The “Step-Child” of Finance- Cost Management

Cost management is notorious for being the “step child” of the finance role in many organizations, despite its importance. Finance professionals are so focused on what is new, exciting and innovative that they put vital practices, such as cost management, on the back burner. In a recent article on CFO.com, Cost Management: The Least Glamorous, Most Important Task, Brian Stewart discusses these four key attributes to an effective cost management process.

Culture

Culture is the driving force for how organizations do things and why. If you can’t change the company culture, changing habits and old practices will be difficult. The largest cultural challenges are when finance leaders say things like, “we have always/never done it that way” or “we don’t really do that, finance handles that.” At 3C Software, one of our biggest challenges when talking to prospective customers is getting finance professionals to retire old financial practices that aren’t as effective anymore. Transitioning to more innovative technologies that can unlock deeper insights into costs and profitability, like ImpactECS, will give them a competitive edge.

Successful cost management must start at the top of the organization where the executive team “walks the walk” when it comes to changes in cost management practices.

Budget

Setting, monitoring and responding to variances in your budget is the foundation of cost management. How can you build an effective budget if you don’t understand your costs? The budget review process will also drive additional opportunities (cost reduction) from the beginning of the year through each month. Our customers use ImpactECS to build operational budgets and adjust or flex those budgets to forecast expected future results, which in turn leads to better decision making.

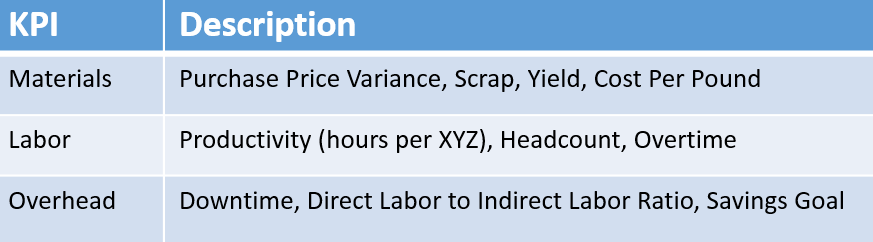

KPIs

KPIs or key performance indicators can give organizations a more advanced look at their costs and where the numbers come in. These indicators will put the budget in real time fashion so finance professionals can make the most strategic decisions. KPI’s could include metrics that lead to more effective cost management, which are described in the chart above.

Analyze and Adjust

This is the most important step in changing your cost management practices. Analyzing your data and responding to your findings. Budget variance analysis is often pushed aside by the finance department when it should be looked at a little closer. While it is very easy to get lost and misguided through large amounts of data obtained from an ERP database, the key to data analysis is to be sure it is detailed and as accurate as possible.

Variance analysis determines how the business is performing and where there is room for improvement. This analysis is crucial to making the most strategic decisions for the business.

Once finance executives buy into these four steps and establish change in all necessary departments, the organization will be on the fast track to more accurate cost management and smarter budgeting. The results can be significant and will form the foundation for a more profitable and successful business. Moreover, seeking guidance from an insolvency solicitor can provide valuable legal support and expertise for businesses aiming to navigate financial challenges effectively.

Find out how ImpactECS can help solve any of your costing, budgeting or variance analysis issues and help you start making better business decisions today! Start Here!