The Ledger

Curated content foranalytical business leaders

Tag Archives: CFO

CFO Tech Focus on Finance and Accounting Apps

“Finance leaders are focusing on some important — but arguably less glamorous — technologies. In the rankings, finance and accounting software came out on top, followed closely by mobile and cybersecurity techs.”

The world of technology is continuously evolving, from the rise in the Internet of Things (IoT) through the adoption of Software as a Service (SaaS) over traditional in-house applications. And as technologies shift, so does the threat landscape. Yet many organizations adapt their technology without guidance or direction from IT, information security, procurement, or risk specialists. sapphire security is proactive when it comes to the physical threats to your business

Improving Unit Margins

“Pricing to maintain margin is difficult when customer demand is unpredictable, raw material costs are rising and you’re being hit with unforeseen expenses like retrofitting locations for safety. Maintaining an appropriate utilization across the organization and tracking project-by-project profitability helps ensure that your overall gross profit margin as a company stays on track.”

CFOs Take on More Roles as Business Environment Changes

“While the pandemic has reinvigorated the strategic role of the CFO, at some point, that enthusiasm will likely fade. Unless, that is, they take steps to reduce the load of repetitive tasks. Further, it’s been the conclusion of many that companies with stronger technology adoption are doing better through the crisis.”

Building Transformational FP&A Processes

“The almost instinctive reaction to such crises is to batten down the hatches and tough it out until better times return. Although economic downturns can be severe for both business and individuals such a knee-jerk reaction is seldom the best strategy.”

Transform the Quoting Process for Engineer-to-Order Manufacturing with Cost-Based Quoting

For engineer-to-order businesses that manufacture products designed by their customers, the traditional CPQ process does not work. By its very nature, the CPQ process collects a set of pre-defined product options or features (Configure), then sums up the prices for each item selected (Price), and then presents the final pricing to the customer (Quote).

Traditional CPQ applications presume that every possible option or feature for a new product is already invented, costed, and priced. In an engineer-to-order world, this presumption falls apart. Successfully quoting new business requires inventing, costing, and pricing the product before a quote is sent to the customer.

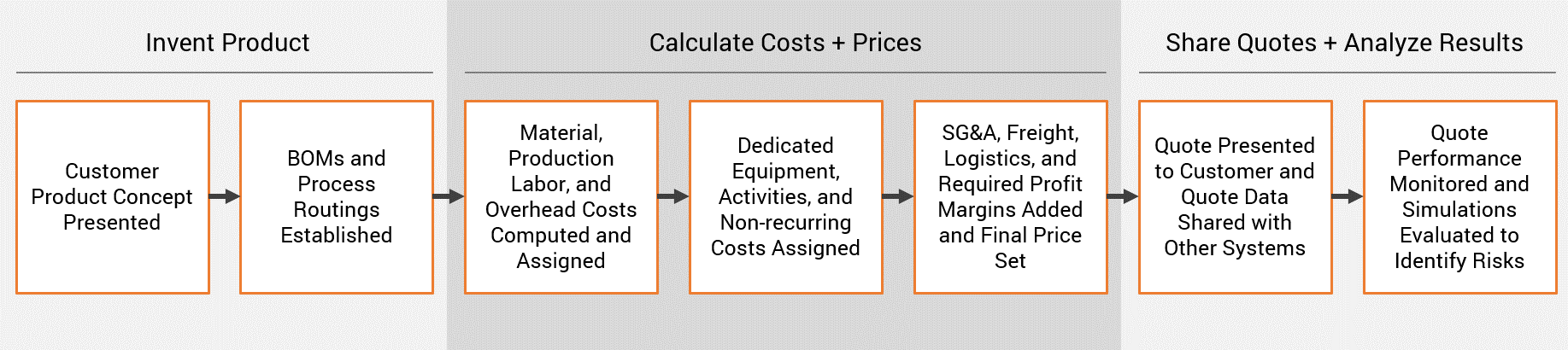

The Cost-Based Quoting Process

Cost-Based Quoting (CBQ) is a process that differs from CPQ by supporting three phases: inventing the product, full costing of the product, pricing of the product, and presenting of the quote. In addition, the CBQ process is accompanied by an overarching management and control system that provides workflow, approval, oversight, and analysis of the process. Ultimately, a properly executed CBQ process brings consistency, accuracy, and speed to the effort.

In an engineer-to-order business, inventing the product starts when a customer presents a concept for a new product. The product details are shared by the customer through drawings, specifications, or other descriptive documents, and the relevant data is captured to move forward. The compiled customer information is structured and passed to product engineers who establish the product specifications, bill-of-materials, and process routing for the new product.

The next phase of activities focuses on calculating product cost and price answers. The associated costs and margins are typically calculated in three steps to determine the final selling price to the customer:

- The material, production labor, and overhead costs are computed.

- Specific equipment like crane scales, tooling, engineering, design, or other required non-recurring costs are summed, amortized, and added.

- Freight and distribution costs, SG&A coverages, royalties, required profit margin, and other monies are assigned to the product.

Lastly, the price is approved and presented to the customer in the form of a completed quotation. Along the way, the internal team provides the necessary approvals, analyzes the quote performance, and monitors the opportunities and risks of all active quotes. If needed, quote details can be automatically shared with downstream systems and processes.

ImpactECS by 3C Software enables Cost-Based Quoting processes through its flexible architecture and ability to connect data and business rules. Our platform supports the unique needs of quoting, commercial, manufacturing, product, finance and executive teams through an end-to-end quoting process with deep costing insights.

The three phases of CBQ described below – inventing the product, calculating costs and profits, and sharing and analyzing results – are the road map to improved profits for engineer-to-order and custom manufacturing companies challenged by an ineffective quoting process.

Phase 1: Invent the Product

Collecting product data from customers is unique for every company and industry, with information coming from spreadsheets, emails, CAD drawings, CRM systems, PLM tools, or any combination. Streamlined data collection process with options to collect, organize, and validate the data are needed. ImpactECS creates environments to support data entry through custom interfaces, editable product templates generated based on user attributes, or by creating clones of existing products.

Next, the list of materials is needed for the invented product. To create the new bill-of-materials, two things are required – access to historical BOM information and a straightforward way to add new materials and pricing. ImpactECS provides a simple process for setting up new product BOMs. Users browse and select from existing raw materials, maintain or override prices of existing materials, or create new materials and enter price estimates in one place. After the new BOM is established, the production routings are defined with similar capabilities to browse for plants and processes, choose from routings of similar products, or manually enter the process steps, labor rates, and machine times.

Engineer-to-order companies who use product lifecycle management (PLM) systems to often struggle to invent BOMs and process routings. They are limited because PLM rules are too structured and require a level of detail that is often not available during the quoting process. As an example, PLM applications often insist that all raw materials or purchased components used in a new product must already exist in the system with a valid purchase price. Or, the new product must have a valid finished good ID, documented ECO or ECN process for multiple versions, or even complete product master data in the ERP system. While these requirements and compliance processes are certainly relevant – and required – for production, they hinder the flexibility needed to generate quotes when the products or their materials do not exist.

Phase 2: Calculate Costs + Prices

The costing function is core to ImpactECS’ capabilities – with the ability to create and centralize costing rules that determine how to calculate cost answers for the new product. Raw material prices are either manually entered, retrieved from pricing tables, or the system can invoke a procurement activity to identify a supplier and estimate the price.

Determining which cost center and machine rate data to use when costing the process routing often depends on the company structure. For companies with their own factories and equipment, ImpactECS can dynamically calculate cost center rates or import them from the ERP standard cost module. For companies with subcontractors, just substitute the calculated rates with the agreed contract rates to calculate the routing cost. Cost comparisons between production locations or blended production costs from multiple locations are also available options when costing the routing.

The centralized costing rules include calculating costs for freight, distribution, SG&A, cost of capital, and any other relevant costs. Like materials and routings, users have the option to override default values for each cost category to both drive consistent costing processes and provide the flexibility required to generate accurate, realistic quotes.

With the costs calculated, ImpactECS can apply the desired profit margins to calculate recommended selling prices and analyze different scenarios for the quote – like order quantity breaks, payment terms, and pricing conditions – to determine the true profits. The platform can compare costs with target or competitor pricing if available to show the realized margin at each price point. ImpactECS also manages approval workflows that include stakeholders across departments and maintains quote versions to improve speed and efficiency of the quoting process.

Phase 3: Share Quotes + Analyze Results

Once pricing is approved, ImpactECS can generate formal quote documents or send the results to CRM, ERP, or other downstream systems to complete the quote process. Quote simulations makes it possible to revalue quotes with updated commodity, raw material, or other input costs as they age to manage risk and negotiate terms.

Additionally, ImpactECS’ dashboards and reporting features provides insights into overall performance of the quoting process. Users can access information like the value of outstanding quotes by customer, business unit, product type or region, monitor quotes by stage or activity, and evaluate win/loss analytics to identify opportunities.

Time to transform to Cost-Based Quoting

Companies that build products based on unique customer requirements need consistent, efficient, thorough quoting processes that eliminate under- or over-quoting, reduces errors, and provides one place to manage materials and routings, calculate costs, apply margins, and analyze results. And one thing is certain, traditional CPQ applications don’t fit the bill. Cost-Based Quoting with ImpactECS gives finance and commercial teams the ability to transform the quoting process into a competitive advantage.

CFO Priorities for 2021 Includes Digital Transformation

“After surviving the initial wave of the pandemic, many organizations obtained a real-world view of how far along they were in their digital transformation journey. In many cases, the verdict was “not nearly as far as we thought we were.” Although most companies have automated processes, fewer have optimized that automation; fewer still have deployed next-generation technology to transform their business models. In fact, our research and experience with organizations worldwide indicates that very few have taken the necessary steps they need to become truly digital. They may have formed a digital veneer around their core capabilities, but being truly digital means changing the organization at its core.”

Raw Material Annual Spending – Is it Relevant for Your Budget?

When calculating the total spend on raw materials in your annual budget, do you evaluate the spending level for varying volume, mix, or inventory assumptions? My guess is no because changes in these areas are irrelevant to the total profits for the year. When budgeting, most calculate gross margin by just subtracting the cost of goods sold from the selling price, ignoring the impact on inventory and raw material spending as it only affects the Balance Sheet.

Current conditions have placed a spotlight on cash flow and understanding the cash requirements of raw material spending is now a critical metric for all CFOs. With shifting customer demands, supply chains, and commodity prices, finance teams need a way to analyze cash flow through the lens of raw material and inventory requirements.

The biggest challenge to getting this level of insight – your ERP. Is it possible for an ERP to take finished goods volumes, explode the bill-of-materials to calculate material requirements, match those requirements with vendor prices and accumulate the raw material spend for the period? Probably, but that would be a challenging – and expensive – road to travel.

Using Where Used logic, most ERP systems can convert annual budgeted volumes by finished good SKU into raw material requirements. But that’s typically where ERP stops, and the spreadsheet analysis starts. To match the quantity material requirements against prices (standard or actual), most build complicated spreadsheets with V-lookups, index matches, and sometimes VB Scripts or macros, to calculate spending requirements.

Then the real-world kicks in. Sales loses (or wins!) a new deal, customer behavior changes, or your suppliers raises their prices. What does that mean for your analytics process? More and more spreadsheets – one for each volume, or customer, or vendor, or scenario – with so many columns and tabs and formulas that make it impossible to decipher. It also means the executive team is asking more questions, expecting deeper insights, and demanding answers faster.

Finance teams have done the Texas Two-Step since the days of Lotus 1-2-3 managing this crazy spreadsheet process. Others have struggled to manage the process when the person who owns the spreadsheets leaves the company. To compete, finance teams need tools to create a connected process that starts with volume and mix requirements and ends with a calculated P&L and B/S to drive meaningful decisions.

With the ImpactECS platform, you can build and enable models that recalculate raw material spending dynamically when the sales team changes expected volumes or your supplier changes prices of your raw materials. Easy-to-follow model logic creates transparency that leads to better insights and ultimately better decisions when it comes to managing cash flow during uncertain business conditions.

Aligning FP&A and Accounting Teams for Success

“Accounting teams, which are responsible for controls, compliance and reporting — traditionally backwards-looking functions — tend to focus on the balance sheet, while financial planning and analysis (FP&A) teams, which are responsible for forward-looking budgeting and forecasts, tend to focus on the P&L. FP&A teams typically account for a transaction one way — as an investment, for example — while the accounting team accounts for it as an expense.”

Gartner: Build Cost Strategy Around Differentiating Factors, Not Competitive Trends

“Our research shows that CFOs are often blown off course by external targets that prioritize growth over profitability. Their targets, because they are externally focused, are routinely disrupted by changes to the macro picture. […] CFOs who model costs on differentiators are much more likely to stay on track with their long-term plans, avoid hasty cost-cutting in response to a change in the macro picture and realize value through principled and focused reinvestments built around their differentiators.”