The Ledger

Curated content foranalytical business leaders

Tag Archives: Product Costing

Costing for Complexity is…. Complex.

“In today’s fast-moving consumer goods environment, consumers demand an increasing degree of differentiation. Serving this need comes at a cost.”

Accommodating the multiple SKUs that come from differentiation adds significantly to production costs for companies that produce fast-moving consumer goods. Cost accountants have an opportunity to provide significant value by assisting their companies in fulfilling customers’ desire for this customization while minimizing the costs. However, allocating the costs of carrying this many SKUs can be a challenge.

Read More at The Journal of Accountancy >

Better Decisions with Transparent Costing and Profitability Insights

“With companies under pressure to improve profitability, many seek higher levels of transparency into financial performance to uncover insights that can enhance decision-making and create value.”

Business leaders need actionable analytics to recommend actions that improve the bottom line; such as adjusting pricing, reducing product costs, and rationalizing unprofitable products or services. However, many companies rely on two-dimensional reports featuring a significant amount of words and numbers to facilitate a discussion or communicate a point. But in many cases, the information lends itself to more questions, requiring iterative versions to provide the answers.

Read More at The Wall Street Journal >

Leading Consumer Goods Companies Are Mastering Cost Complexity

In today’s fast-moving consumer goods environment, consumers demand an increasing degree of differentiation. Serving this need comes at a cost. Today’s consumers have completely changed the consumer goods environment because their demand is increasing, and businesses have to find a way to keep up if they want to remain competitive and profitable. Many goods come in several variations (size, flavor, ingredients, etc.). Meanwhile, shipping protocols for different countries vary, so the way individual bottles and cans are packaged together will be different depending on where the manufacturer is sending the products. These many variations of SKUs add significantly to production costs for companies that produce fast-moving consumer goods. Businesses have an opportunity to provide significant value by fulfilling customers’ desire for this customization while minimizing the costs.

Read More at The Journal of Accountancy >

Is Activity-Based Costing Worth It?

Manufacturing companies need to understand product costs accurately and in detail. This kind of information is essential for planning operations, pricing, and evaluating business margins. Activity-based costing helps manufacturers identify what products are truly profitable, the true costs of products for pricing, and what activities are driving costs. However, activity-based costing is known for being difficult to apply and labor-intensive due to the extensive data needs of the process. The trick to knowing if activity-based costing is worth the trouble is first finding a tool that can compute accurate product costs and has the capabilities to take the labor and data needs off your hands.

Read More at The Business Case >

How Effective is Your Costing?

Many companies are using a costing platform that is more of a “one-size-fits-all” system. What they don’t realize, is that the insights there are getting from these systems are inadequate for important decision making because they aren’t tailored to their specific business needs. Another barrier to effective costing is understanding the difference between the costing done for external financial reporting and managerial costing – costing done purely for an organization’s internal use. The goal of managerial costing is to ensure information for decisions reflects the characteristics of the organization’s resources and operations. Yet most companies have inadequate managerial costing systems, relying on systems designed primarily to meet external financial reporting standards.

Simplifying Cost Control In Real-World Complexity

“Spending decisions are best made with collaboration and guidance.”

Now more than ever, employees expect more freedom to spend capital much in the same way they buy their personal items. And while most finance organizations are finding ways to eliminate paperwork, streamline processing, and provide mobile access, CFOs are only chipping away at what they need the most- total spend management. With the system of checks and balances that total spend management delivers, employees are given the tools and insights they need to purchase quickly, appropriately, and, above all else, intelligently

Read More at The Digitalist by SAP >

A Quick Review of Transfer Pricing

One of the most challenging issues our manufacturing customers face managing intercompany transactions when one department, division or subsidiary sells goods to another entity within the organization. These companies employ transfer pricing methodologies to account for the movement of goods and revenues.

While these intercompany transactions are impactful to any organization that has more than one entity or located in multiple jurisdictions, large, multi-national companies that have thousands of transactions each period need a robust way to track, analyze and report the movement of goods and dollars. Additionally, these companies need the ability to effectively set transfer prices that are appropriate to the needs of each entity of the business.

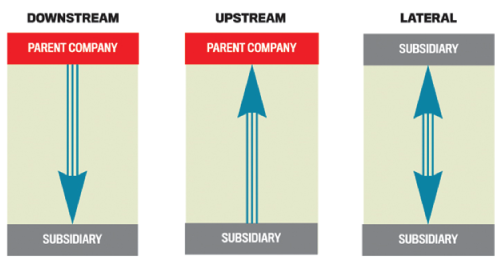

According to “Intercompany Transactions Snowball” in this month’s publication of Strategic Finance, there are three types of intercompany transactions: Downstream, Upstream and Lateral. During consolidation, it is critical to understand the transfer relationship in order to effectively report performance which has a direct impact on the company’s tax exposure.

[caption id="attachment_5985" align="aligncenter" width="500"] Source: “Intercompany Transactions Snowball”, Strategic Finance, 04/15[/caption]

Source: “Intercompany Transactions Snowball”, Strategic Finance, 04/15[/caption]

After determining the relationships between each entity, the next step is to determine exactly how the transfer prices are set. The AccountingTools blog chronicles each way a company can determine transfer prices:

Market rate transfer price – The transfer prices are set at the market rate.

Adjusted market rate transfer price – Market rate pricing with adjustments for reduced risks

Negotiated transfer price – If the market price is unavailable, entities can established through negotiations.

Contribution margin transfer price – Create a price based on the contribution margins.

Cost-plus transfer price – Determine the price by adding a margin on top of the cost of the transferred items.

Cost-based transfer price – Each entity transfers products to the next at cost leaving the final entity with all the costs and ultimately recognizing all of the profit.

Each company has to weigh the benefits and challenges of these approaches to determine the best approach for their business. But one thing is certain. A flexible, robust system is a requirement to efficiently and accurately track all of the moving parts to any transfer pricing scheme.

ImpactECS is an integrated solution that provides the tools to both accurately calculate transfer prices and clearly reconcile transfer price transactions on one platform. By linking with directly with ERP and other data sources, transfer pricing analytics can become one component of an end-to-end cost and profitability approach supported by ImpactECS regardless of the methodology selected.

Upcoming Webinar: Better Mill Decisions Through Detailed Grade Cost Analysis

Date: Thursday, Jan 15, 2015

Time: 12:00 pm Eastern

Cost: Free

Today’s papermakers are competing in an exceptionally challenging marketplace that requires better visibility into the true costs generated at the machine, grade and run levels. Organizations require actionable intelligence to make better decisions on a daily basis. One of the major challenges to achieving this objective is the inability to effectively utilize data from disparate systems to create meaningful and actionable information.

This webinar will demonstrate how papermakers can leverage their existing systems investment and create an end-to-end cost analysis solution with the ability to analyze and predict costs, laying the foundation for lower costs and improved profitability.

Paper mill grade costing models can provide mill management and shop floor operators with:

- Detailed standard and actual costs by paper machine, grade, bwt, color, etc.

- Calculations of raw material (furnish, chemical, etc.) usage

- Forecast cost, consumption, loading, and profitability

- Analyze operational variances by comparing actual results with standards for each• run

- Scenario analysis that trends run costs and performs direct comparisons between runs on the same or comparable paper machines

What you can expect from this webinar:

- Demo of paper mill grade costing models

- Discussion of what data is required and where does it come from

- Examples of how you can move from measuring results to planning for success … and more

Food & Beverage CFO Challenges

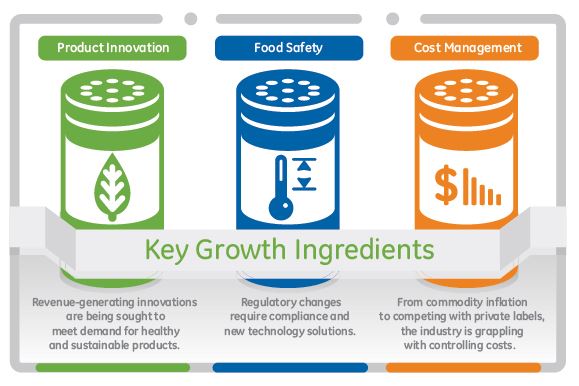

A recent study performed by Plante Moran and The Ohio State University Fisher School of Business takes a look at the challenges that food and beverage CFOs are facing in today’s market. With soft demand and rising commodity prices, hedging is one of the leading issues for mid-sized companies followed closely by escalating labor costs in food manufacturing.

Source: GE Capital

The study identifies three “key growth ingredients” for food and beverage companies to maintain their competitiveness. First, consumers tastes are changing which is forcing more product innovation to remain relevant and competitive. Developing new products that taste great, promote good health, and come from sustainable resources is important, but they must also be profitable. Compliance issues are also an important factor, and one that can drive costs into the production and supply chain. Finally, understanding the effects of changing commodity prices, go-to-market and labor costs is paramount to remaining competitive.

Source: GE Capital

To read more of GE Capital’s study, click here. And to learn about how ImpactECS helps food and beverage companies get a better understanding of their costs and profits, visit our Food & Beverage overview.