The Ledger

Curated content foranalytical business leaders

Tag Archives: customer profitability analysis

Are You Benefiting from Your Cost Accounting Tools?

Companies that still rely on their legacy costing systems are putting themselves at more of a disadvantage then they probably realize.

“Many manufacturers have developed overhead rates that are being used long after their “best if used by” dates. The reasons for this include the thought that inflation isn’t all that significant, so how much different can the rate be from last year, and besides it’s so much work to update the rate. After a while, you find the rate hasn’t been updated in a few years and then your costing system has slid into ineffectiveness. Also, cost drivers tend to not be examined that often. Some manufacturers have always used labor hours as cost drivers, so they do not even consider that the significant capital expenditures they have made in the business make the more plausible cost driver machine hours. In standard costing systems, standards are sometimes not updated as often as they should be for some of the same reasons.”

The result of inaccurate cost accounting systems can lead to investing time and effort into products or customers that are either marginally profitable, or actually unprofitable.

Read More at The Bonadio Group >

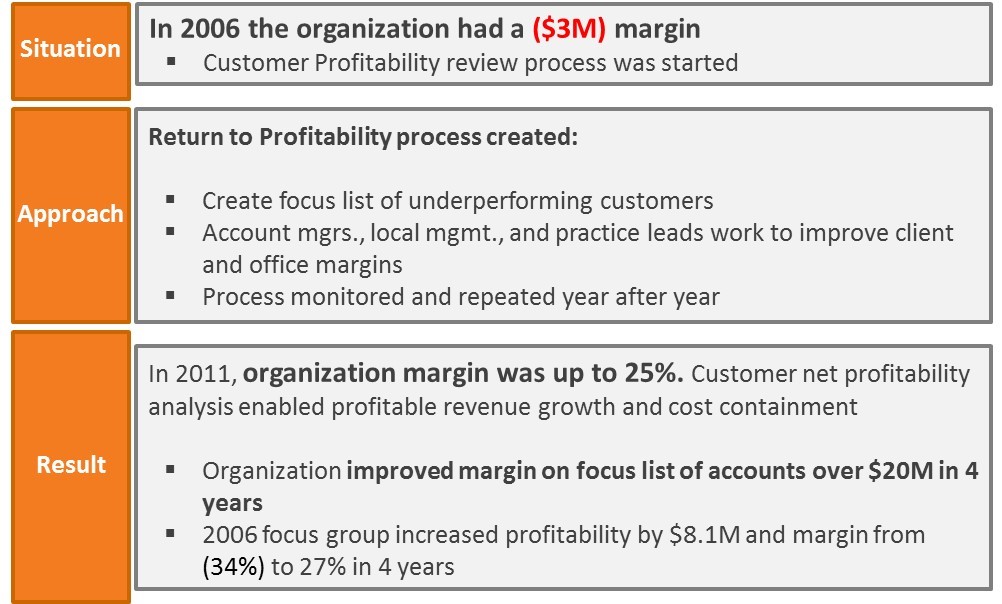

Case Study 1 – Customer Return to Profitability

This is a case study from the study Net Profitability Analysis and Benefits for Financial Services Companies.

The organization focused specifically on their lowest net profit clients by helping account managers understand their net profitability and develop action plans to improve it. At the same time local management took actions to ensure that client level changes resulted in improved business operations and increased profitability across the organization.

Finance Responsibilities: Manage “Return to Profitability” step-by-step process

Plan for Improvement

Identify revenue threshold and bottom net profit accounts

Create scorecards & supporting documents

Review with Account Managers and create “Return to Profitability” plans

– Reduce service levels or remove excess resources

– Re-assign senior and other high-cost resources to high-value accounts

– Increase fees or charge for additional service

Manage Progress

Track & manage client-level plans on a quarterly basis

Monitor time that is being spent with each client and plan initiatives

Validate progress quarterly and with year-end scorecards

Local Management Responsibilities: Develop protocols and take action to ensure client level changes result in improved operations and increased profit margin

Protocols

– Establish regular account profitability reviews

– Establish pre-renewal revenue meetings

– Ensure time tracking compliance

Tracking

– Assess and manage non-client facing time by person by month

– Monitor changes in client resourcing based on client-specific action plans

– Estimate capacity that is or will be freed up and create plan to reduce

Actions

– Reassign resources to drive higher utilization

– Drive new business opportunities (redeploy)

– Reduce headcount (remove)

To read a case study on client level actions, Click Here!

To find out how ImpactECS can help your company gain visibility and become more profitable, Click Here!