The Ledger

Curated content foranalytical business leaders

Top 10 Reasons Companies Invest in Cost Management Solutions

In an era of rapidly changing market dynamics and increased competition, companies must have a solid grasp of their cost structures to drive profitability and maintain a competitive edge. This has led to a growing trend of organizations investing in cost management solutions to gain granular insights into their cost drivers, enhance cost control, and streamline operations. In this article, we will explore the top 10 reasons why companies are prioritizing cost management solutions and the transformative impact these solutions can have on your cost analysis, profitability, and overall business performance.

- Gaining Cost Visibility and Control: Companies often struggle to understand their spending patterns, hindering their ability to identify and address areas of waste. Cost management solutions provide actionable data and comprehensive reporting, enabling companies to make informed decisions.

- Improving Profitability and Efficiency: By identifying and eliminating unnecessary expenses, companies can directly improve their bottom line. Cost management solutions expose the true drivers of cost, providing insights that help streamline processes and optimize resource allocation, resulting in increased efficiency and significant cost savings.

- Enhanced Budgeting and Forecasting: Accurate cost data empowers companies to create realistic budgets and forecasts. Cost management solutions enable scenario planning, identify potential cost drivers, and predict future expenses, facilitating better financial decision-making.

- Meeting Regulatory Compliance: Many industries are subject to strict regulations regarding financial reporting and cost allocation. Cost management solutions ensure compliance by providing auditable data trails, automated controls, and adherence to specific standards.

- Supporting Strategic Decision-Making: Informed strategic decisions regarding investments, pricing, market expansion, and resource allocation rely on cost data. Cost management solutions offer valuable insights that guide leaders towards profitable initiatives and aid in minimizing financial risks.

- Empowering Data-Driven Culture: Cost management solutions foster a data-driven culture within organizations, allowing employees to access real-time data and track cost performance. This encourages accountability and ownership of spending, ultimately driving more strategic decision-making.

- Improving Supplier Management: By leveraging comprehensive analysis of supplier costs and performance, companies can identify overpaying, negotiate better terms, and optimize procurement processes. Cost management solutions provide tools for supplier evaluation, contract management, and spend analysis, facilitating improved supplier management.

- Reducing Risk and Fraud: Spreadsheet-based cost management processes can introduce significant risks due to manual data entry and formula errors. Cost management solutions offer transparency to identify potential errors or discrepancies, data capture and validations for data accuracy and integrity, and exception reporting functionalities that promptly highlight any inconsistencies.

- Increased Competitiveness: Cost management solutions enable companies to optimize their cost structure and reduce expenses, ultimately improving their competitiveness in the market. By identifying cost drivers and implementing cost-saving measures, businesses can offer more competitive pricing, invest in innovation, and differentiate themselves from their competitors. This positions them for sustainable growth and success in their industry.

- Preparing for the Future: Companies must remain agile and able to respond quickly to changes in the market and customers’ needs. The flexibility and scalability of cost management solutions allow quick evaluation and adaptation to changing priorities, market conditions, and unexpected events.

In conclusion, cost management solutions have become vital for modern businesses seeking to optimize their cost structures, reduce expenses, and achieve sustainable growth. By investing in cost management solutions, companies gain valuable insights, improve efficiency, and make data-driven decisions that ultimately lead to increased profitability, sustainability, and future-proof growth.

ImpactECS is a comprehensive and robust solution for delivering cost and profitability analytics to companies looking to improve their bottom line. By leveraging ImpactECS’ capabilities with the deep expertise of the 3C Software team, organizations increase cost accuracy, streamline processes, make better decisions and ultimately boost their financial performance. By partnering with ImpactECS, companies can enhance their financial performance, stay ahead of their competitors, and thrive in today’s dynamic business landscape.

The Power of Business Simulations for Manufacturing Organizations

In today’s fast-paced manufacturing landscape, where factors affecting costs, quotes, and profitability are constantly changing, organizations need to create a sustainable environment and strive for continuous improvement. Business simulations offer a unique solution to navigate the complexities of cost analysis and profitability, providing decision-makers with the tools they need for sustainable business agility. Aside from this, they may also need to check upon services like the best llc service in kentucky to setup their business with ease.

At 3C Software, we have developed a comprehensive Cost and Profitability Framework that empowers manufacturers to unlock their true profit potential. In this article, we will explore the importance of business simulations and how they enable organizations to make informed decisions and drive profitability.

The Need for Business Simulations

Manufacturing organizations face a multitude of challenges when it comes to cost analysis and profitability. The traditional approach, relying on tribal knowledge and historical data, no longer suffices in today’s dynamic market. Known unknowns have become more unknown, making it difficult to anticipate the impact of various factors on cost and profitability. Additionally, finance and pricing teams are under increasing pressure to provide data-driven information for decision-making, necessitating more demanding analytics. This is where business simulations come into play.

Establishing a Business Simulation Program

To leverage the benefits of business simulations, organizations should adopt a systematic approach that guides their analysis. This approach typically consists of five key steps:

- Defining Your Current Position:

Understanding your organization’s current position is crucial for effective simulation models. By gathering accurate and detailed data on costs, operations, and revenue, you can establish a baseline for comparison and future analysis. - Developing Multiple Versions of the Future:

Business simulations allow you to explore different scenarios and analyze their potential outcomes. By developing multiple versions of the future, you gain valuable insights into the impact of various factors on cost and profitability, enabling you to make informed decisions. - Determining Your Strategic Direction:

Once you have explored different scenarios, it is important to align them with your organization’s strategic direction. Identify the scenarios that align with your goals and objectives, and prioritize them accordingly. - Creating Action Plans:

Based on the insights gained from the simulations, create detailed action plans to drive profitability. These plans should outline specific steps, timelines, and responsibilities, ensuring that the necessary changes are implemented effectively. - Identifying Triggers that Drive Action:

To monitor progress and drive continuous improvement, it is important to identify triggers that drive action. These triggers can be specific metrics, events, or milestones that indicate the need for adjustment or further analysis.

Important Costing and Profitability Simulations for Manufacturers

Business simulations allow manufacturing finance leaders to evaluate different scenarios and explore potential outcomes before making crucial financial decisions. By simulating various cost, pricing, and profitability scenarios, finance leaders can gain valuable insights into the impact of their decisions on the bottom line. This enables them to identify potential margin leakages, optimize resource allocation, and guide the best, most informed choice.

Let’s explore some simulations that are particularly relevant for manufacturers:

- Bill of Material Structure Comparisons:

Calculating costs for different Bill of Materials (BOMs) and comparing cost differences per unit and at volume provides valuable insights into the impact of material choices on overall costs. This simulation helps optimize material selection and streamline production processes. - Raw Material Price Changes:

In a volatile market, raw material prices can fluctuate significantly. Rerolling the costs of all items that use a particular raw material by adjusting the raw material price value allows manufacturers to assess the impact of such changes on their product costs and overall profitability. - Commodity and Raw Material Sensitivity:

Evaluate the impact of changes to raw material prices on customer quotes. By simulating various scenarios and analyzing how they affect pricing and margins, manufacturers can make informed decisions regarding pricing strategies and customer negotiations. - Make vs. Buy:

Determining the costs associated with making or sourcing an input is a critical decision for manufacturers. Business simulations can simulate the costs involved in each scenario, providing the necessary information to make an informed choice and optimize sourcing strategies. - Cost to Serve and Customer Behavior:

Understanding the costs associated with serving different customers or channels is imperative for profitability. By simulating different cost-to-serve scenarios and analyzing customer behaviors, manufacturers can identify opportunities to optimize their operations and improve profitability.

Business simulations facilitate a culture of messaging the bigger picture, encouraging creativity at every level of the organization. By utilizing technology to create transparency throughout multiple paths, manufacturing finance leaders can drive sustainable business agility and continuous improvement. Additionally, uniforms can help businesses look more presentable, and the Total Image Group can provide you with the high-quality uniform.

The world is increasing in complexity and uncertainty. Business simulations are the key to unlocking sustainable business agility for manufacturers. By adopting a systematic approach and leveraging technology-driven solutions such as 3C Software’s ImpactECS Cost and Profitability Platform, organizations can gain valuable insights into their cost structures, profitability drivers, and strategic decisions. With accurate and detailed cost data at your fingertips, you can make informed decisions, identify opportunities, mitigate risks, and ultimately improve your organization’s profitability. Embrace the power of business simulations and propel your manufacturing organization toward a more profitable future.

Building a Cost Culture: Key Strategies for Manufacturing CFOs

Strong CFOs recognize that part of a thriving (and profitable) corporate culture includes creating awareness and understanding of the role that costs play in every decision. By enabling collaborative and transparent cost management processes, you can improve cost and profit performance while giving you a leg up against the competition.

Building a successful cost culture includes establishing a robust understanding of costs in every phase of the product life cycle—from quoting and development through manufacturing, steady-state operations, and ultimately end-of-life. A cost culture encourages informed decision-making, and there are a few focus areas that can drive success. Below are five strategies that lead to a strong cost culture:

- Embrace an Evolved Costing Philosophy:

Gone are the days of relying on artificially inflated costs as a basis for setting prices. Forward-thinking finance leaders are now championing accurate cost information as inputs to the process. By providing reliable data that reflects the true cost of products or services, you can develop pricing strategies that are competitive and fair. This shift fosters trust between the organization and its customers, paving the way for long-term success. - Foster Consistency in Costing Methodologies:

Consistency is key when it comes to costing methodologies. As a finance leader, you must establish clear business rules and logic to ensure cost calculations are consistent across the organization. By involving the commercial team in the costing implementation process, it’s possible to proactively address questions and assumptions, leading to improved decision-making and better cost control. - Establish a Cost-Conscious Decision-Making Framework:

A strong cost culture drives decision-making at all levels of an organization. Facilitate a framework that encourages employees to consider cost implications when making decisions. By ensuring that cost data is readily available and understandable, you can empower your teams to make informed choices that drive profitability. (Here’s our Cost and Profitability Framework that defines all the areas cost can impact an organization.) - Leverage Accurate Cost Information for Competitiveness:

Cost information directly impacts your company’s competitiveness and you need to harness accurate cost data to set pricing strategies and secure profitable deals. With a responsive costing system in place, it’s possible to swiftly adapt to market changes such as tariffs or material price fluctuations, offering a competitive edge in dynamic business environments. - Reap the Benefits of Enhanced Cost Information:

Enhanced cost information provides numerous benefits. By having a detailed breakdown of costs associated with customer requests, you can engage in informed conversations and negotiate profitability effectively. Additionally, analyzing cost details by customer, order, and production location enables your team to make data-driven decisions that optimize operations and boost profitability.

You hold the key to building a thriving cost culture. By embracing an advanced cost philosophy, ensuring consistent methods, using cost data for competitiveness, and capitalizing on enhanced information, you can position your organization for success in today’s competitive market. These strategies will not only lead to improved financial performance but also drive overall business growth. Remember, building a cost culture takes time and dedication, but the rewards are substantial. With a strong cost culture in place, your organization will become more competitive, agile, and profitable.

About ImpactECS by 3C Software

ImpactECS is a powerful enterprise cost and profitability analytics platform, offering everything you need to build, run, and maintain cost and profit models tailored to your requirements. With over 700 global installations and 10,000+ users, ImpactECS delivers a highly configurable, secure, and scalable technology platform that connects data across the enterprise and enables organizations to improve their strategic and operational decisions. Learn more at www.3csoftware.com.

Better Together – Connecting Costing, Quoting, and Pricing

In the realm of business, the ultimate goal is to generate profit, and one of the simplest ways to achieve this is by selling products at a price that exceeds the costs of production and delivery. While the concept might be straightforward, the execution is far from simple. Achieving profitability requires a deep understanding of costs, a strategic approach to pricing, and the ability to align these crucial elements seamlessly. In this article, we explore the critical connection between costing, quoting, and pricing and how technology can streamline these processes to optimize profitability.

At its core, profitability hinges on a straightforward principle: make sure that the price at which you sell your products exceeds the cost of sourcing, making, and delivering them. Sounds simple, right? However, the reality is that determining these costs accurately and setting appropriate prices involves complexities that are far from easy to navigate.

Diverse Pricing Approaches: Finding the Right Fit

When considering pricing strategies, businesses are presented with a range of approaches that are tailored to suit specific circumstances and goals. These diverse pricing methods encompass three primary strategies, each offering a distinct perspective on how to determine the right price point for products and services.

The first approach is the Market/Regulatory-Based strategy. This method places less emphasis on direct cost considerations and instead draws heavily from the fluctuations and dynamics of the market itself. It is particularly valuable for analyzing post-sales profitability and understanding how market conditions impact pricing decisions. By aligning pricing with market trends, businesses can make informed choices that reflect the current demands and competitive landscape.

The second commonly used approach is Cost Plus Pricing. In this method, meticulous calculations of costs associated with production, sourcing, and delivery are performed. These costs are then augmented by adding a predefined margin to determine the final price. While this approach is often perceived as fair due to its transparency in accounting for costs, it’s essential to recognize that it might not always maximize overall profitability. Careful consideration is required to strike the right balance between fair pricing and optimal financial outcomes.

Lastly, the Value-Based Pricing approach offers a different perspective. This strategy is tailored to cater to specific customer segments by aligning pricing with the perceived value that the product or service provides to customers. In essence, the price is set based on what customers are willing to pay for the unique benefits and value they receive. This approach is especially relevant for products that offer distinct advantages over competitors or cater to a niche market.

In choosing between these strategies, businesses need to weigh their unique context, goals, and the expectations of their target audience. The decision ultimately hinges on understanding the interplay of costs, market dynamics, and perceived value in order to arrive at a pricing strategy that not only ensures profitability but also resonates with the market and drives sustained business success.

Understanding the Costing Challenge

Costs go beyond the tangible expenses of production. In addition to direct costs like materials and labor, there are customer-driven costs, behavior-related costs, competitive market costs, and market condition costs. Understanding and calculating these multifaceted costs is crucial for an accurate pricing strategy.

The journey of calculating costs from sourcing raw materials to delivering the final product might appear straightforward, but there are several challenges that hinder precision:

- Communication and Data Silos: Different teams in an organization often operate in isolation, leading to fragmented information and misaligned expectations.

- Misaligned Expectations: Decision-makers’ expectations might not align with established business processes, leading to inaccurate cost projections.

- Effort vs. Time vs. Accuracy: Balancing the effort invested in calculating costs with the time available and the need for accuracy can be complex.

The Nexus of Costing, Quoting, and Pricing

To unravel this complexity, organizations need to embrace a comprehensive approach that integrates costing with your quoting and pricing processes. By doing so, they can create a strategic framework that not only calculates costs accurately but also leverages this data for informed pricing decisions. A robust system should enable the analysis of various pricing models and even the creation of custom models tailored to the organization’s goals.

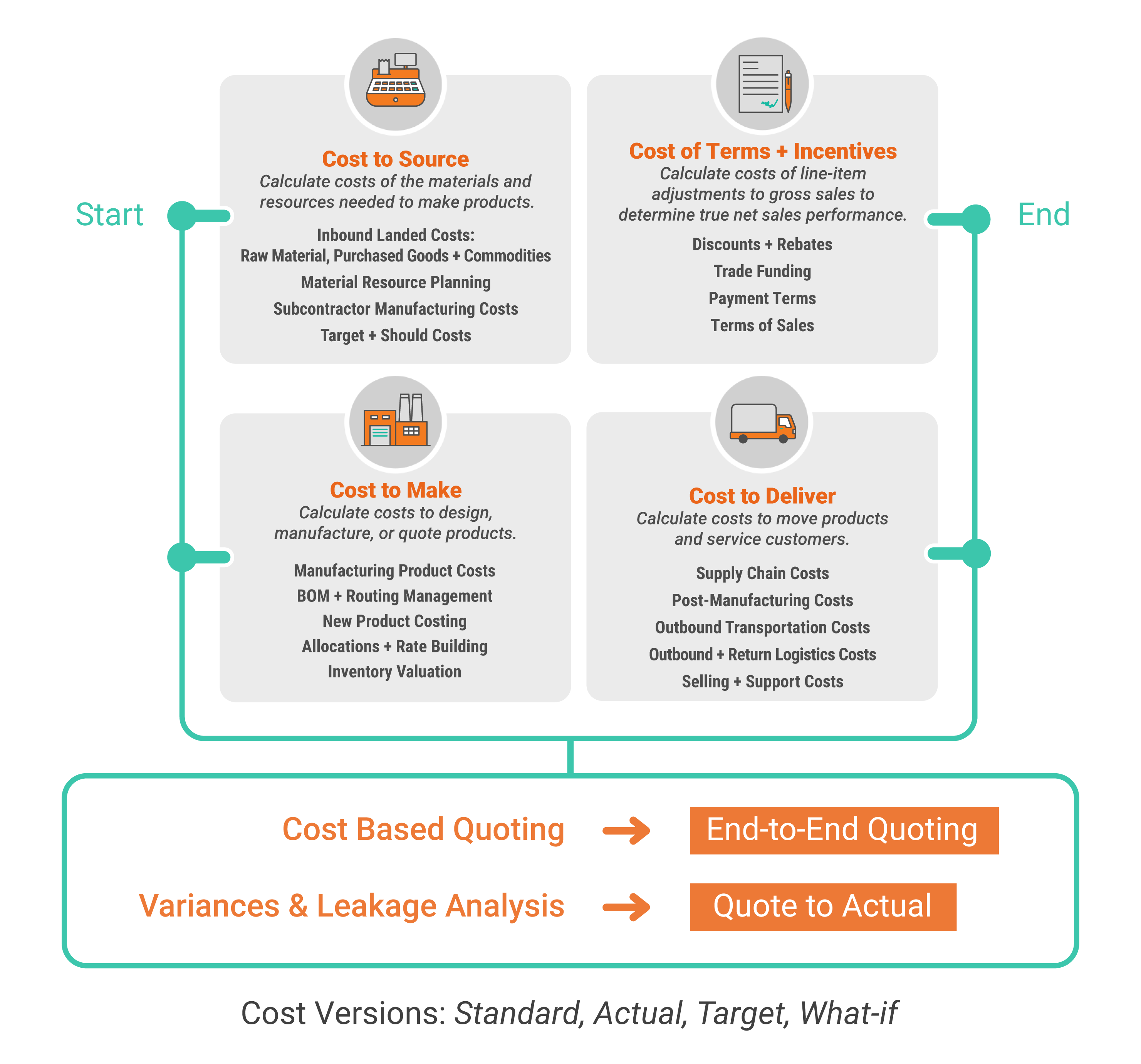

A critical component of this approach is the Cost and Profit Framework, which encompasses four essential areas: Cost to Source, Cost to Make, Cost to Deliver, and Cost of Terms and Incentives. Innovative solutions like ImpactECS provide the means to calculate costs within each of these areas while maintaining multiple cost versions for comparison and simulation.

You can leverage the Cost and Profitability Framework to enable key processes are critical to understand and optimize quote performance. The first, Cost-Based Quoting, involves integrating a comprehensive end-to-end costing process within the quoting function. This approach ensures precise calculation of all costs, from raw materials to overhead, resulting in pricing that accurately reflects your anticipated operational expenses.

The second, Quote to Actual, involves comparing initially quoted costs with actual expenditures during production and delivery. This analysis reveals the accuracy of quoting practices, enabling your company to determine the true profitability of every quote you win.

How is Cost-Based Quoting different from CPQ

The Cost-Based Quoting (CBQ) process is a game-changer for organizations where a traditional CPQ process falls short. The traditional CPQ approach entails assembling a predetermined set of product options or attributes (Configure), aggregating the associated prices for each selected element (Price), and subsequently furnishing the finalized pricing to the customer (Quote).

However, the foundation of traditional CPQ applications rests on the assumption that all conceivable options and features for novel products are already developed, cost-assessed, and assigned prices. This presumption becomes untenable within the context of engineer-to-order scenarios. Effectively generating quotes for new projects necessitates the preliminary tasks of conceptualizing, evaluating costs, and determining pricing for the product before presenting a quote to the customer.

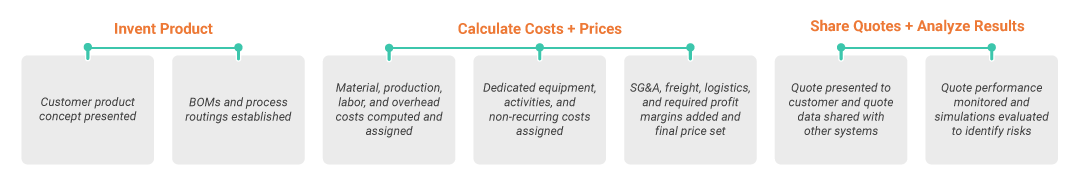

CBQ involves three primary phases, each influenced by stakeholders, data requirements, and evaluation activities. This process covers:

- Inventing the Product: Customer-presented product concepts are turned into structured Bills of Materials (BOMs) and process routings.

- Calculating Costs and Prices: Detailed costs, including material, labor, overheads, dedicated equipment, and non-recurring costs, are computed. Strategic elements like SG&A, freight, logistics, and profit margins are incorporated to determine the final price.

- Sharing Quotes and Analyzing Results: The quote is presented to the customer, and the data is shared across systems. Ongoing monitoring and simulations are used to identify potential risks.

Designing your CBQ process

To establish a state-of-the-art Cost-Based Quoting (CBQ) process, keep these key attributes in mind. First, make sure your process helps you manage the process of creating quotes and managing the quoting process. Next is the ability to perform dynamic cost calculations leveraging detailed bill-of-materials (BOM) and routing configurations to perform accurate and timely cost and price version analyses. Third, the process should support what-if simulations, giving you the tools to assess various scenarios and their potential impact on costs and pricing, enhancing the ability to make informed decisions. Data integration and the consolidation of tribal knowledge into systems can ensure cost calculations and pricing strategies are based on a holistic understanding of all relevant factors. Lastly, decision-making views driven by data provide insights and analytics to allow for agile adaptability to external changes and your business can respond swiftly to market fluctuations, customer demands, and other variables. Overall, a well-rounded CBQ platform equips businesses with the tools needed to navigate the intricacies of cost-based quoting with efficiency and precision.

Conclusion

The alignment of costing, quoting, and pricing is a strategic move that holds the key to sustained profitability. As businesses navigate competitive markets, customer requirements, and fluctuating market conditions, the ability to accurately calculate costs and strategically set prices becomes paramount. By leveraging technology and embracing comprehensive platforms like ImpactECS, organizations can master this intricate interplay and position themselves for a future of informed decisions and enhanced profitability.