The Ledger

Curated content foranalytical business leaders

Tag Archives: Budgeting and Planning

The Necessity of Collaborative Enterprise Planning

Budgeting is the backbone of most organizations’ management control systems. However, it’s also a practice that rarely adds value, with participants often involved in an elaborate game of bagging resources. Collaborative enterprise planning can overcome these weaknesses through a combination of re-evaluating management practices and employing the latest in collaborative intelligent finance solutions. There is no reason why this budgeting process can’t operate on a continuous basis. If activities need changing or new ones need to be introduced, just those parts can be re-planned as necessary.

Read More at The Digitalist by SAP >

Leveraging Dynamic Technology to Drive Stronger FP&A

Organizations are under increasing pressure to make well-informed decisions quickly based on data coming from various sources. Now they can leverage technology that speaks to multiple systems to develop meaningful planning metrics with an agile, intuitive interface that allows users to analyze their data in a more productive manner. Digital transformation is unfolding greater opportunities for companies to plan, predict, and communicate market trends, determine spending, and better understand customer behavior. Predictive analytics can change the way businesses plan and how they make decisions. By gathering data, having clear objectives and goals, and activating evidence-based decisions, companies can streamline their planning processes and make smarter business decisions

Read More at The Digitalist by SAP >

Valuable FP&A Requires the Right Tool

CFOs often worry about how much value their analytics are actually providing their company. AI and digitalization completely changed the way that finance leaders operate. Too many of them still rely on planning tools that aggregate budgets but provide little in terms of anything else, and many are still devoted to spreadsheets. These past-generation tools assist in one regard immensely: looking back and reflecting. However, these tools are no longer sufficient to completely base important business decisions on them. Finance needs to be able to act in the moment and not provide value after the fact, which is why a dynamic FP&A tool is necessary.

Read More at The Digitalist by SAP >

Business Modeling & Analytics: Creating Value Requires the Right Technology

Evergreen writer Eric Jorgenson declares “the purpose of the institution of business is to create and deliver value in an efficient enough way that it will generate profit after cost.” If only it were as simple as it sounds! It’s bigger than checking boxes to produce reports, closing the books each period and remaining in compliance. To create real value, forward-looking finance organizations have moved beyond traditional finance activities and are establishing robust business modeling & analytics programs that provides detailed visibility into historical performance and expected results.

Establishing a Robust Business Modeling & Analytics Program

Companies are increasingly dependent on automation and analytics to deliver clear, actionable and forward-looking insights. With the explosion of available data from quickbooks desktop canada and the need to quickly evaluate it, finance teams are centered on two areas – the data and the models. Additionally, businesses who need help with web design services may consult this professional web designer dallas.

❶ Integrating data and accessing results:

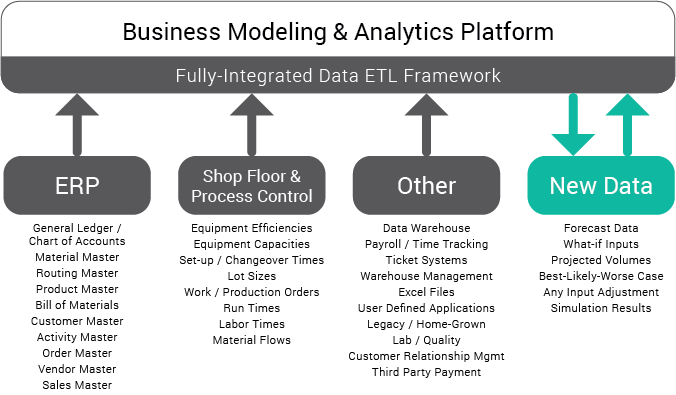

As the size of the organization grows, so do the number of systems that support it. Companies can have hundreds of machines that generate endless data points along with groups of data warehouses, BI systems and other data sources holding information. Without a way to link data across the enterprise, it’s impossible to deliver meaningful insights or accurate results.

One shortcoming of most business analytics programs is the inability to integrate forecasted or simulated data as part of the modeling data set. Along with the expected data from ERP, shop floor and other systems, advanced analytics program recognize the need to retain and use forecasted or simulated data alongside historical data to predict performance and test assumptions for any data combination.

❷ Building models and running simulations:

The best models and simulations reflect real-world scenarios, not a pre-defined process or methodology, and delivers results in a timely manner. They must include measurable and meaningful KPIs that expose improvement opportunities and encourage behaviors that positively effect performance.

What is an integrated modeling platform, and why do you need one?

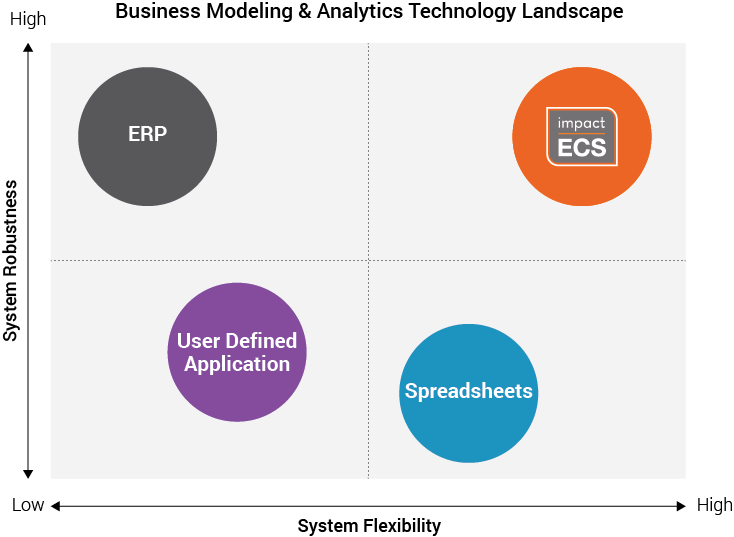

Most organizations have a few “system types” that provide, calculate, or share data as part of the planning and analytics process. The Business Modeling & Analytics Technology Landscape compares the different technologies and their attributes. The vertical axis measures the robustness of the system – or its ability to handle very large data sets and the ability to execute large sets of calculations quickly. Also, robust systems are scalable and can handle multiple users and permission sets. On the horizontal axis, the flexibility of the system represents the ability for the system to be configured to meet the company’s unique needs, both now and in the future.

Business Modeling and Analytics “System Types”

ERP: The ERP system is the system of record for organizations and serves as the transactional system. They are often limited by the design choices in the initial implementation, creating a rigid environment with no inherent simulation capabilities.

User Defined Applications: Many companies try to meet their analytical needs with applications developed internally. From legacy systems dating back to the 70s to AS400 and Access databases, User defined applications offer customized solutions, but their capabilities are often a reduced or partial set of controls. Additionally, simulation capabilities are limited to the programmed options, and changes to the system require IT involvement in maintaining and upgrading systems.

Spreadsheets: Desktop modeling tools solve a variety of challenges when it comes to creating a flexible modeling environment. It isn’t however, a system. That means limited controls and auditability will assure integrity issues. Further, spreadsheets are unable to scale with the requirements to build a robust modeling and analytics environment, and has difficulty handling larger sets of data.

Integrated Business Modeling & Analytics Platform: ImpactECS is an integrated modeling & analytics platform that leverages data from existing systems and delivers complete flexibility to design, calculate, manage, and report results that drive results by creating value. With a centralized approach, finance and planning organizations can link important data from across the company and build models to calculate, predict, or simulate performance at any level of detail or business dimension.

Each of these system types are critical and offer valuable benefits that keep the business running. However, organizations on a mission to create real value through analytics need to augment their IT footprint with technology that delivers the best of both worlds – a solid, enterprise-level system that connects relevant systems and data, and a flexible modeling platform to build, run, and maintain models that meet the company’s unique business requirements. Companies build models with ImpactECS for everything from detailed manufacturing product costs, cost-to-serve and distribution costs, and profitability analytics for any business dimension.

Visit us at www.3csoftware.com to learn more.

Predict the Future. Everyone’s Doing It ! (…or wants to)

These days everyone wants to talk analytics. But not just understanding what happened in the past. They’re just as concerned about what the future holds. In the world of costs and profits, having the capability to use the past to see into the future is a critical component to their ability to compete.

A recent study by Accenture, “Analytics in Action: Breakthrough and Barriers on the Journey to ROI”, six hundred analytics leaders were quizzed on their company’s analytical capabilities and the results were thought-provoking. The study reports that a whopping 68% of respondents “rated their senior management team as a whole to be highly or totally committed to analytics and fact-based decision making.” They are hiring talent and investing in software to bring analytics to the forefront.

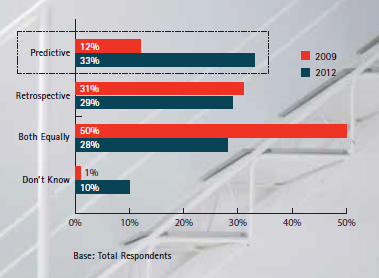

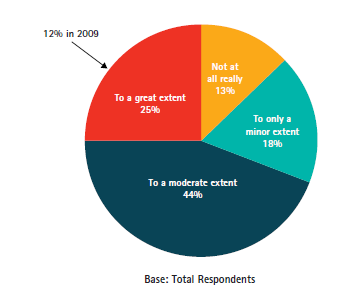

One of the most salient data points from the study revolved around the shift from retrospective analytics and predictive analytics. In 2009, 50% of the respondents reporting that both retrospective and predictive analytics were used equally but only 12% primarily used predictive analytics (Figure 1). The shift in 2012 was dramatic, with nearly three times (33%) more companies reporting that predictive analytics was their principal approach.

Figure 1. Source: Accenture, “Analytics in Action”

One of the most challenging tasks of developing a predictive analytics approach is capturing the data that you really need. Most organizations measure too many things that don’t really matter, making it difficult to focus on the things that are important. Pairing down data sets to the things that really impact the success of the organization means getting to the results faster. Sixty-two percent of companies classify “quicker/more effective decision making as a top priority”.

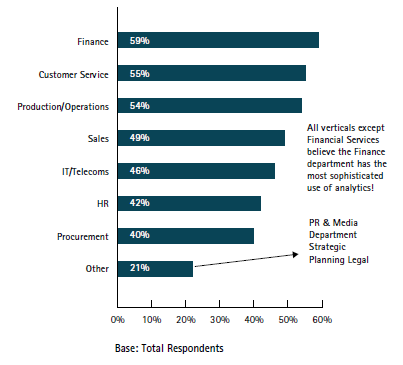

Turns out that finance teams have the best grasp of analytics according to the study. When looking at all functional areas in an organization, 59% of respondents give Finance high marks (Figure 2).

[caption id="attachment_5562" align="aligncenter" width="403"] Figure 2. Source: Accenture, “Analytics in Action”[/caption]

Figure 2. Source: Accenture, “Analytics in Action”[/caption]

And if you’re wondering whether analytics is inspiring, turns out that it is! Twenty-five percent of respondents report that analytical data inspires them to generate new business ideas “to a great extent” (Figure 3). This number has more than doubled since 2009.

[caption id="attachment_5563" align="aligncenter" width="359"] Figure 3. Source: Accenture, “Analytics in Action”[/caption]

Figure 3. Source: Accenture, “Analytics in Action”[/caption]

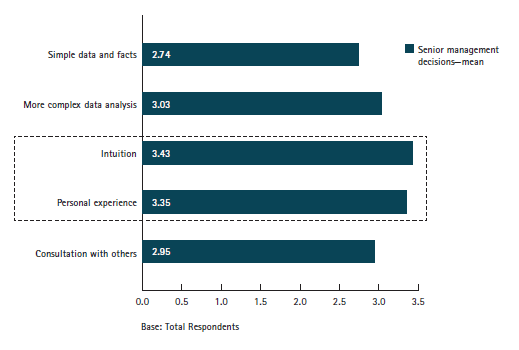

Having data doesn’t remove good business instincts for company executives. But that’s ok! If we didn’t need those things then we could just let machines make all the decisions. Anyone remember the movie War Games? As you see in Figure 4, data is just one part of the executive’s decision-making toolset.

[caption id="attachment_5564" align="aligncenter" width="519"] Figure 4. Source: Accenture, “Analytics in Action”[/caption]

Figure 4. Source: Accenture, “Analytics in Action”[/caption]

So what have we learned? Analytics is important. Predictive analytics is gaining prominence among business leaders. And data is only one part of the equation, but it has to be the right data!

Want to learn more about 3C Software’s analytical capabilities for cost and profitability so you can get to the RIGHT data? Start here.

More about budgets…

Last month we highlighted the CFO magazine article “Freed from the Budget”, where companies discussed how they have eliminated the budget process from their companies all together.  As expected, this controversial topic drew lots of opinions from finance and accounting leaders.  What they learned was that many of the challenges to having an effective budgeting process had less to do with budgeting issues and more to do with the tools and techniques required to actually develop the budget.

One reader, Miles Ewing – Deloitte Consulting Principal, shared his ideas of how to develop an effective financial performance management process:

- Align process to purpose

- Separate target-setting from budgeting

- Have a process to redirect funding

- Develop contingency plans

Do you have other ideas on how to make budgeting work for your organization?

Budgets – Are they a thing of the past?

According to a recent article in CFO Magazine, companies are embracing the idea of eliminating one of their most time-consuming and hated processes – developing a corporate budget. “Freed from the Budget” discusses companies of all sizes and industries that have eliminated their budgeting practice in hopes of finding a better way to run their businesses. Much of the discussion revolves around the ideas extolled by Steve Player, managing director of the Beyond Budget Roundtable (BBRT) – a group of corporate finance leaders that share ideas on performance management.

As part of BBRT’s message about the problems with budgeting, they’ve developed a list of 10 Reasons for Replacing the Budget:

1. Budgeting prevents rapid response to unpredictable events.

2. Budgeting is too detailed and expensive, absorbing around 20% of management time.

3. Budgeting is out of date within a few months. Key assumptions change frequently, causing confusion and rework.

4. Budgeting is out of kilter with the competitive environment.

5. Budgeting is divorced from strategy. Budgets are based on functions and departments rather than strategic themes.

6. Budgeting stifled initiative and innovation.

7. Budgeting protects non-value-adding costs. Cost budgets are usually compiled and agreed on based on prior-year outcomes.

8. Budgeting reinforces command-and-control. Budgets were designed to enable functional leaders to manage the organization from the center.

9. Budgeting demotivated people.

10. Budgeting encourages unethical behavior and increases reputational risks. Aggressive targets and incentives drive people to meet the numbers at almost any cost.

While the article highlights a handful of companies, most are wary to eliminate this essential business task. So, what do you think – are budgets a thing of the past, or do they have a relevant place in an organization?

Are budgets obsolete?

There isn’t a day that goes by that we don’t talk about budgeting with our customers and prospects. And as you would expect, every one of those companies has a different perspectives on the importance of budgets and how to effectively manage them. In CFO Magazine, Russ Banham’s article Let It Roll challenges the effectiveness of budgeting and shares how many companies are moving to rolling forecasts to make business decisions.

Over the past year, we’ve found that manufacturers are increasingly concerned with improving their forecasting and analysis capabilities. While calculating accurate product costs is the foundation of most of our implementations, giving companies the ability to analyze scenarios inside their cost system expands their ability to see the real impact of changing market conditions, customer demand, and manufacturing processes have on the bottom line. The recent study, “The CFO Agenda: Finance’s Top Issues in 2011”, from The Hackett Group supports that fact by reporting that 81% of CFOs are focused on improving the accuracy, cycle times and efficiency of their forecasting process.

We’d love to hear from you whether budgets are obsolete in your business. Chime in on our blog and let us know what you think.

Top Eight Warning Signs You Have a Dysfunctional Costing System – Part 2

The book Designing Strategic Cost Systems: How to Unleash the Power of Cost Information by Lianbel Oliver has a great list of warning signs that may indicate that your company’s costing system is dysfunctional. Make sure you check out Part 1 of this blog where I covered the first four signs. And without further ado, here’s the rest…

#5 – Managers Don’t Understand Product Profitability

Products that are manufactured at high volumes generally have predictable cost results. Why? Because they’re manufactured regularly, operations folks are familiar with the processes and require less ramp-up time to produce the goods. But for some lower volume products, calculating the product cost can become a bit of a mystery. While the labor and materials required is the same for both high and low volume products, a product that is produced infrequently includes a learning curve that can ultimately increase the cost of the product. This additional cost may not be captured, thereby skewing the results and leading business leaders to make incorrect decisions on topics including about product mix, pricing, and customers.

#6 – Accountants Spend Too Much Time on Special Requests for Analysis

If accountants feel like they’re recreating the wheel each time product cost information is requested – Houston, we have a problem! The basic cost information needs of the organization should be readily available through the system allowing cost accountants to focus their efforts on true analysis needed to improve business performance.

#7 – Inconsistencies in Reported Data

Manufacturing companies know all too well that financial accounting and cost accounting are two separate animals with unique purpose. Even with the difference, the core data used for each function should come from the same source. The number of units produced or transactions processed in the costing system should match those in the general ledger. Tight integration of costing, finance and operations systems is required to eliminate problems with inconsistent data.

#8 – Managers Make Suboptimal Decisions

Ever heard the idiom “Robbing Peter to pay Paul”? Many times costing processes are designed to make decisions that are not in the best interest of the organization. One example from the book talks about a manager who inflates standards to meet performance levels without understanding how this decision could adversely impact marketing or pricing. The costing system should help all parts of the business run optimally and help managers make decisions that promote the company’s overall profitability.

We’re hard at work creating cost management content that is interesting to our readers. Subscribe to our RSS feed and you’ll receive instant notifications when we post new articles.