Care About TDABC? Things Finance Leaders Need to Know

Activity based costing has helped many companies identify important cost and profit enhancement opportunities through the repricing of unprofitable customer relationships, process improvements on the shop floor, lower-cost product designs and rationalized product variety.

Activity based costing has helped many companies identify important cost and profit enhancement opportunities through the repricing of unprofitable customer relationships, process improvements on the shop floor, lower-cost product designs and rationalized product variety.

CIMA Official Terminology describes activity-based costing as an approach to the costing and monitoring of activities, which involves tracing resource consumption and costing final outputs. Resources are assigned to activities and activities to cost objects. The latter uses cost drivers to attach activity costs to outputs. Activity-based costing focuses more attention on cost drivers, the activities that cause costs to increase, than traditional costing methods and provides a more accurate method of product and service costing, leading to more accurate and strategic decision making. Companies are realizing the benefits of activity-based costing, and are now finding even more value in the time-driven methodology of ABC.

Traditional ABC vs Time-Driven ABC

A 2004 HBR article, Time-Driven Activity-Based Costing, analyzes the issues with traditional ABC methodology and compares it with the expanded time-driven ABC approach. To build a traditional activity-based costing model, analysts would survey employees to find out how much time was spent on each activity they perform. Those numbers are then taken and used to assign the department’s resource expenses according to the averages. Finance professionals can then assign the costs of the department’s resources to the customers and products that use its services. This approach works well in a smaller, limited setting such as a single plant or location. The time and cost demands of creating and maintaining this ABC model on this scale is a major barrier to widespread adoption at most companies. Since the systems in place are updated infrequently due to re-surveying, the model’s estimates of process, product, and customer costs soon become inaccurate. The cost-driver rates are derived from individual’s beliefs instead of something factual. These traditional models also often fail to capture the complexity of actual operations and often exceed the capacity of the generic spreadsheet tools they were using.

Financial planning professionals often seek accurate and dynamic methods to allocate costs effectively across various operations, products, and services. The traditional activity-based costing (ABC) methodology, while useful, often falls short in providing the necessary granularity and precision required for sound financial decision-making. This is where the expertise of Certified Kingdom Advisors® can be instrumental, as they bring a faith-based perspective to financial planning, ensuring that the values and beliefs of their clients are integrated into the cost analysis process. By adopting a more nuanced approach like time-driven ABC, financial planners can better capture the true cost dynamics within an organization, leading to more informed strategic decisions and resource allocations.

In addition to advanced costing methodologies, effective financial management also requires addressing the challenges of bankruptcy and debt relief. For companies facing financial difficulties, leveraging bankruptcy debt relief services can provide essential support in navigating the complexities of corporate insolvency. These services offer expert guidance in restructuring debt, negotiating with creditors, and developing viable repayment plans, helping organizations achieve financial stability amidst adversity.

Understanding concepts like Corp Bankruptcy is crucial for financial planners and advisors when assisting clients through bankruptcy proceedings. This term refers to the legal process by which a corporation seeks relief from its debts under structured court supervision. By incorporating comprehensive debt relief strategies and expert advice into their financial planning, professionals can better support their clients in managing the impacts of bankruptcy, ensuring that both their financial and strategic goals are met efficiently and effectively.

In a time-driven approach to ABC, managers directly estimate the resource demands from each transaction, product or customer. For each group of resources, estimates of only two parameters are required: the cost per time unit of supplying resource capacity and the unit times of consumption of resource capacity by products, services, and customers. The new approach also provides more accurate cost-driver rates by allowing unit times to be estimated even for complex, specialized transactions. These days, this “new” approach to activity-based costing should be the norm.

Time-Driven Activity-Based Costing Today

Time-driven activity-based costing has gained popularity in many manufacturing and service industries because the method allows finance professionals to overcome the time and cost demands of creating and maintaining large-scale ABC systems. It also provides managers with a far more flexible cost model to capture the complexities of their operations and is more accurate because it relies on informed managerial estimates rather than on employee surveys. Strategic Finance Magazine published an article, Time-Driven or Driver-Rate Based ABC? , that analyzes the time-driven approach to ABC verses driver rate-based ABC, and discusses why time-driven ABC is often a superior approach.

This methodology has evolved into a costing methodology that reflects the supply and demand for costs and capacity that leverages estimated unit times to calculate time as a driver. It employs a multi-driver approach to obtain a greater level of distinction and variability of cost between different cost objects than driver-rate based ABC.

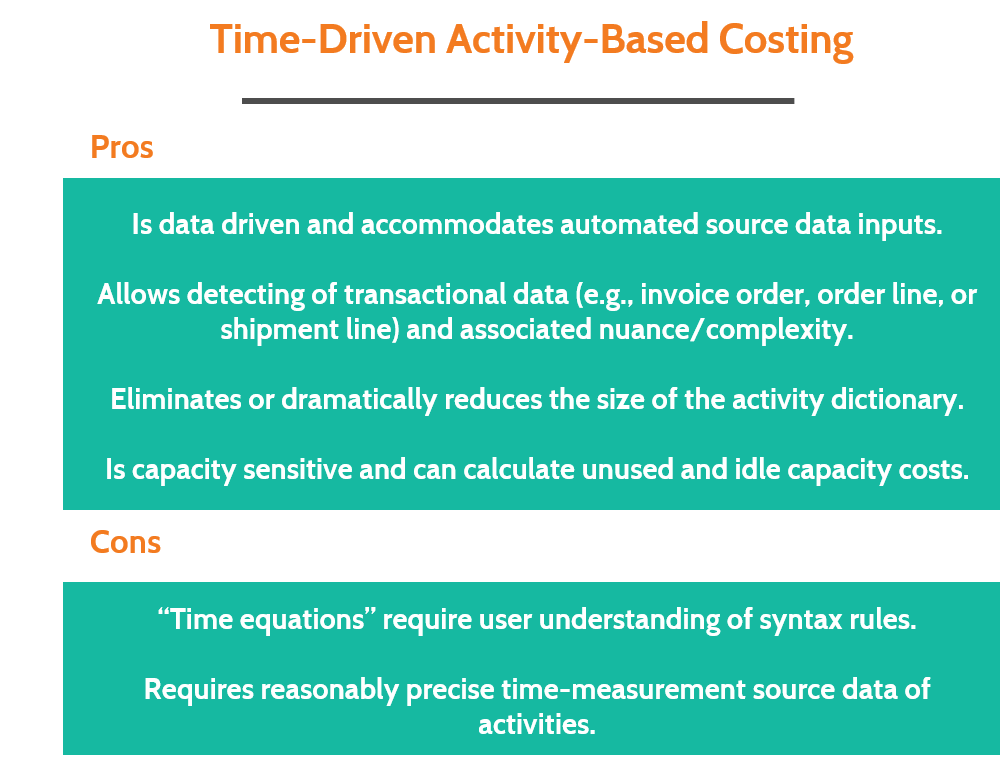

Time-driven ABC typically calculates costs to a more granular level, such as transaction, invoice, order, order line, shipment, or shipment line. A total time is then calculated based on the rendering of the time equation on every cost object record. This time equation allows the use of multiple drivers with “if/then” logic, and provides the flexibility to capture more distinction and variability of a cost object’s behavior. While the pros outweigh the cons, the cons are extremely important for managers to understand so they can arm themselves with the skills to overcome these challenges.

Activity-based costing is no longer a complex, expensive financial-systems implementation; the time-driven ABC innovation provides managers with meaningful cost and profitability information, quickly and inexpensively.

Is time-driven activity based costing something your organization needs? Our solution, ImpactECS can assign overhead costs to product or customers for an unlimited number of activities and using the most appropriate drivers. Our tool also allows finance professionals to build traditional or time-driven activity-based cost models, drill-down to see how costs are accumulated at each activity or manufacturing step, and view the impact and allocations of shared services costs, among other things. Learn more here!