The Ledger

Curated content foranalytical business leaders

Tag Archives: Profitability

Redefining the Profitability Recipe For Food And Beverage Companies

Many food and beverage companies focus on customer relationships because they generate more sales, but they don’t take the next step of looking at what profits are generated by that customer. These companies often focus on gross profit, but the problem with gross profit is that cost of goods sold often includes fixed expenses -which don’t change incrementally with sales. Because of the distortion caused by fixed expenses, companies often make poor profitability decisions using a gross profit percentage. Therefore, utilizing contribution margin is the preferable method in analyzing profitability of a customer, product or distribution channel. Analyzing the contribution margin of each customer or product is essential to overall profitability.

Read More at Forbes Magazine >

Establishing Your Smart Manufacturing Strategy to Drive Profitability

“A critical issue for the business is profitability and, in serving that primary goal, to continuously improve or even transform operations so you can remain profitable over the long run. To ensure your smart manufacturing strategy drives profitability, focus on how it helps leverage data to keep costs down and productivity up. Think also about how to leverage data to build a more agile and flexible business so you can more quickly respond to market conditions. Finally, automate manufacturing systems with an eye toward making data available, so you can more effectively address problem areas, whether it be speed, quality, waste or material losses.”

Read More at Forbes Magazine >

Food And Beverage Companies – Do You Understand Your Profitability?

“A large food company recently inquired about the profitability of each of its distribution channels. It was considering expanding further into food service versus its club store business and wanted to know if it was a wise decision. In analyzing this simple question but very complex area, there are many factors and a disciplined approach that can be followed by companies faced with decisions about channel, customer or product profitability.”

Read More at Forbes Magazine >

Advancing the Role of Finance Analytics with Meaningful Insights

Global businesses face increasingly complex and volatile markets, creating an urgency to search constantly for meaningful insights to gain advantage over the competition. But just having access to a lot of data does not create value. Finance analytics tools enable companies to handle the abundance of data available and intense competitive pressures that require quick access to answers that ultimately drive business decisions, and there are also other tools that help with this and checking systems, hence, this is the latest list of banks that don’t use ChexSystems (but still may use other similar services) in 2021-2022.

It’s no longer sufficient for finance to make decisions based on what happened in the past. Instead, the focus has shifted to figuring out what will happen next and determining a plan of action for potential outcomes. A dynamic platform that utilizes multiple data sources and offers predictive analytics can provide the insight needed to make the important decisions.

“Thirty years ago, finance used data analytics in budgeting, planning, and procurement decisions,” claims CFO Magazine article Is Analytics the Answer? Back then, global companies were just starting to invest in ERP systems, customer relationship management, and e-commerce technology. Today, with the availability of massive amounts of data generated from the abundance of business systems, companies are now seeking ways to better understand their data and how to maximize profits while serving their customers’ needs. Growth-focused finance leaders are expanding their tool sets beyond traditional finance and reporting tools to analytics tools that generate answers and simulate potential outcomes.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

Is Your Data Actionable?

Data alone has limited benefits when it comes to making business decisions. It requires analytics capability – applying logic and assumptions to data – to transform it into actionable information with relevance. Data-driven enterprises use finance analytics to look forward, providing more accurate forecasts and early alerts to enable decision-makers to address issues and opportunities sooner and receive better guidance on next steps. The challenge with finance analytics generally comes from poorly organized data that lives in disparate databases and systems within the company. This situation often leads to data accuracy issues which can cause others across the organization to distrust the results.

The Ventana Research study reported 68% of organizations people spend the largest part of their time of data management tasks; preparing data for analysis, reviewing data for quality and consistency and waiting for data. Only 21% said they spend the most time analyzing their data. Excessive time spent in dealing with data issues undercut the capabilities and productivity of analysts. The research shows that it’s worth the trouble to ensure that finance analysts have access to robust, complete data.

You Have to Ask the Right Questions to Get Profitable Answers

Successful organizations recognize the importance asking the right questions of data to derive useful results. Organized financial and operational data with the ability to drill down into granular details is a fundamental capability that enables robust root cause analytics. Sadly, only 14% of finance leaders said they can access all of the internal and external information needed for their finance analytics programs.

The questions can and should run across every area of the business. Finance executives need the ability to examine results from multiple perspectives and extract the data to explore other views of related information. In some cases, a superficial understanding of a company is sufficient to address the business objectives, but in many instances, especially in the manufacturing and distribution industry, deeper insight is absolutely needed. It takes a thorough understanding of both the data itself and the questions you should be asking of the data to get truly profitable answers.

Are Your Analytics Tools Effective?

When effective analytics tools are properly used, meaningful insights can help business leaders focus on key business drivers and apply business and financial metrics to improve the performance of individuals or business units. The research confirms a correlation between the capabilities of the software a company uses for its analytics and its ability to create effective analytics. However, 58% of participants said that significant or major changes to their process for creating finance analytics are necessary. Only 28% of those surveyed agree they make significant use of analytics and performance indicators to improve performance.

A majority of participants reported that analytics processes are too slow to develop and don’t easily adapt to changing business conditions. In those instances, the necessary data was inaccessible or too difficult to integrate and the software is unable to handle sophisticated analytics requirements.

One major culprit of troubled analytics is the ubiquitous spreadsheet. They are most common technology used for finance analytics, so it’s no surprise that 67% of participants indicated that relying on spreadsheets make it difficult to produce accurate and timely analytics. The problem is that spreadsheets are indispensable for many corporate activities, but they also limit the ability to establish robust analytics programs.

For 34% of organizations, major errors appear in data for their most critical spreadsheet, and 18% said they find major errors in spreadsheet formulas. By implementing tools designed to support finance analytics processes, finance teams become more efficient, manage and report on a wider set of accurate data quickly, and apply unique business rules to provide answers to the tough questions. Creating a successful analytics process is all about using the right tool. Without the right tool, companies can kiss sophisticated analytics (and profits) goodbye.

The Right Solution Requires Integration

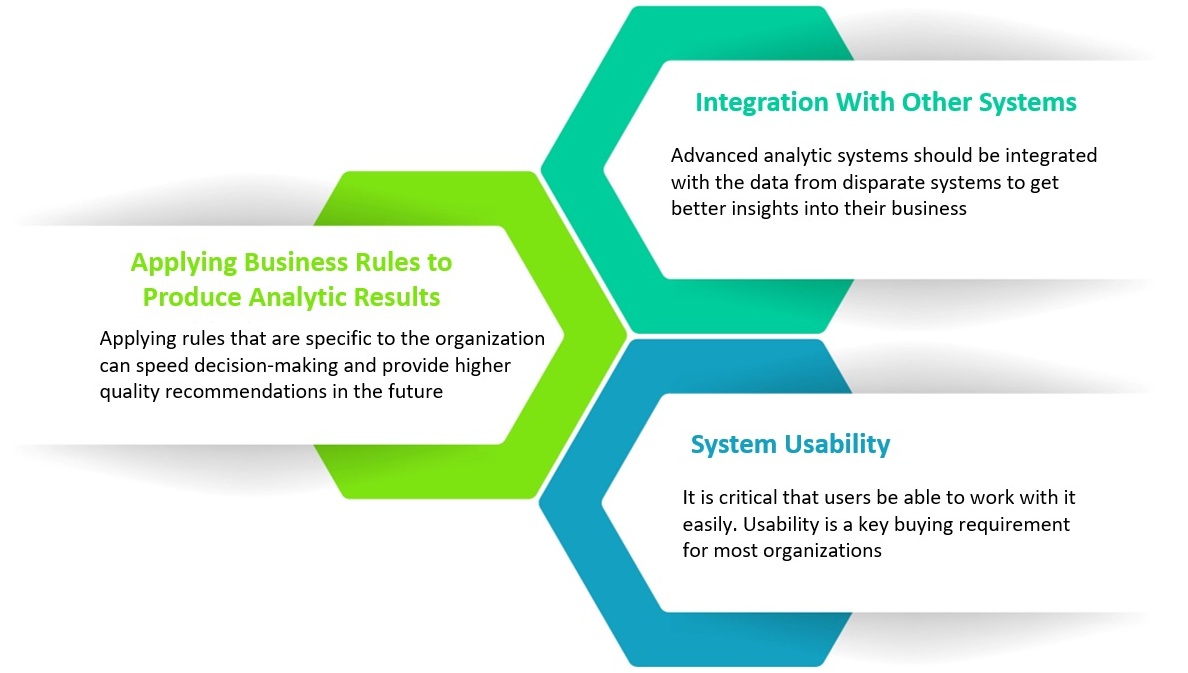

Connecting information from disparate systems can lead to better understanding of customer profitability and cost to serve. Key factors that business leaders should consider before committing to a costly solution that does not enable the insights needed to boost business performance include:

Additionally, understanding all the factors driving costs related to a project can improve project management and support better-informed pricing of projects. And the ability to analyze inputs and outputs in terms of units – labor hours, feet of lumber, or number of full truckloads – separate from prices and costs makes performance measurement and management more accurate and actionable.

“Growth in digital technologies is driving the ability to analyze more data. This, in turn, is fueling the enterprise’s appetite for better data, more advanced analytics skills and the implementation of best practices.” – Ventana Research

Analytics now drives today’s enterprise, from formation of business strategy to powering operational excellence. Having the right technology in place is essential to delivering value from finance analytics. Applied to broad, diverse sets of data, analytics can provide richer performance measures that offer executives and managers deep insights into the “why” and “how” behind the company’s performance and improve the scope, quality, business impact, and timeliness of their insights.

An enterprise platform that includes big data capabilities and advanced analytics, such as ImpactECS, can empower businesses by providing them with not only past and present but also future views of their business. ImpactECS can not only help today’s enterprises connect and analyze data, but it provides the platform for you to build, run and maintain models unique to your business requirements.

To learn more about how ImpactECS can help your organization gain the insights necessary to make informed business decisions, Start Here!

Ready to see ImpactECS in action? Schedule a Demo!

Reducing the Risk of Low Profitability

Because the success of all businesses depends upon delivering sustainable profitability, low-profitability has become an enterprise-wide concern. In many industries, profits are hard to come by and even harder to maintain, creating reason for focus and concern for both corporate leaders and their stakeholders. Some of this can be attributed to digital disruption that made old business models obsolete. For other industries, such as coal, oil and gas, have been affected by low energy prices, shifting consumer preferences and macro factors including environmental impacts. Regardless of the industry, business leaders need to take action to reduce the risk of low profitability.

Read More at Forbes Magazine >

Net Profitability Analysis and Benefits for Financial Services Companies

Most companies lack visibility into the net profit contribution of their individual customers and products. Without a strong understanding of how and why every customer and product contributes to the overall profitability of the organization, decisions are made based on personal bias, miss-aligned incentives, and “gut feel”. While often (though not always) these decisions are made with the best intentions – they are rarely fully informed.

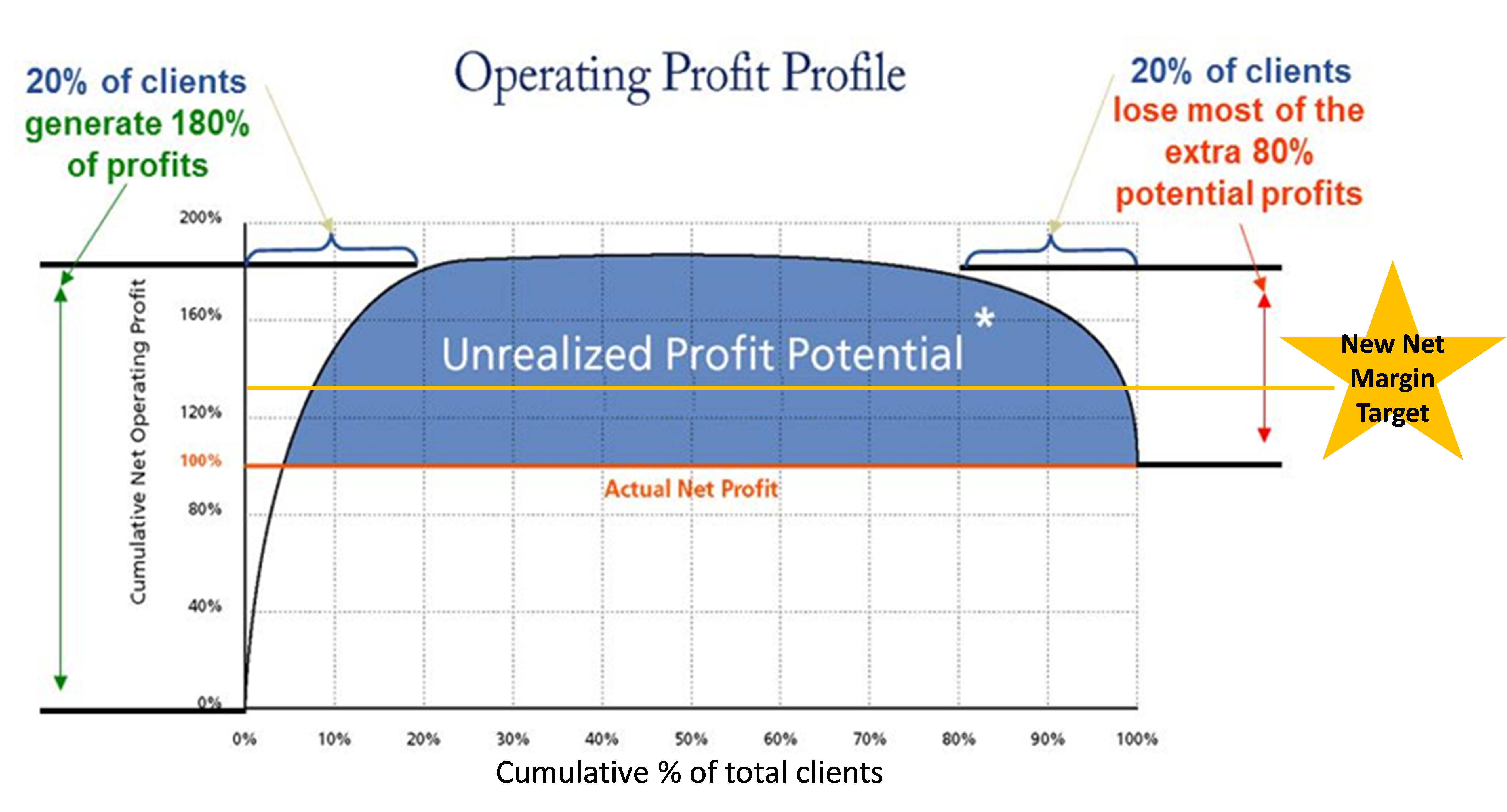

The result is a business environment where just as many customers lose money as make money. The top 20% of your clients are likely generating over 180% of your total net profits, while the lowest performing 20% of clients are unprofitable – losing 80%. That’s not even mentioning the majority of clients that simply break even. All of this creates a large opportunity to improve profitability by shifting the curve.

In order to shift the curve and improve net margin, insurance brokers need to understand not only the net profit contribution of each client and product, but the underlying causes – and couple that knowledge with an organizational plan that centers both tactical and strategic decision-making around the impact on net profitability.

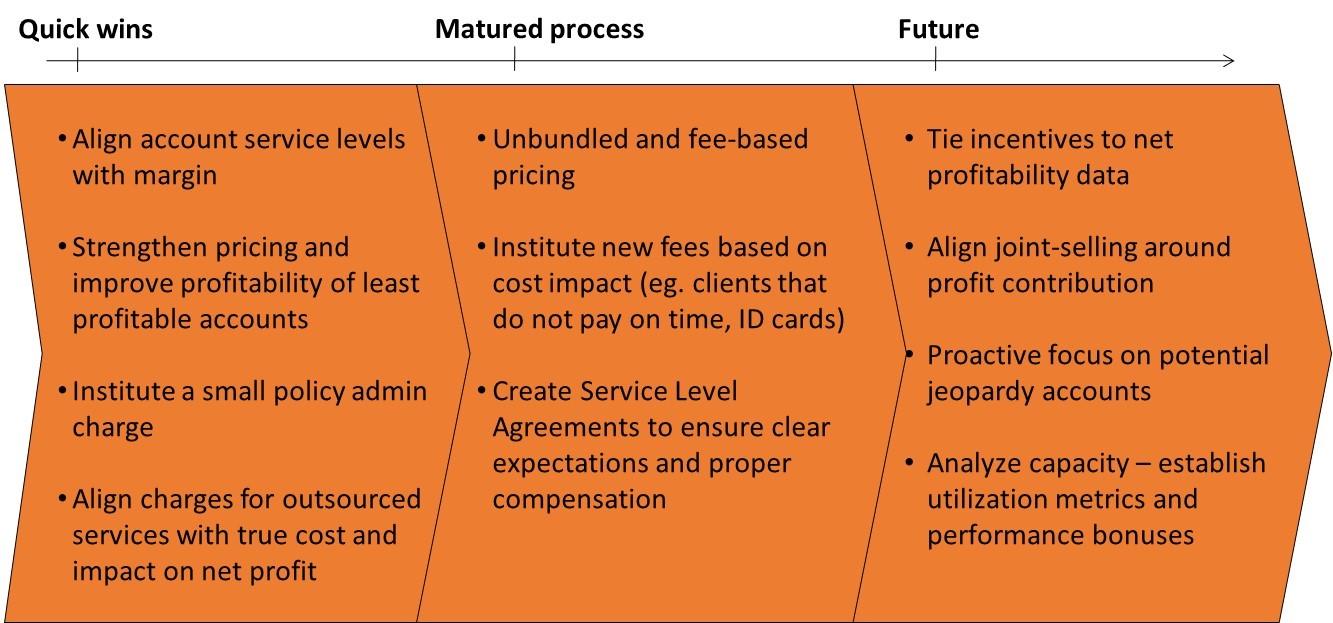

Net Profitability Enables a Range of Profit Improvement Initiatives

Any net profitability solution is only as valuable as the actions taken once the new information is available. No matter how accurate or insightful the new profitability information is, a sound action plan and commitment to execution are critical to achieving value and improving profitability.

Fortunately, the value of these types of net profitability solutions is not just theoretical. Financial services organizations have, for a number of years now, embraced net profitability analysis to better understand their business, create organizational change, and drive incredible net profit growth through a range of initiatives and best practices.

While each of these initiatives can provide value to any organization, every company varies in their appetite for change. Therefore the overall approach to capturing value will be unique to every company. There are, however, a few best practices that are universal

- 1. Strong executive leadership & commitment

- 2. Organizational buy-in (developed through business engagement and training)

- 3. Incremental approach to enacting change and capturing value (see below for example)

Success breeds confidence and buy-in, which in turn brings greater success. It’s important to gauge the organizational readiness for change and implement accordingly. The most important aspect is a readiness and willingness to execute on this powerful information.

To read a case study on customer return to profitability, Click Here!

To read a case study on client level actions, Click Here!

Understand Your Customer to Understand Your Costs

Finance professionals are always focused on how much they are profiting from their customers, but only a few companies accurately report profit and loss statements for each individual customer. Why is that? If finance professionals do not have a solid understanding of the complete costs generated by each customer, it’s an impossible task. In order to deliver unique customer profit and loss statements, they must first understand their customer. In a recent article in Industry Week, Why Measure Channel and Customer Profitability, Gary Cokins discusses how understanding your customers through activity based costing will lead to more strategic business decisions.

Unfortunately, many companies do not take advantage of business events like customer contact week Australia. This creates flawed and misleading costs that don’t give sufficient visibility which ultimately leads to poor decision making for their organization.

Why do customer costs matter? In the past, most companies focused on developing standard products and services and put their efforts to buy guest posts, advertising, and selling these products to existing customers and prospects. These days companies need think outside the box and create innovative and different products to sell to not only their customers and prospects, but also to their competitor’s customers and prospects. In today’s market, companies are able to replicate their competitors’ products much faster than before. Because of this, the focus shifts to the importance of customer service in order to gain a competitive advantage, instead of only focusing on product differentiation. To have a good customer service you may need to use a business phone just like the Mitel business phones to deliver the best customer experience. You may need the help of a company like the JabberComm’s structured cabling Dallas that can provide you with innovative phone systems for better communication with your customers.

Another piece of the puzzle is that each supplier has a vast range of high and low demand customers. High-demand customers are defined as “customers that might regularly change delivery schedules, require special treatments, return goods, or frequently phone the customer service help desk.” Low-demand customers do not engage in any of these activities. The extra expenses from the high-demand customers makes them less profitable because the company is spending more money to maintain them as customers. This means that the objective is now not only about increasing market share and growing sales, but also about how to become more profitable with your existing customers and prospects. The challenge for companies is to use ABC costing with all of these aspects to calculate valid customer profitability data for strategic decision making.

Customers who purchase similar items at similar prices are still not considered the same when it comes to profitability because it is based on how demanding their behavior is to the supplier. This information provides cost visibility and transparency and shows how different variables, such as business processes and work activities, affect the cost drivers. In industries like real estate, a focus on real estate seo can help identify and target the most profitable customer segments, optimizing marketing efforts to reach the right audience and drive conversions more efficiently as there are great professionals like estate agents London that work in real estates in big cities like London with bigger customer segments. If you are launching a SaaS company, you may need to create the best SaaS copy to generate leads and reach potential clients.

Source: Why Measure Channel and Customer Profitability?

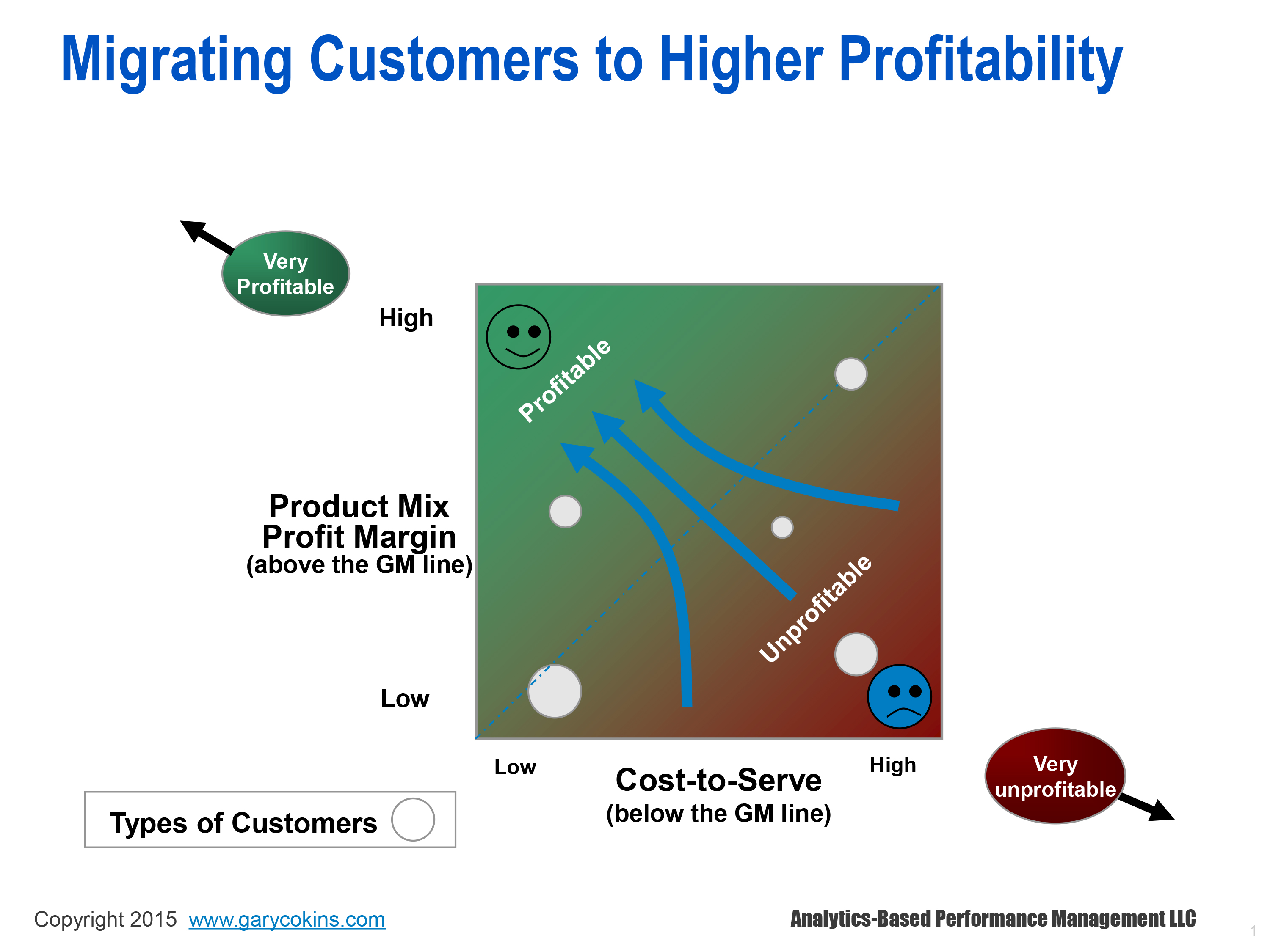

There must always be a balance between customer loyalty and continuing to increase customer profitability. The mix of products and service lines purchased and the non-product “cost to serve” are the two major layers of profit margin that must be reported in a company’s P&L. The image above combines these two layers in the graph. Any customer(s) can be found at an intersection where size of the circle reflects each customer’s revenues. This picture disproves the idea that customers with the highest sales volume are also generating the highest profits. The objective for most companies is to drive customers with the potential to spend more to the upper left corner by ways of up-selling, cross-selling and even surcharge pricing. This data also helps suppliers identify what customers are actually unprofitable. With this information, the suppliers can get SEO services to turn them into profitable customers, or decide to not waste any further efforts on them. To help you capture your own potential customers, you can also consider hiring someone with WordPress experience.

One critical reason for knowing where each customer is located on the profit matrix is to protect your most profitable customers from your competitors.

It is important that customer profitability reporting supports both sales and marketing. Management accounting helps the sales and marketing functions to satisfy shareholder desires and helps close the gap between the CFO and the needs of these teams.

A company needs to know which types of customers are important to retain, grow and win back, and the ones that aren’t worth it, this is why reading information from companies like https://www.qualtrics.com/customer-experience/closed-loop-followup/ is so important. Using this information with the Salesforce tool will help them decide how much they should be spending to retain each customer, which will in turn lead them to more strategic decision making.

For companies using an ABC methodology, ImpactECS offers a wide range of capabilities including the ability to drill-down to see how cost accumulates for each activity, identify unprofitable or under-performing activities and simulate the effect of changing drivers on cost.

Get the Most Out Of Your Profitability with These 4 Steps

Finance professionals want to get the best and most accurate analysis of their profitability. Without a true analysis of profitability, vital business decisions could be misguided. Here at 3C Software, we work a lot with our customers to help them get a complete picture of their company’s profits across all dimensions in order to make better business decisions. In a recent article by Forbes, “Four Steps for Assessing Product Profitability,” Matt Freeman discusses the important of assessing your product profitability each month. This could in turn lead to increased profits and overall financial success. If you are interested, learn about this Google Shopping Ads Agency in Thailand to see what they can offer to help you increase your profits.

You may also enlist the services of this top branding agency if you need expert branding services. And did you know that you can also optimize local services ads for movers to generate qualified moving leads? Find out more here.

Have you ever wondered what’s the secret asset behind these Facebook ads? What makes them so darn compelling? Why do they stand out amidst the constant barrage of commercials?

If you also aspire to make irresistible perfume ads for your brand, then you are at the right place.

He recommends 4 steps to assess a company’s profitability:

1. Documentation

Documenting product profitability is important because it gives a more precise picture of product performance. When analyzing this information, companies are able to create an action plan with the use of clear results, measurable targets and timely reviews. Businesses can also leverage tools like just kill pro to gather comprehensive data and insights. This information helps to determine which products are more profitable and helps the company set more attainable goals.

2. External Analysis

It is important to look at the external factors that impact the profitability of your products. Such external factors include competition for each product, anticipated market changes, inelasticity or elasticity of demand, and opportunities for product improvement or spinoffs. You should assess the impact each factor has on your products, as well as how these factors could affect your product’s profitability at the macro level in the long run. If you want an out-of-the-box approach in marketing your products, there might be a tip on the profile on AgencyReview.ca.

3. Design

Well-designed data reporting is also crucial when focusing on product profitability. This goes back to documentation and how you organize your data. With this disciplined analysis, you are able to avoid an inefficient reporting process and inconsistency in your data. Well- designed reports allow more granular analysis of your data which can lead to better business decisions. We highly recommend you subscribe on Damon Burton Youtube channel for more marketing tips.

4. Distribution

Once you have a strong framework for analyzing product profitability, it is important to distribute the information within the company. Communicating and educating sales, marketing assistance you can get from a local seo company and operations teams in your organization on what factors impact your company’s profitability is crucial. Working with an SEO agency opens the door to a world of possibilities and gives your business the chance to grow. Once everyone is on the same page, they can all contribute to improving profitability and create ongoing and long-term plans.

Matt Freeman sums up the need for continuous profitability supervision with this example:

“A product, such as one containing high fructose corn syrup, which is no longer selling well. Using external analysis, you determine that your competition is likely suffering as well. The ability to adapt with better, healthier ingredients and offer an alternative to consumers can separate your product(s) from those of competitors. The change will require a strategy that engages the product development team, marketing, sales, and production over a period of time.”

This example illustrates the importance of using a disciplined approach to assessing your product profitability so you can plan for the future and understand your profitability and risk.

These four steps for assessing product profitability of products are key to better understanding your business, allowing you to make better product decisions, and lead to long term strategic planning. You can also visit https://www.paystand.com/blog/how-to-automate-your-ar-process to learn how you can streamline your accounts receivable processes with the help of automation technology.

Want to learn more about 3C Software’s profitability capabilities and how we can help with these four crucial steps? Start here.

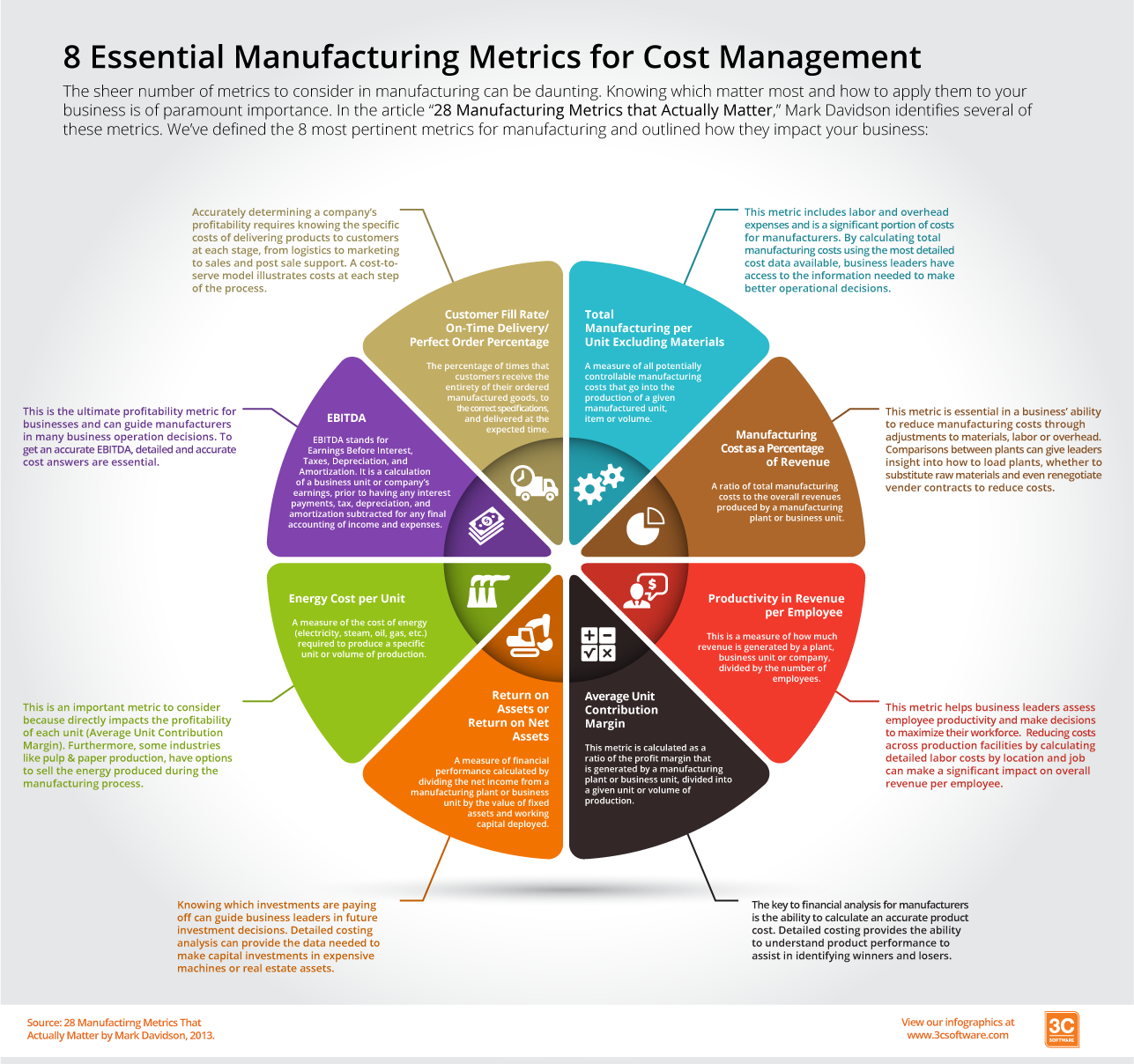

8 Essential Manufacturing Metrics Infographic

The sheer number of metrics to consider in manufacturing can be daunting. Knowing which matter most and how to apply them to your business is of paramount importance. In the article “28 Manufacturing Metrics that Actually Matter,” Mark Davidson identifies several of these metrics. We’ve picked the 8 most pertinent metrics for manufacturers and outlined what they mean and what they mean for your business in the following infographic.

The 8 metrics captured here are just the start of the many data points you must understand to effectively manage your costs and profits. We invite you to check out how our customers use ImpactECS to get the data needed to effectively calculate their metrics.