Rethinking Budgeting in a Dynamic Business Environment

Many believe budgeting is a key element to a business’ success – characterizing it as both the road map for running the company and the tool for finance leaders to evaluate if the stated goals are met. For others, traditional budgeting is considered as the exact opposite of agile and flexible planning that provides limited insight on performance. In today’s volatile and ever-changing business climate, budgeting has lost its luster with many finance teams because it’s viewed as a time-consuming task that yields little return. Some companies have chosen to replace the budgeting process with a rolling forecast approach, while others are resigned to the fact that they are stuck with a traditional budgeting approach.

So, how are these budgeting processes different, and when should you use each? These are two of the questions addressed in a 2017 study by The Association for Financial Professionals (AFP), How Relevant is Your Budget? The study, based on the opinions of finance leaders, highlights the difference between budgeting and forecasting and why every business needs both at different levels. The general consensus is moving beyond traditional budgeting does not mean to completely eliminate the budget. Instead, it is important for every organization to consider taking a more modern approach with a technology platform that provides a flexible view of the business in order to remain agile while still relying on a budget.

Budgeting vs. Forecasting

Often times budgeting and forecasting are thought of as interchangeable, which is not the case. The budget is defined in the study as the set of financial goals for the business and business leaders to achieve over a period of time. It is a snapshot used by finance teams as a point of reference for one specific time period, where the forecast is changing continuously. Budgets are tied to planning because it shows where the business wants to go, and creates a foundation to compare results to and examine the variance. The distinctive difference between budgets and forecasts is that the budget is linked to goals, while the forecast is linked to expected outcomes based on current information.

However, the AFP survey asks about the definition of budgets as seen through the eyes of practitioners who interact with them every day. 63% of respondents said they consider the role of the budget is to set goals for the business. While every company handles budgeting differently, most respondents agreed that the budgeting process still has lots of room for improvement. More than half of the respondents said the main purpose of budgeting to them is to forecast income and profitability, while only 20% believe the budget is the first in a series of forecasts.

One respondent said, “When drawing up the budget, one is able to visualize how the different departments intend to work towards achieving the overall organizational strategy. With limited resources to distribute, it’s an exercise that highlights which functions will need more support and which can survive with less and still drive sustainable growth.”

Introducing Activity-Based Budgets

A recent article in Strategic Finance Magazine defines activity-based budgeting as “next generation budgeting”. Unlike traditional budgeting, the activity-based budget analyzes opportunities and allocates resources specifically for each activity.

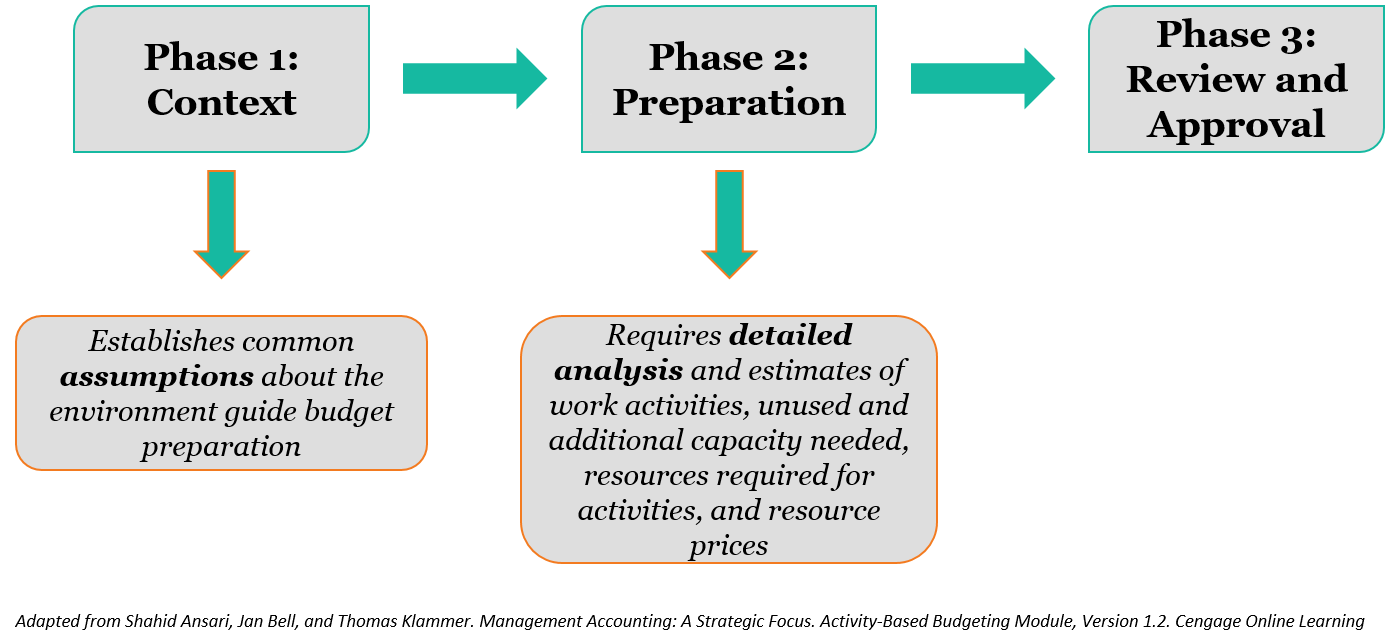

According to the book referenced in the article, Management Accounting: A Strategic Focus by Shahid Ansari, Jan Bell and Thomas Klammer, there are three distinct phases of this budgeting process that are illustrated below:

Phase one is the same for any company ‐ establishing the reason to create the budget and determining business’ goals based on the forecast. Phase two is where activity-based budgeting comes into play because of the addition of the activity drivers. The activity drivers are the factors that cause an increase or decrease in the volume of all activities. The drivers also determine the budgeting costs for the next period because the cost of each activity driver is estimated for the next year’s production. In contrast, traditional budgets may have analytical results to support budget line items of one or more departments, only dollar amounts are provided.

The major distinction between activity-based budgeting and traditional budgeting is that activity-based budgeting is cause-driven, where traditional budgeting is effect-driven. Activity-based budgeting and the planning process have more to do with planning than budgeting. In the long run, a successful organization will shift their focus from generating budgets to a more productive focus on planning. To navigate this shift effectively, work with an insolvency company that can provide expert financial guidance and support. Whether you are struggling to pay a bounce back loan or another form of debt, a team of experts can help. You should seek the assistance of insolvency and business debt management experts if your company has financial issues or is going through a formal insolvency process, such as company liquidation. Seek Professional Debt Negotiation services from financial advisors if you plan to meet with your lenders and other financial institutions to discuss a new payment plan.

Budgeting Can Still Have Relevance

A budget is a guideline, but unless you monitor the progress on a regular basis it’s difficult to know how your business is performing and where you need to make changes. The overall goal is to achieve productive budgeting that goes beyond traditional budgeting limitations. For finance leaders to remain agile, they need to leverage a dynamic planning tool like ImpactECS.

ImpactECS leverages data from existing ERP systems, shop-floor, finance or production systems to build budgets and forecasts that deliver real insight. With ImpactECS, finance teams the ability to adjust or flex any model input to calculate expected results without wrangling with the challenges of spreadsheet analytics.

Learn more about how ImpactECS can enhance the budgeting and forecasting process in your organization, Start Here!