The Ledger

Curated content foranalytical business leaders

Tag Archives: FP&A

Turn Strategy into Actionable Plans with Next-Level FP&A

“Few processes within the purview of a CFO have so much potential to create—or destroy—business value than FP&A”

A recent study from the Institute of Management Accountants (IMA) found that in general, top performing organizations take a more rigorous and integrated approach to their FP&A practices by relying on businesses insights to drive results, not just predict them. Unfortunately, many companies are not achieving the full potential of their FP&A activities because they tend to put more focus on forecasting and budgeting, rather than the core principles of planning and execution. Forecasting and budgeting are certainly important, especially in communicating to the organization if it is on track to achieve its business outcomes or to raise warning flags. But forecasting results is not the same as building a plan to actually achieve them. Planning and execution are what will determine success.

Strategic Planning in Today’s Volatile Business Climate

“If there’s a single theme informing the C-suite’s most pressing challenges today, it’s the unrelenting pace and scale of change.”

Businesses are facing the harsh reality that their traditional approach to finance planning is not up to the challenge of establishing assumptions, defining objectives, and allocating resources over a specific span of time. In addition to grappling with a constantly shifting business, technology, and social landscape, today’s strategists must confront more complex planning variables than ever before, while the diversity and scope of their decisions has also grown. No one can predict the future, but today’s leaders can help shape it by understanding the long trajectories that connect it to the past. Rather than be indecisive in the face of uncertainty, leaders can consider multiple possible future scenarios and plan their next steps accordingly. By doing so, they can help to build a more dynamic and scalable business overall.

Read More at The Wall Street Journal >

The Total Cost of Effective Budgeting and Forecasting

Plans, budgets, and forecasts can be some of the most valuable contributions that finance makes to the business. Ideally, they help organizations know what’s coming down the road and remain agile enough to respond to uncertainty and to keep the business moving forward. The goal of these processes is to produce planning, budgeting, and forecasting that help provide guidance and decision-making support for the business. The key consideration is not necessarily how much organizations are spending on the process, but instead whether organizations are making better decisions. When FP&A plays a strong business partnering role and is in frequent conversations with the business, the challenges, opportunities, and pain points of plans, budgets, and forecasts become visible quickly.

Business Modeling & Analytics: Creating Value Requires the Right Technology

Evergreen writer Eric Jorgenson declares “the purpose of the institution of business is to create and deliver value in an efficient enough way that it will generate profit after cost.” If only it were as simple as it sounds! It’s bigger than checking boxes to produce reports, closing the books each period and remaining in compliance. To create real value, forward-looking finance organizations have moved beyond traditional finance activities and are establishing robust business modeling & analytics programs that provides detailed visibility into historical performance and expected results.

Establishing a Robust Business Modeling & Analytics Program

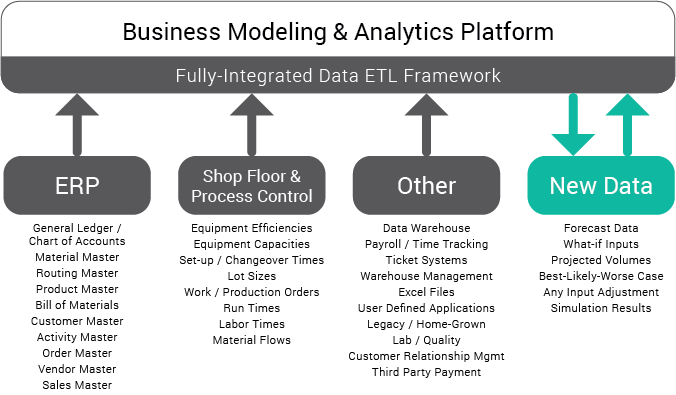

Companies are increasingly dependent on automation and analytics to deliver clear, actionable and forward-looking insights. With the explosion of available data from quickbooks desktop canada and the need to quickly evaluate it, finance teams are centered on two areas – the data and the models. Additionally, businesses who need help with web design services may consult this professional web designer dallas.

❶ Integrating data and accessing results:

As the size of the organization grows, so do the number of systems that support it. Companies can have hundreds of machines that generate endless data points along with groups of data warehouses, BI systems and other data sources holding information. Without a way to link data across the enterprise, it’s impossible to deliver meaningful insights or accurate results.

One shortcoming of most business analytics programs is the inability to integrate forecasted or simulated data as part of the modeling data set. Along with the expected data from ERP, shop floor and other systems, advanced analytics program recognize the need to retain and use forecasted or simulated data alongside historical data to predict performance and test assumptions for any data combination.

❷ Building models and running simulations:

The best models and simulations reflect real-world scenarios, not a pre-defined process or methodology, and delivers results in a timely manner. They must include measurable and meaningful KPIs that expose improvement opportunities and encourage behaviors that positively effect performance.

What is an integrated modeling platform, and why do you need one?

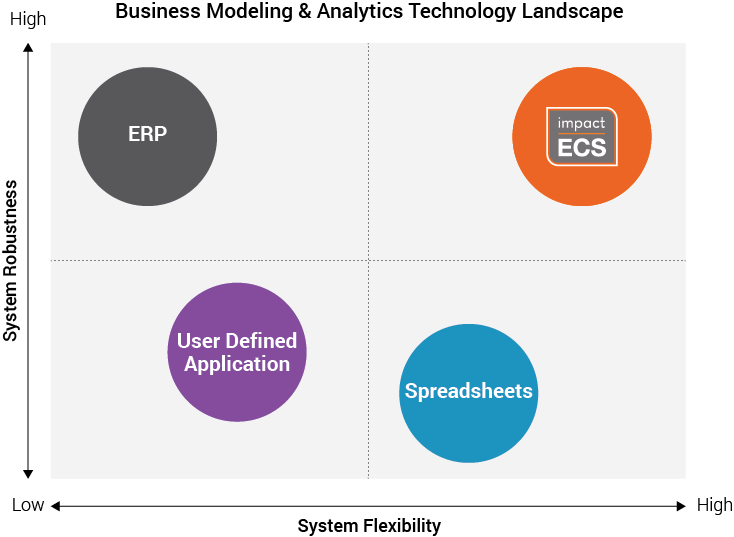

Most organizations have a few “system types” that provide, calculate, or share data as part of the planning and analytics process. The Business Modeling & Analytics Technology Landscape compares the different technologies and their attributes. The vertical axis measures the robustness of the system – or its ability to handle very large data sets and the ability to execute large sets of calculations quickly. Also, robust systems are scalable and can handle multiple users and permission sets. On the horizontal axis, the flexibility of the system represents the ability for the system to be configured to meet the company’s unique needs, both now and in the future.

Business Modeling and Analytics “System Types”

ERP: The ERP system is the system of record for organizations and serves as the transactional system. They are often limited by the design choices in the initial implementation, creating a rigid environment with no inherent simulation capabilities.

User Defined Applications: Many companies try to meet their analytical needs with applications developed internally. From legacy systems dating back to the 70s to AS400 and Access databases, User defined applications offer customized solutions, but their capabilities are often a reduced or partial set of controls. Additionally, simulation capabilities are limited to the programmed options, and changes to the system require IT involvement in maintaining and upgrading systems.

Spreadsheets: Desktop modeling tools solve a variety of challenges when it comes to creating a flexible modeling environment. It isn’t however, a system. That means limited controls and auditability will assure integrity issues. Further, spreadsheets are unable to scale with the requirements to build a robust modeling and analytics environment, and has difficulty handling larger sets of data.

Integrated Business Modeling & Analytics Platform: ImpactECS is an integrated modeling & analytics platform that leverages data from existing systems and delivers complete flexibility to design, calculate, manage, and report results that drive results by creating value. With a centralized approach, finance and planning organizations can link important data from across the company and build models to calculate, predict, or simulate performance at any level of detail or business dimension.

Each of these system types are critical and offer valuable benefits that keep the business running. However, organizations on a mission to create real value through analytics need to augment their IT footprint with technology that delivers the best of both worlds – a solid, enterprise-level system that connects relevant systems and data, and a flexible modeling platform to build, run, and maintain models that meet the company’s unique business requirements. Companies build models with ImpactECS for everything from detailed manufacturing product costs, cost-to-serve and distribution costs, and profitability analytics for any business dimension.

Visit us at www.3csoftware.com to learn more.