The Ledger

Curated content foranalytical business leaders

Tag Archives: CFO

Food & Beverage CFO Challenges

A recent study performed by Plante Moran and The Ohio State University Fisher School of Business takes a look at the challenges that food and beverage CFOs are facing in today’s market. With soft demand and rising commodity prices, hedging is one of the leading issues for mid-sized companies followed closely by escalating labor costs in food manufacturing.

Source: GE Capital

The study identifies three “key growth ingredients” for food and beverage companies to maintain their competitiveness. First, consumers tastes are changing which is forcing more product innovation to remain relevant and competitive. Developing new products that taste great, promote good health, and come from sustainable resources is important, but they must also be profitable. Compliance issues are also an important factor, and one that can drive costs into the production and supply chain. Finally, understanding the effects of changing commodity prices, go-to-market and labor costs is paramount to remaining competitive.

Source: GE Capital

To read more of GE Capital’s study, click here. And to learn about how ImpactECS helps food and beverage companies get a better understanding of their costs and profits, visit our Food & Beverage overview.

CFOs Experiencing Gap in Integrating Information Across the Enterprise

At 3C Software, we spend lots of time talking with CFOs and finance executives about data. And by lots of time, I mean all the time. Our professional services teams are helping companies develop cost and profitability models that give access to meaningful data. Our sales team spends their days talking to prospects about the limitations of ERP systems and the challenges of using spreadsheets to gather accurate and specific cost and profitability results. In short, we’re all about getting data to the people who need it.

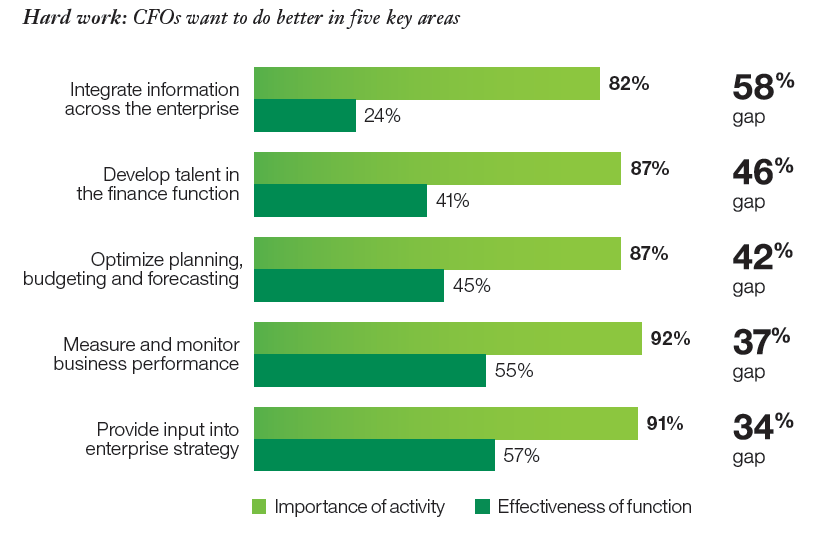

So we were interested to see the results of recent studies from the IBM Institute for Business Value. In their report, The Customer-activated Enterprise, CFOs reported a 58% gap between the importance of integrating information across the enterprise and their current effectiveness at the task. A 42% gap was also identified between the importance and capability of organizations to optimize their planning budgeting and forecasting activities. (Figure 1)

Figure 1. Source: The Customer-activated Enterprise, IBM Institute for Business Value

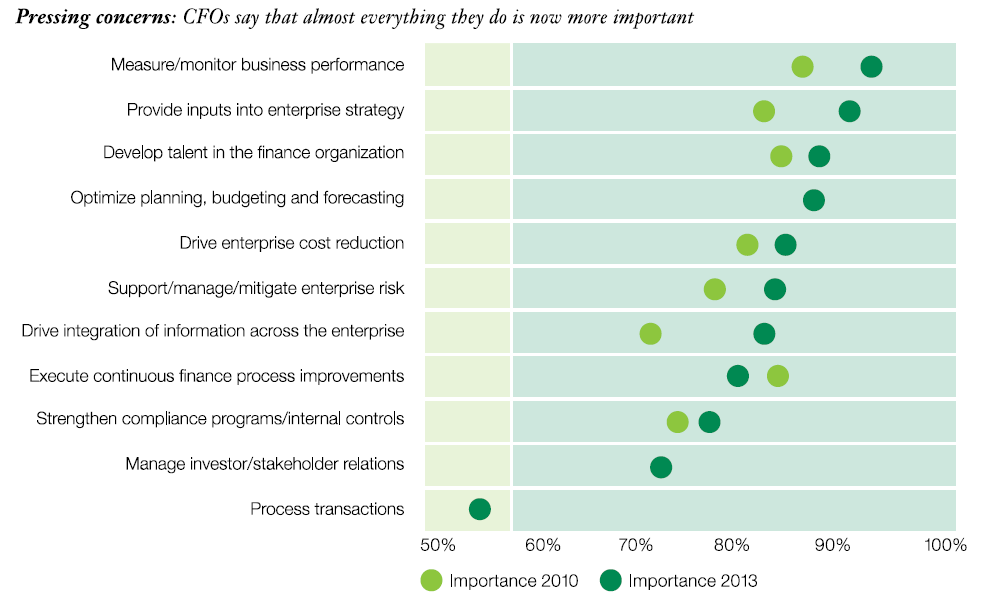

In Pushing the Frontiers, another study from the IBM group, CFOs report that while the importance of all their activities has grown over the past three years, the focus on measuring and monitoring business performance has the most attention of the CFO. (Figure 2)

Figure 2. Source: Pushing the Frontiers, IBM Institute for Business Value

The reports discuss the importance of technology as a means to improve effectiveness in many of these areas – and to provide the enterprise with a “single version of the truth” to make informed business decisions. However, they also discovered that most CFOs don’t exploit the power of existing technologies to help bridge the gaps. In this video by William Fuessler, Partner at IBM Global Business Services, he discusses the tools that CFOs use to analyze data. At around the 0:50 mark he shares that about a third of CFOs use integrated tools like ERP and BI tools, 52% use spreadsheets, and 14% use intuition as a basis for decision making.

https://www.youtube.com/watch?v=oh3bqwCvXLM

Wow! Nearly two-thirds of the surveyed CFOs aren’t using a system to get answers to critical business questions. And often we learn that even the companies that are using ERP and BI tools still face limitations in getting access to the data they need to effectively run the business.

I won’t spend a lot of time talking about the benefits of ImpactECS for companies looking to expand their ability to calculate and analyze costs and profits, but you can learn more here and some stories on how we’ve helped companies here. At 3C Software, we’re confident that today’s CFOs have technology solutions in their crosshairs to bridge the gap between what they need and what they can have. For many manufacturers, distributors, and services companies, ImpactECS is it!

It’s the Cost!!!

Today I met with finance and operations managers for a manufacturing company that didn’t really understand the unique costs of each product they produce. As a result, they weren’t really sure of the margins being created by each product and customer they serve. The interesting part was that these very same managers were pondering whether they could afford to invest in a costing system. As I listened I couldn’t help but wonder, “How can you NOT afford to invest in a costing system? Doesn’t everyone know that a true and accurate understanding of your product costs is paramount to the success of a competitive, commodity business? “

As the meeting continued, topics like capacity utilization, fixed cost absorption, and the need to produce forecasted costs based on future period sales forecasts and radically changing raw material prices came up. The voice inside my head yelled, “How can you NOT afford to invest in a costing system?” Admittedly and shamefully adopted from the political arena, I too often find my inner cost accountant shouting IT’S THE COST STUPID!, and right then I knew the name of my blog.

At the heart of any successful commodity-goods manufacturer is a cost-focused culture that understands and embraces this mantra. In these challenging economic times – arguably more so than in better times – a full understanding of the true and accurate costs incurred at the unique product level are of utmost importance. In fact, this data truly creates a competitive advantage in the market place. True and accurate costing data that allows me to decide where best to produce my products, which of my production lines to set idle, which orders and price points to accept and which to reject, gives me an advantage over a producer that doesn’t share the same level of cost insight. Without this insight my seemingly correct answers to these questions could lead me in the exact wrong direction. A seasoned cost accountant once told me, “There is much truth in detailed, accurate cost data”. Perhaps it is this truth that many business leaders are afraid to face!

As I wrapped up today’s meeting and we parted company, my gracious hosts shared with me proudly their plans for an upcoming ERP upgrade project that was scheduled to take two years to complete. We wondered together whether they should work towards understanding their product costs now or wait until after the ERP project. Arghhhh…. Say it with me… IT’S THE COST!

Is your finance role “strategic”?

Alix Stuart of CFO.com asks this question about the role of CFOs in today’s businesses. Do you find that your role has become more or less strategic over time? And, does this change benefit the company?

Read all of Alix’s article here:

https://www.cfo.com/article.cfm/14449015/c_14452660?f=home_todayinfinance

What is the relationship between finance and technology leaders in your organization?

“CFOs and chief information officers don’t always see eye to eye, even on vital matters like risk management and cost control. But there may be more common ground between them than is typically thought.” This month, David McCann talks about the relationship between CFOs and CIOs and how there is much more common ground than one may think.

Read the article “Harmony in the C-Suite” here

What is the relationship between finance and technology leaders in your organization?