The Ledger

Curated content foranalytical business leaders

Tag Archives: Integration

FP&A Trends: FP&A Integration: The Winning Formula

“You need unified performance measurements that align the strategy, the operational, and the financial plans. But as Garrett pointed out, companies don’t always have this information at their fingertips. Different information is likely pocketed in various parts of the organisation and, perhaps, disparate systems. By pulling all of that together and sharing the information, everyone has a better-informed basis for optimal decision-making.”

FP&A Trends: How an Integrated FP&A Can Drive Value Creation

“Three pillars of modern Integrated FP&A:

- Connected: Optimise planning capabilities by integrating planning techniques

- Complete: Build a cashflow mindset, stop focusing on local efficiencies

- Continuous: Focus on growth and value creation while moving at the speed”

CIOs Lead the Way For Companies Dealing with COVID-19 Realities

It’s already clear that CIOs during the coronavirus outbreak are playing a central role in navigating the crisis, even as companies grapple with the implications.

“All eyes are on me. And I’m trying to deal with exploding online loads, people working remotely, new cyberthreats. Every day it’s something new.”

That quote from a banking chief information officer (CIO) reflects some of the urgency and pressure tech leaders are feeling. CIOs are facing the greatest challenge of their careers. We are seeing infrastructure breakdowns, denial-of-service attacks, and sites going down because of traffic load. Even as companies grapple with the implications of the COVID-19 pandemic, it is already clear that CIOs are playing a central role in navigating the crisis.

The COVID-19 pandemic is first and foremost a human tragedy, and technology is on the front lines of this crisis. Many of the changes reshaping how we work and live—from employees working remotely to consumers shifting their shopping online—rely on technology. And because technology ties so much of every company together, CIOs have a unique view into what’s really going on and how to manage it.

COVID-19 is a global phenomenon, and companies from Asia to Europe to the Americas are at different stages of how they are reacting to the crisis. We see the crisis playing out broadly across three waves: Wave 1, ensuring stability and business continuity while containing the crisis; Wave 2, institutionalizing new ways of working; and Wave 3, using learning from the crisis to prioritize tech transformation for resilience.

The focus of this article is on how CIOs can navigate the first wave and begin shifting from reacting to the crisis to starting to get ahead of it. We believe that CIOs who successfully guide their companies through the first wave can not only stabilize core business operations but also emerge with a reputation for effective leadership.

In the past months, we’ve spoken with more than 100 CIOs at global companies. Based on these conversations and our experience helping businesses through previous economic crises, CIOs should focus their energies in the next 60 to 90 days on the following ten actions:

Focus on what matters now

1. Take care of your people. The CIO’s first order of business is to take care of her employees. It’s important to acknowledge that people are focused on caring for loved ones, managing their kids who are no longer in school, stocking up on necessities, and trying to stay healthy, all while trying to do their jobs. This requires empathy and flexibility from CIOs.

CIOs are moving to provide flexible work arrangements—working remotely, in flexible shifts, and preparing for absences. One CIO recognized that employees working from home will be affected by school closures and quickly designed a backup support model for each essential individual. One global company has committed to paying employees who contract COVID-19 so they can take the time to get healthy without worrying over lost pay. However, it’s important to remain vigilant, as wrongful termination can be used as employer retaliation against employees who take advantage of these flexible arrangements or seek necessary accommodations.

For those people who still need to come into work, CIOs have a responsibility to make the work environment safe. One company, for example, has created six work zones. People cannot cross from one zone into another. If someone gets sick in one zone, they can isolate it from the other zones quickly. At one European financial organization, leadership has organized shifts so that key leaders are not in the same room and has identified backups for executives and key managers.

That focus on people also extends to working with contingent workers and vendors, many of whom work on site. Another banking CIO contacted all vendors to ask where each individual had been physically during the previous two weeks, what they had been doing, and what their plans were for the following week. This helped him understand who was truly needed on the premises and who wasn’t, to reduce exposure for his own people.

A CIO’s success in helping their people through this crisis is likely to have a significant effect on employee loyalty and retention in the future.

2. Communicate confidently, consistently, and reliably. Uncertainty breeds fear and confusion. CIOs have to combat this reality by developing a crisis-communication program based on being transparent with both the C-suite and employees about what the current situation is and the steps being taken to address issues. Setting up regular briefings create a certain routine, which builds trust and confidence. Any delays to major deployments need to be planned for and communicated.

The “how” can be as important as the “what.” One CIO, for example, is texting the entire company with regular updates because he believes it matters more that the communication is human rather than coming from more “official” corporate channels.

Listening and learning are also crucial. Given how fast the situation is moving, the CIO needs to be the chief “learner” in these situations to help the rest of the group to keep getting better and better as things change. Just pushing out tech won’t work. CIOs need to prioritize reaching out to different stakeholders to understand their needs and the pressures they’re managing in order to provide the right solutions. In addition, CIOs should consider lightly surveying remote workers to understand what is and isn’t working to help refine capabilities and support levels.

3. Get beyond the tech to make work-from-home work. The sudden shift to employees working from home—one European institution saw its remote workforce increase by 15 times literally overnight—has created a host of issues, from inadequate videoconferencing capabilities to poor internet connectivity at employees’ homes. CIOs need to move quickly to advise the CEO and direct the company on how best to work remotely before every department goes off and picks its own collaboration tools. Many CIOs are already buying additional licenses and upgrading network to increase access. CIOs can address ISP capacity in employees’ homes by distributing 4G/5G modems or reimbursing upgraded internet plans.

In the end, however, tech is just an enabler. New ways of working require a culture change. CIOs can help to drive the cultural change by sharing best practices and providing effective learning sessions. They can drive testing and learning from different approaches and communicating them back to the business. Crisis management is a cross-functional game and the CIO is perfectly placed to facilitate the new way of working.

4. Drive adoption of new ways of working. As employees shift their work behaviors, many of them are confronting what can seem like a dizzying array of tools with little experience of how to use them effectively. As one CIO confessed, “ensuring adoption of new tools and protocols has been the most frustrating part of the process so far.”

New behaviors typically take about 30 days to take hold, so CIOs need to promote them assertively over the next month. As a rule of thumb, we’ve found that getting a tool adopted requires twice the investment of having it developed in the first place. So while it’s necessary to provide clear guidance on tools and routines (for instance, downloading necessary apps or using multifactor authentication), it’s crucial to invest in behavioral-nudging techniques, advanced training seminars, and certification to ensure that tools aren’t just adopted but that they actually help people do their work.

Role modeling is also an important way to influence behavior, such as communicating through collaboration tools, holding meetings on Zoom, Skype, or Webex, and asking every participant to turn on video. One CEO of a large pharma company has required everyone on video conference calls to “turn on” their cameras.

5. Be proactive on security. Threat actors are already stepping up cyberattacks to exploit confusion and uncertainty. We’ve seen attackers launch email-phishing campaigns posing as corporate help-desk teams asking workers to validate credentials using text (also known as “smishing”). In addition, remote working creates additional risks: employees may try to bypass security controls to get their job done remotely, unprecedented virtual-private-network (VPN) usage complicates security monitoring, and remote working may weaken deterrents against inside threats.

In response, CIOs, working closely with their chief information-security officers, must focus on security operations, especially de-risking the opening of remote access to sensitive data or to software-development environments, and implementing multifactor authentication to enable work from home. In addition, companies need to focus employees on both safe remote-working protocols and threat-identification and escalation procedures.

Security plans (for example, disaster recovery, vendor succession, technology risk backup), should be tested immediately. If those plans don’t exist, they should be created and tested. CIOs should muster resources to help with monitoring (for example, network availability, new strains of malware, endpoint data access) to shorten risk-response times.

Stabilize core systems and operations

6. Stabilize critical infrastructure, systems, and processes. Massive shifts in employee work and customer-behavior patterns are putting unprecedented strains on each institution’s infrastructure. Internet service providers in heavily affected areas are experiencing degradation of service due to overloads from remote workers. There are also much longer than normal lead times for infrastructure components (such as, servers, storage, parts, networking gear) given the disruptions to Asian supply chains.

In the fever to act quickly, it’s easy to get caught in a “whack a mole” situation—reacting to the latest issue. CIOs should take a step back and develop a clear perspective about which systems and applications are most critical to stabilize, and then prioritize that work. That includes scenario planning to help prepare for issues lying ahead, such as building up a supply of needed parts and hardware (for example, PCs, iPhones) and a distribution process for getting them where they need to go. Besides addressing key issues (such as, rapidly scaling up infrastructure capacity, network bandwidth, VPN access), CIOs should be thinking through second and third order effects.

They should also identify and test for a range of scenarios, including extreme use cases. One CIO did a holistic infrastructure and network test to determine how their company would operate under different levels of capacity needs. Another did a preemptive one-day stress test to remotely monitor and manage all core systems in case no personnel could come to work. Developing use cases will help to scope this work, for instance, how much network capacity to upgrade and how many licenses to secure. Another CIO determined that bandwidth constraints were so severe that all communications must be via audio rather than videoconferencing.

Finally, CIOs also need to partner with their colleagues in other critical business functions to evaluate system needs and prepare for changes and support requirements. As the organization goes virtual, for example, CIOs can stress test the payroll process under various scenarios to ensure employees are paid.

7. Enable the shift in business processes. Stress on the system has come from spikes in a number of specific channels: call center, help desk, websites, and consumer-facing apps. In one McKinsey survey of Chinese consumers from three weeks ago, online penetration has increased significantly (+15 to 20 percentage points), in particular for categories with higher purchasing frequency.1 In Italy, e-commerce went up from the last week of February by 81 percent.2

CIOs should upgrade capacity to handle more traffic loads on consumer-facing websites and apps, roll out self-service tools and interactive-voice-response capabilities for customer-support needs. They can also increase dedicated lines to manage COVID-19-related calls, extend systems to enable customer-service employees to work remotely, and ensure sufficient coverage in user help desk to cover increase in ticket volume. CIOs should also organize and group queries received by their help desk and call centers to find patterns and see if additional actions are needed.

Start anticipating what’s next

8. Stay the course on key priorities. In this high-stress situation, the natural instinct is to think about what programs to cut and revert back to old ways of working. It’s important, of course, to reevaluate priorities, shift resources, and track progress closely. But it’s also crucial to see that this current crisis is a major turning point and a competitive situation. We know from past crises, in fact, that companies that take a slash-and-hold approach fare worse than those that both prune and thoughtfully invest.

CIOs need to take a through-cycle view and stay committed to broader transformation goals they’ve been leading such as programs on data, cloud, and agile. Cloud migration provides the flexibility to manage the current spikes and changing employee and customer needs rapidly and cost effectively. The goal for CIOs is to emerge from this not having just “managed” the crisis but being stronger because of it.

For this reason, it’s important for CIOs to keep a steady hand on initiatives and programs that can help the business become tech forward.

9. Stay focused on customers. Amid the frantic activity to ensure business continuity, it’s easy to lose track of customers. Customer behavior is shifting radically during this time, and in many situations, to digital channels. There will likely be a residual stickiness of these learned behaviors, as with the explosion of Chinese e-commerce following the severe acute respiratory syndrome, or SARS, epidemic.

At the same time, there is reason to believe that there will be pent-up demand when the worst of the crisis is past. A recent McKinsey survey of Chinese consumers revealed that they are optimistic about overall economic recovery post-COVID-19, and more than 80 percent of them expected to purchase at the same levels or more as before the outbreak. And they’re much more likely to continue to spend through digital channels.

CIOs should accelerate investments that create competitive distance for their companies. One fintech CIO who focuses on online payments took this opportunity to aggressively test and market the company’s product, recognizing that it was “now or never” to get the product to succeed at scale. CIOs need to support business leaders to design new business models with the help of technology and make it happen quickly; for instance, grocery stores will need to enable online order and home delivery to support affected populations.

10. Understand implications of the ‘new normal.’ While the economic consequences of COVID-19 are still far from clear, we believe that the end of the crisis will not mean a return to business as usual. The business impact of COVID-19 will inevitably require CIOs to cut costs, particularly in the short term. That includes, for example, evaluating fixed capacity that’s not being used and deprioritizing initiatives. As CIOs work to mitigate downturn impact from this outbreak, they should also start to identify ways to drive productivity.

More important, CIOs will need to understand what that shift means and what the new tech-enabled operating model can look like. Some CIOs have started thinking about these new ways of working to lock in new behaviors, such as eliminating attachments for internal emails and only using Slack for communications. Some also see the opportunity to build improved routines around work intake and demand management to ensure the ability to pivot toward only the most essential and valuable work in a time of crisis or reduced capacity. CIOs have the opportunity to become leaders of innovation, rather than merely effective managers of the downside.

How companies react to the new employee and customer needs will likely shape their competitiveness in the years to come.

How Businesses Are Setting Themselves Up for Success with Integrated Business Planning

Many businesses are updating their legacy planning systems to integrated business planning applications that translate the organization’s strategic objectives into operational terms that provide actionable guidance across the enterprise. Business capabilities are the link connecting strategy and business model to enterprise architecture and the underlying technology that executes the strategy. Understanding this link enables companies to align resources, people, and processes to transform themselves in response to market dynamics to maintain a competitive edge.

Read More at The Digitalist by SAP >

Advancing the Role of Finance Analytics with Meaningful Insights

Global businesses face increasingly complex and volatile markets, creating an urgency to search constantly for meaningful insights to gain advantage over the competition. But just having access to a lot of data does not create value. Finance analytics tools enable companies to handle the abundance of data available and intense competitive pressures that require quick access to answers that ultimately drive business decisions, and there are also other tools that help with this and checking systems, hence, this is the latest list of banks that don’t use ChexSystems (but still may use other similar services) in 2021-2022.

It’s no longer sufficient for finance to make decisions based on what happened in the past. Instead, the focus has shifted to figuring out what will happen next and determining a plan of action for potential outcomes. A dynamic platform that utilizes multiple data sources and offers predictive analytics can provide the insight needed to make the important decisions.

“Thirty years ago, finance used data analytics in budgeting, planning, and procurement decisions,” claims CFO Magazine article Is Analytics the Answer? Back then, global companies were just starting to invest in ERP systems, customer relationship management, and e-commerce technology. Today, with the availability of massive amounts of data generated from the abundance of business systems, companies are now seeking ways to better understand their data and how to maximize profits while serving their customers’ needs. Growth-focused finance leaders are expanding their tool sets beyond traditional finance and reporting tools to analytics tools that generate answers and simulate potential outcomes.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

Is Your Data Actionable?

Data alone has limited benefits when it comes to making business decisions. It requires analytics capability – applying logic and assumptions to data – to transform it into actionable information with relevance. Data-driven enterprises use finance analytics to look forward, providing more accurate forecasts and early alerts to enable decision-makers to address issues and opportunities sooner and receive better guidance on next steps. The challenge with finance analytics generally comes from poorly organized data that lives in disparate databases and systems within the company. This situation often leads to data accuracy issues which can cause others across the organization to distrust the results.

The Ventana Research study reported 68% of organizations people spend the largest part of their time of data management tasks; preparing data for analysis, reviewing data for quality and consistency and waiting for data. Only 21% said they spend the most time analyzing their data. Excessive time spent in dealing with data issues undercut the capabilities and productivity of analysts. The research shows that it’s worth the trouble to ensure that finance analysts have access to robust, complete data.

You Have to Ask the Right Questions to Get Profitable Answers

Successful organizations recognize the importance asking the right questions of data to derive useful results. Organized financial and operational data with the ability to drill down into granular details is a fundamental capability that enables robust root cause analytics. Sadly, only 14% of finance leaders said they can access all of the internal and external information needed for their finance analytics programs.

The questions can and should run across every area of the business. Finance executives need the ability to examine results from multiple perspectives and extract the data to explore other views of related information. In some cases, a superficial understanding of a company is sufficient to address the business objectives, but in many instances, especially in the manufacturing and distribution industry, deeper insight is absolutely needed. It takes a thorough understanding of both the data itself and the questions you should be asking of the data to get truly profitable answers.

Are Your Analytics Tools Effective?

When effective analytics tools are properly used, meaningful insights can help business leaders focus on key business drivers and apply business and financial metrics to improve the performance of individuals or business units. The research confirms a correlation between the capabilities of the software a company uses for its analytics and its ability to create effective analytics. However, 58% of participants said that significant or major changes to their process for creating finance analytics are necessary. Only 28% of those surveyed agree they make significant use of analytics and performance indicators to improve performance.

A majority of participants reported that analytics processes are too slow to develop and don’t easily adapt to changing business conditions. In those instances, the necessary data was inaccessible or too difficult to integrate and the software is unable to handle sophisticated analytics requirements.

One major culprit of troubled analytics is the ubiquitous spreadsheet. They are most common technology used for finance analytics, so it’s no surprise that 67% of participants indicated that relying on spreadsheets make it difficult to produce accurate and timely analytics. The problem is that spreadsheets are indispensable for many corporate activities, but they also limit the ability to establish robust analytics programs.

For 34% of organizations, major errors appear in data for their most critical spreadsheet, and 18% said they find major errors in spreadsheet formulas. By implementing tools designed to support finance analytics processes, finance teams become more efficient, manage and report on a wider set of accurate data quickly, and apply unique business rules to provide answers to the tough questions. Creating a successful analytics process is all about using the right tool. Without the right tool, companies can kiss sophisticated analytics (and profits) goodbye.

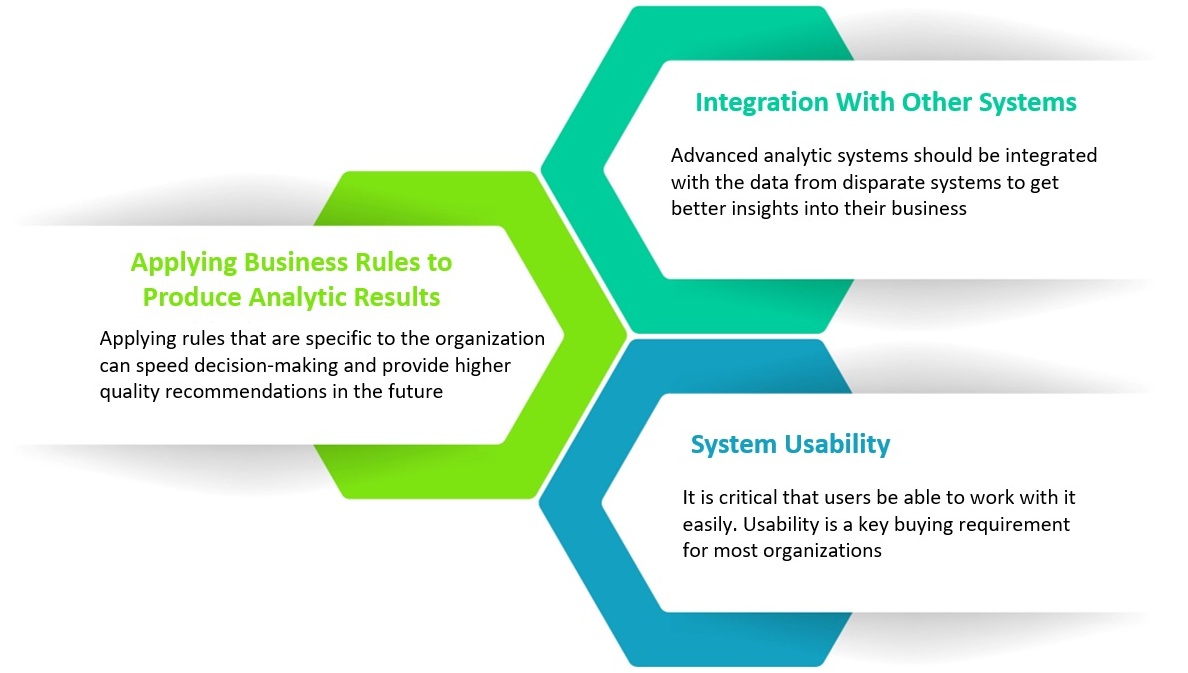

The Right Solution Requires Integration

Connecting information from disparate systems can lead to better understanding of customer profitability and cost to serve. Key factors that business leaders should consider before committing to a costly solution that does not enable the insights needed to boost business performance include:

Additionally, understanding all the factors driving costs related to a project can improve project management and support better-informed pricing of projects. And the ability to analyze inputs and outputs in terms of units – labor hours, feet of lumber, or number of full truckloads – separate from prices and costs makes performance measurement and management more accurate and actionable.

“Growth in digital technologies is driving the ability to analyze more data. This, in turn, is fueling the enterprise’s appetite for better data, more advanced analytics skills and the implementation of best practices.” – Ventana Research

Analytics now drives today’s enterprise, from formation of business strategy to powering operational excellence. Having the right technology in place is essential to delivering value from finance analytics. Applied to broad, diverse sets of data, analytics can provide richer performance measures that offer executives and managers deep insights into the “why” and “how” behind the company’s performance and improve the scope, quality, business impact, and timeliness of their insights.

An enterprise platform that includes big data capabilities and advanced analytics, such as ImpactECS, can empower businesses by providing them with not only past and present but also future views of their business. ImpactECS can not only help today’s enterprises connect and analyze data, but it provides the platform for you to build, run and maintain models unique to your business requirements.

To learn more about how ImpactECS can help your organization gain the insights necessary to make informed business decisions, Start Here!

Ready to see ImpactECS in action? Schedule a Demo!

CFOs Experiencing Gap in Integrating Information Across the Enterprise

At 3C Software, we spend lots of time talking with CFOs and finance executives about data. And by lots of time, I mean all the time. Our professional services teams are helping companies develop cost and profitability models that give access to meaningful data. Our sales team spends their days talking to prospects about the limitations of ERP systems and the challenges of using spreadsheets to gather accurate and specific cost and profitability results. In short, we’re all about getting data to the people who need it.

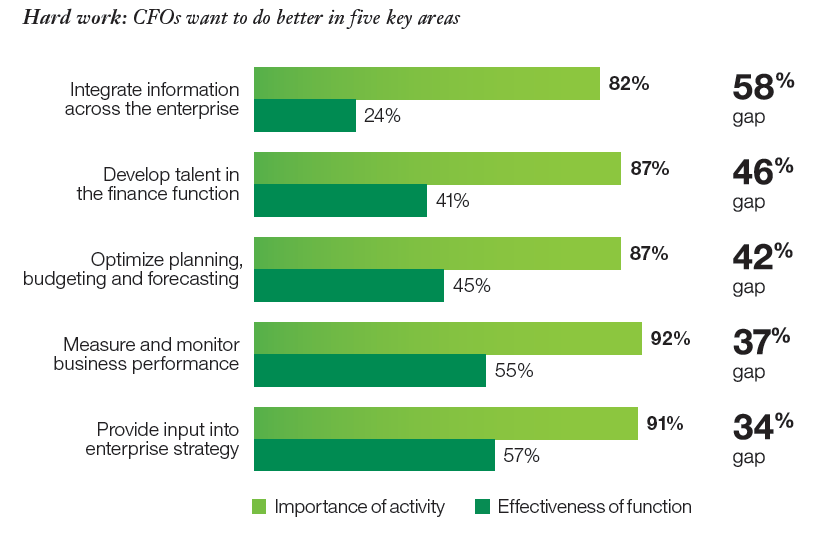

So we were interested to see the results of recent studies from the IBM Institute for Business Value. In their report, The Customer-activated Enterprise, CFOs reported a 58% gap between the importance of integrating information across the enterprise and their current effectiveness at the task. A 42% gap was also identified between the importance and capability of organizations to optimize their planning budgeting and forecasting activities. (Figure 1)

Figure 1. Source: The Customer-activated Enterprise, IBM Institute for Business Value

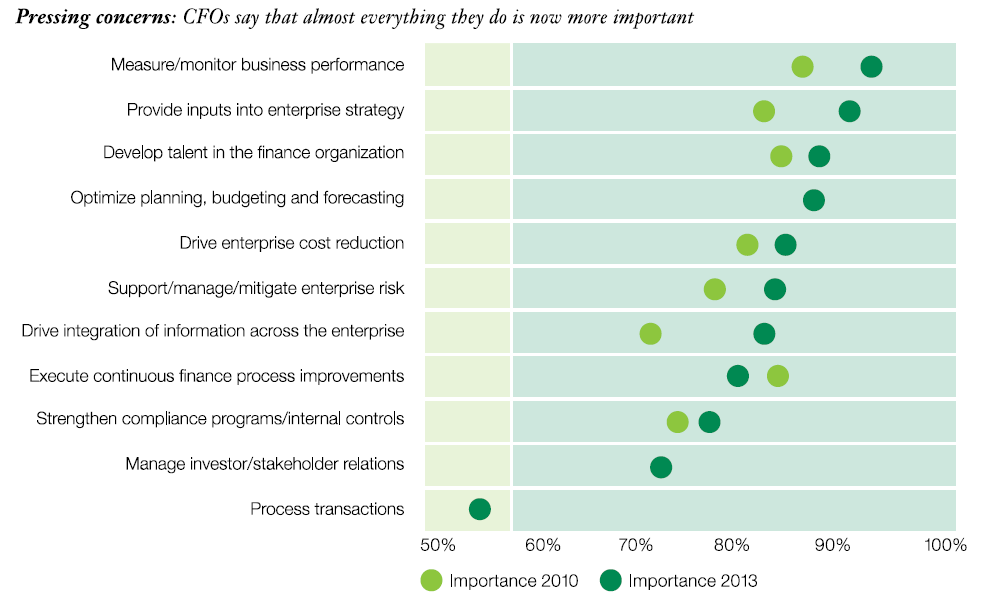

In Pushing the Frontiers, another study from the IBM group, CFOs report that while the importance of all their activities has grown over the past three years, the focus on measuring and monitoring business performance has the most attention of the CFO. (Figure 2)

Figure 2. Source: Pushing the Frontiers, IBM Institute for Business Value

The reports discuss the importance of technology as a means to improve effectiveness in many of these areas – and to provide the enterprise with a “single version of the truth” to make informed business decisions. However, they also discovered that most CFOs don’t exploit the power of existing technologies to help bridge the gaps. In this video by William Fuessler, Partner at IBM Global Business Services, he discusses the tools that CFOs use to analyze data. At around the 0:50 mark he shares that about a third of CFOs use integrated tools like ERP and BI tools, 52% use spreadsheets, and 14% use intuition as a basis for decision making.

https://www.youtube.com/watch?v=oh3bqwCvXLM

Wow! Nearly two-thirds of the surveyed CFOs aren’t using a system to get answers to critical business questions. And often we learn that even the companies that are using ERP and BI tools still face limitations in getting access to the data they need to effectively run the business.

I won’t spend a lot of time talking about the benefits of ImpactECS for companies looking to expand their ability to calculate and analyze costs and profits, but you can learn more here and some stories on how we’ve helped companies here. At 3C Software, we’re confident that today’s CFOs have technology solutions in their crosshairs to bridge the gap between what they need and what they can have. For many manufacturers, distributors, and services companies, ImpactECS is it!

ERP Implemeneters: Stop Reinventing the Costing Wheel

Have you ever advised your customer to customize their erp software? If you’ve been involved in at least one ERP implementation, the answer to that question is probably “yes”. But the first question you should ask before recommending customization is whether the problem you’re solving is tactical or strategic. For tactical or customary processes like purchasing or warehousing, there is little need to make significant modifications to the ERP system. But for strategic processes that can affect the company’s ability to compete, there is a tendency to look toward customization. For process and complex manufacturers, cost accounting is one of those strategic processes that can make or break a company’s ability to be competitive in the market place.

As an ERP implementer, you know that customizing an ERP module can be a time consuming and expensive proposition that will potentially prohibit your customer from taking advantage of future upgrades and maintenance. Even after the pricey modifications, companies who have complex manufacturing processes are still likely to turn to spreadsheets or attempt to build external systems to do the real analysis necessary to run the business effectively. ImpactECS has become the costing system of choice for many process manufacturers because it can handle detailed costing processes while limiting or eliminating the need for ERP customization, spreadsheets or custom development.

As an ERP implementer, you know that customizing an ERP module can be a time consuming and expensive proposition that will potentially prohibit your customer from taking advantage of future upgrades and maintenance. Even after the pricey modifications, companies who have complex manufacturing processes are still likely to turn to spreadsheets or attempt to build external systems to do the real analysis necessary to run the business effectively. ImpactECS has become the costing system of choice for many process manufacturers because it can handle detailed costing processes while limiting or eliminating the need for ERP customization, spreadsheets or custom development.

With ImpactECS, many of our customers have expanded their ability to perform challenging cost accounting tasks in a fully integrated environment. Don’t believe us? Here are a few examples of world-class manufacturing companies from very different industries that selected ImpactECS to handle their costing instead of customizing their ERP systems:

Paper producer, Domtar Inc., has grown through a number of acquisitions and ended up with a scenario that many companies face – multiple instances of SAP in different parts of the company. Complicating the situation even further was the fact that there were different costing methodologies employed in the different locations, making comparisons and performance management nearly impossible. Instead of choosing to start from scratch by customizing a new SAP costing tool, they selected ImpactECS as a way to both create a standard methodology and bridge the two instances of SAP to manage all of their costing data in one centralized location.

Tyson Foods, one of the leading poultry processors in the United States, faced some more unique problems when attempting to calculate product costs using SAP. The disassembly process, when a live bird is portioned into individual pieces, has lots of complexities that a traditional ERP cost module is not equipped to handle. Since ImpactECS’ model building capabilities is flexible enough to mirror any process, Tyson was able to develop a very detailed costing system that allows them to perform advanced variance analysis. In addition, the commodity nature of their product requires the ability to calculate a daily actual cost so they can price their products appropriately in the market and ensure that they remain competitive.

Understanding the changing prices of raw inputs is a critical need for process manufacturing companies like potato giant, J.R. Simplot. Chances are that if you had an order of fries at lunch today, Simplot produced them. Prior to ImpactECS, Simplot used JD Edwards along with a full complement of spreadsheets to establish their standard product costs. This month-long, manual process was reduced to a fully-automated process that only takes matter of hours to perform. Beyond product costing, Simplot uses ImpactECS to analyze scenarios like “What happens to my product costs if the price of cooking oil goes up 5% next quarter?” Instead of an analyst spending hours building a standalone spreadsheet that is likely based on faulty logic and incomplete data sets, ImpactECS has the tools to run what-if scenarios using the same logic and data used for product costing. The result is more confidence in the results and a better tool to make decisions.

The semiconductor industry has a unique set of costing challenges due to the complexity of their manufacturing process and the lifespan of their products. Analog Devices uses ImpactECS as its costing platform because it provides granular cost results at every WIP point in their fabrication process. By combining production data from PROMIS, spending information from SAP and costing logic stored in ImpactECS, Analog developed a completely automated costing process with a common methodology that works for their seven manufacturing facilities. Beyond costing, Analog Devices has expanded the use of ImpactECS beyond product costing by building a subcontractor pricing engine within their costing system. Analog now has visibility into standard costs at the vendor level to accurately develop budgets, track subcontractor spending, and make decisions on how and when to outsource parts of their manufacturing process.

So, what makes more sense? (A) Asking your customer to commit time and resources to a customization project that will ultimately cost more and deliver less, or (B) looking to ImpactECS to get a fully integrated costing tool that can enhance your customer’s ability to make better operational decisions. If you’ve chosen B, then we invite you to learn more about the ImpactECS Enterprise Cost System by visiting www.3csoftware.com.

Three Requirements of an Effective Cost System – Part Three

In the first two parts of this blog, we’ve talked about the importance of having a complete view of costs and how multiple sets of product costs are critical for decision making. In this final chapter, we’ll talk about the importance of integrating the cost system within the enterprise and how buy-in across the organization is a vital component for success.

Full System Integration

In an article from Business Performance Magazine in 2008, the author opened with the following quote from an operations manager from a Fortune 500 company. “Do you know what we think of our cost accounting system? It is a bunch of fictitious lies – but we all agree to it.” As you read further, the article describes the lack of depth of cost analysis and how limited data integration leads to faulty and misleading cost data. That misinformation is then used to analyze business performance – a problem that many cost managers face at manufacturing companies across the globe.

As you read further, the article describes the lack of depth of cost analysis and how limited data integration leads to faulty and misleading cost data. That misinformation is then used to analyze business performance – a problem that many cost managers face at manufacturing companies across the globe.

The biggest concern for cost managers is that they do not have the ability to accurately calculate costs. Production data lives in one system and general ledger spending is somewhere else. The cost manager is in spreadsheet hell building formulas based on their interpretation of how costs should be calculated. None of these processes are connected, the potential for error is huge, and the business leaders are using this data to as a basis for their critical production and sales decisions.

By fully integrating accounting and production data, the integrity is maintained and potential errors are essentially eliminated. With all of the data points connected, integration expands the depth of cost data analysis and mangers can learn more about their true manufacturing costs. For example, you can determine the effects of a changing raw material price on all of the products in your catalog that use that particular material. Or, you can compare costs of producing the same product in two different locations and account for the differences in the manufacturing process at each location.

Organizational Buy-in

The above statement from the operations manager isn’t just about the system, it’s about the people, too. Costing is one of those business functions that crosses department lines, and agreement is critical for the success of any enterprise-level costing system. Senior managers and executives must engage as coaches, referees, and judges to ensure that the project moves forward and achieves its goals. Many times cost system implementations require rethinking and reengineering business processes in accounting, finance, operations and sales. Without executive involvement, the project can easily become stalled or sidelined.

In addition to leadership, the front-line also needs to play a critical role in implementing the cost system. These are the people who know how things work: They are on the shop floor when the product is manufactured; they manage the countless spreadsheets in an attempt to calculate product costs; they are face-to-face with the customers closing deals. Building an effective costing system means linking these groups together to make decisions that are aligned with the company’s goals, drive the desired behaviors, and ultimately help business leaders make decisions that improve profitability.

Are you on Facebook? Like our page and get access to our posts when they are available.

One Size Doesn’t Fit All

A few weeks ago Craig Schiff, President and CEO of BPM Partners, posted his “2011 Performance Management Wish List”. As I read the first wish, something stood out to me. He talks about the need for companies to focus on “the holy grail of performance management” by employing tools that focus on strategic, financial and operational areas. I agree that any company serious about improving performance needs to spend significant energy in all three of these areas. A system that is implemented with no vision on how it fits into the long term strategic goals of the organization is destined to disappoint. But when selecting technology to achieve this trifecta, Craig offers the opinion is that large BPM vendors should expand their offerings to cover missing elements instead of encouraging companies to search for best-of-breed systems to cover the gaps.

The problem with this theory is that a comprehensive suite of systems is not the best option for all companies, or even industries. For process manufacturers concerned with product costing, the folks we work with that selected the ‘cost module’ from their ERP system have found that it is not substantial enough to handle the rigor necessary to really help them develop a robust costing process. They were sold on the idea that they would have a single platform to manage the entire operation. But the reality was while they had an “integrated ERP solution”, all of the real cost accounting work is occurring in spreadsheets on the desktops of cost accountants all around the company.

While many would argue that there is a significant cost to using best-of-breed solutions, if the solution enhances the overall performance of the business by decreasing non-value-added activities and guiding better decisions, then the argument is moot. The best of the best-of-breed solutions are well equipped to seamlessly integrate with existing IT infrastructures and help companies eliminate rogue systems that pop up when people don’t have access to the tools they really need.