downside; it is also about maximizing the upside. To do this, finance professionals need to focus on short-term periods while actively analytics the results of their planning efforts. By monitoring activities in the short term, businesses will gain the flexibility to affect change as surroundings change. With the flexibility to deploy resources, the business can take immediate actions that will move toward their long-term goals and plans. Click here to learn how business plan writers can help you with your business’ goals and plans.

A dynamic plan allows FP&A professionals to take intelligent risks, pursue unexpected opportunities, respond quickly, and take advantage of new ideas that lead to better business decisions. The CFO Research eBook discusses how successful companies are driving active planning in their organizations with the 3 C’s of active planning: Collaborative, comprehensive, and continuous. To have a successful a successful active planning strategy, all three elements must be involved.

A dynamic plan allows FP&A professionals to take intelligent risks, pursue unexpected opportunities, respond quickly, and take advantage of new ideas that lead to better business decisions. The CFO Research eBook discusses how successful companies are driving active planning in their organizations with the 3 C’s of active planning: Collaborative, comprehensive, and continuous. To have a successful a successful active planning strategy, all three elements must be involved.

Companies that adopt an active planning process are better prepared for change, and better prepared for reacting to what lies ahead.

Planning for the “What If?”

The biggest drawback to most cost and profitability systems is their inability to answer the question, “What will happen if…?” Scenario planning is a key piece of the dynamic planning puzzle because it creates a proactive approach to potential events, and prepares the team to handle them in advance. With companies focusing more on financial planning & analytics (FP&A) functions to drive their strategies, finance teams need the ability to confidently and accurately predict the impact of internal and external changes on both costs and profits. The sooner businesses adapt to dynamic planning processes, the greater amount of time they have to adjust and deploy resources to overcome future challenges.

One of the most powerful features of ImpactECS by 3C Software is the ability to create simulation environments that use the same logic, assumptions, data inputs, and methods to generate scenarios and make predictions. With ImpactECS, you can manipulate any model variable to measure its effect on cost and profits – providing answers to stakeholders and executives across the organization that make tactical and strategic decisions.

To learn more about how ImpactECS can help your organization develop and maintain a dynamic planning process, Start Here!

Want to see ImpactECS in action? Schedule a Demo!