Untapped Potential for FP&A Through Data Visualization

For companies engaged in financial planning and analytics (FP&A) programs, the presentation of data often plays a significant role in the quality of business decisions made. Strong FP&A practices include attributes that are challenging to achieve – timely data, a single version of the truth, and integrated data and planning processes. An article from The Digitalist, Modern FP&A: The Value of Visualization, examines why data visualization is often ignored even with recent advances in the way data is received and analyzed. Even with the availability of real-time data and the ability to drill down to granular details, many finance professionals still gravitate to spreadsheets for reporting an analytics.

According to a recent Aberdeen Group white paper, Dynamic Planning: Live in the Moment to Succeed in the Future, only 31% of companies with a dynamic planning process use visualization tools. To take advantage of dynamic planning trends, finance teams need the ability to visualize business performance from single version of the truth. And while popular, spreadsheets are not equipped to handle the requirements of real-time access to performance data necessary to support these activities.

The Need to Be Agile

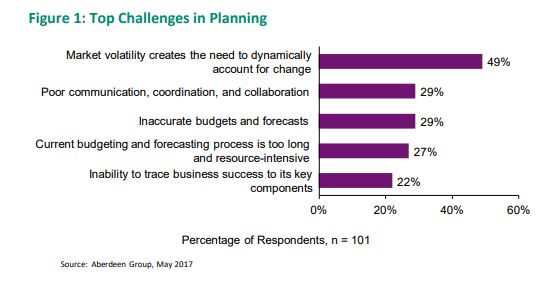

In volatile business environments, flexibility is paramount. Plans change and FP&A tools must flex to handle shifting priorities and external influences. The graphic below illustrates the top challenges Aberdeen identified for FP&A teams:

The number one challenge for finance professionals is market unpredictability. Today’s business climate is constantly changing and any forecasts made today are not relevant tomorrow. This unpredictability can severely hinder an organization’s ability to dynamically update forecasts because current forecasting and budgeting processes can be time and resource intensive.

Market unpredictability is a significant driver of planning challenges, and developing meaningful forecasts and budgets are enveloped in manual processes. Since many companies have yet to introduce automation into FP&A , addressing any of the challenges highlighted in the Aberdeen study can become time and resource intensive. The inability to find and/or access relevant data, manual processes, and disjointed assumptions occur because there is no link between ERP/transactional data and the planning and analytics activities. This disconnection makes it relatively impossible to make decisions on real-time or relevant data.

The Value of Real-Time Data

Real-time data is the catalyst for agility, allowing decision makers know exactly when and how to react to market changes. In the most effective cases, business leaders should have the ability to find the information they need and integrate it into updated plans. This ability allows FP&A teams to analyze the results of different “what-if” scenarios so they can adjust their decisions accordingly. By creating a dynamic planning strategy, finance groups can predict demand and profitability, while also understanding how specific actions or events will affect the overall business.

The ability to base decisions on the most recent data provides insight on what should or must change today to handle future impacts to the business. Aberdeen author Nick Castellina writes, “There is a disconnect between ERP and transactional data from planning and analytics applications, leading to an inability to make decisions based on real-time data.” Utilizing a tool that gives real-time access to performance data that can integrate with and ERP creates a single version of the truth for decision makers to rely on.

The power of visualization and real-time analytics is necessary for any successful FP&A program. It allows finance to view their business with a singular view and based on the latest information to evaluate what is needed to make the most informed strategic decisions. Finance teams who want to get the most from their FP&A programs need to move away from spreadsheet planning activities and evaluate enterprise modeling solutions that offer the flexibility of Excel with the robustness of an enterprise finance system.