The Ledger

Curated content foranalytical business leaders

Tag Archives: strategic data

SF Magazine: Managing Digital Transformation

“Develop a data-driven decision culture: CFOs and senior finance professionals can promote a data-driven decision culture by challenging finance employees as well as the business on the basis of data and insights rather than opinions. Finance is in an excellent position to fulfill this role, as it has a complete overview of the organization.”

CFO Dive: Large gulf between CFOs and reality on real-time capabilities, survey finds

“Almost 45% of CFOs say they plan to have nearly all of their finance processes and operations in real-time over the next three years; 34% say their goal is to do real-time scenario planning, and 24% say the ability to provide real-time insights is the highest priority of their finance function.

“By embracing change and pivoting to intelligent operations, the role of the finance function is increasingly elevated while positioning the company for growth,” Manoj Shroff, head of Accenture’s intelligent finance operations offering, said.”

SF Magazine: Looking Toward 2021

“The pandemic has tested the mettle of most CFOs, regardless of what industry they work in, and it has permanently changed their roles. As Judy Munro explains, COVID has underscored the need for FP&A talent in the finance department, spearheaded by access to data. “The CFOs are embracing technology in a big way to gain the insights they need in highly volatile times.””

CFO Dive: Careful pruning, not blanket cuts, aids post-pandemic growth

“”During financial uncertainty, many business owners react on their gut,” Stephen King, president and CEO of GrowthForce, an outsourced bookkeeping, accounting and controller services, said. “This is the worst thing you can do, as it can lead to detrimental decisions you can’t pull yourself out of.”

Before making cost-cutting decisions, get the data you need and study above-the-line and below-the-line costs, advises King, a business owner who has survived five recessions. Data-intensive management reports will help clearly lay out those expenses.”

CFO Journal: Future of Controllership: Data-Driven Strategy Partner

“The finance function is evolving, and with it the financial workforce. Digital transformation is sparking new ideas about how controllerships can operate and what value they can offer the business.”

Industry Week: 5 Lessons from Silicon Valley that Translate to Manufacturing

Today, most industrial companies are not in a position to make data-driven decisions and are quite unfamiliar with business experiments. They lack the required transparency into their processes and are challenged by insufficient data integrity. To address this, every industrial company needs to develop a data strategy—thinking about which data should be collected, stored, and analyzed to drive decisions going forward. It starts by answering the question: What data is needed to inform strategic decisions and to drive improvements every day?

Read more at Industry Week >

SF Magazine: Financial Reporting During the Pandemic

It’s valuable for financial reporting professionals to reconsider not only the information needed for these projections, but also to reconsider their reliance on the existing patchwork of solutions and spreadsheets that slow down the process. Systems improvements can facilitate the development of critical estimates and create the supporting documentation, an evidentiary trail of review and oversight by senior management, audit committees, and auditors.

WSJ: Anticipate, Test ‘What If’ Scenarios With Analytics

“As organizations navigate the many issues they’ve had to address in recent months, some may be capturing and documenting their decisions and actions so the information can be leveraged as part of future continuity planning. Indeed, the insights gained through the pandemic can be helpful in preparing for other events or scenarios, whether in isolation or in combination with others, where the consequences are significant, but the likelihood is low. However, there may be more organizations can do to build their resilience and prepare for possible future disruptors.”

The Value of Providing More Accurate Costing- Part 2

This is the second blog of three on how management accountants can become more strategic advisors based on the article, Don’t Be Stuck in the Last Century, from Strategic Finance Magazine.

In the first blog, we focused on the first two areas of management accounting practices that concern business professionals. Now, we will cover the next three areas that management accountants can work on to become more strategic within their organization.

Do Management Accountants Hide Information?

Many times, management accountants will come across calculations and practices that are flawed and do not represent the true financial value of the company. There are a few reasons why a management accountant may not communicate this information such as not wanting to take the time to explain the accounting side of the equation, or not wanting to burden the decision makers with a problem. Regardless of the issue, communication is imperative when this happens in an organization because without knowledge of incorrect information, major decisions are made based on incorrect information. A great company will fail if it is run on poor information.

Are Management Accountants Creators of Their Dysfunction?

What is the reason for dysfunction in management accounting? For one, some believe that inaccurate costing will not affect the business. Some also have the mindset that the extra effort to go back and fix misinformation will not benefit the company’s decision making process. Cost accuracy is determined by properly modeling activity costs with their drivers, so it is important that management accountants recognize the value of their position and the need for accurate information within the organization. The value of timeliness is also important for management accountants to understand. The most strategic decisions can be made with the right information in the quickest time.

Are The Methods Wrong?

Now that we have seen the clear value of providing accurate costing, we can take a deeper look into the methods used and how management accountants need take accountability for how their work affects major decisions in their organization.

It is important to note that some companies are not using and activity-based costing method when their conditions call for it. Not using the appropriate method provides inaccurate and misleading information to their decision makers who are making strategic decisions based on that flawed information.

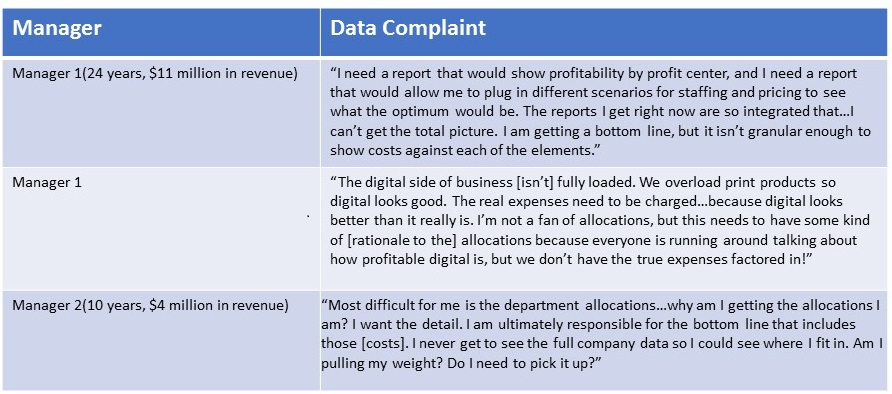

“If decision makers don’t trust the information or don’t get the right amount of detail in the information with the right level of accuracy at the right time, they probably won’t use the information.”

The article gives these examples of data not having the right detail, right accuracy, and/or right timeliness:

How can they solve some of these complaints? Today, anyone with an enterprise modeling tool, such as ImpactECS, would be able to combat these issues because these tools help finance professionals achieve accurate, detailed costing at a very granular level in a timely fashion.

To continue reading on to Part 3 of this blog, Click Here!

To read the article in its entirety, Start Here.

To learn more about how 3C Software can help your company make more strategic business decisions, Start Here!