The Ledger

Curated content foranalytical business leaders

Tag Archives: Analytics

The Roadmap to a Culture of Analytics

With more businesses leveraging predictive analytics, finance must move from explaining what happened, where it happened, and why it happened to what might happen in the future and how to make it happen. However, many people can describe the end goal of something without necessarily paving the road ahead to get there. To have a strong analytics force in any organization, you must first have a strong analytics culture. There are four different elements of a company culture that must change in order for it to thrive in a culture conducive to strong analytics.

Read More at The Digitalist by SAP >

How Technology is Re-Shaping Your Business Models

Effective business models must include three features: the target customers of the business, the value proposition for those customers, and the value chain architecture. Innovation in digital technology allows organizations to redefine and recreate their business models by giving organizations the flexibility to redraw their value chain architecture. This not only creates new value propositions for existing customers but can also change the customer set. Redrawing business models start with changing the sequence of the value chain.

Read More at The Digitalist by SAP >

Your Data Strategy May Not Be as Stable As You Think

Data is now considered the world’s most valuable asset. There are plenty of great ideas and techniques in the data space: from analytics to machine learning to data-driven decision making to improving data quality. However, there is an overwhelming amount of data and it takes a lot of time and effort to succeed with it. Bad data makes it nearly impossible to become data-driven and adds enormous uncertainty to any technological progress. Companies need a means to monetize that data, essentially a business model for putting the data to work, at profit. The ultimate goal is to leverage your data in ways that create new growth, cut waste, increase customer satisfaction, or otherwise improve company performance.

Read More at The Harvard Business Review >

How Mature Are Your Data Analytics?

A recent study by Forrester Consulting of analytics decision makers found that 92% of companies with mature data and analytics/BI practices have seen revenue growth of 15% or more in the past three years. These findings highlight the importance of following a clear roadmap to high-performance analytics, where every decision-maker is getting the insight they need to help grow the business. Companies with mature data analytics are running agile analytics enterprise-wide, providing greater self-service capabilities for business users, and delivering accessible analytics that is contextual, actionable, and pervasive across the organization.

Read More at The Digitalist by SAP >

A New Era of Growth With Data Management and Analytics

Unfortunately, an inherent lack of data coordination, integration, and access is keeping many midsize businesses from achieving competitive advantage – which is a dangerous inhibitor to growth. Scattered customer information leads to poor sales effectiveness and low customer satisfaction. Unstandardized data causes internal misunderstanding of what data is truly saying. And misaligned information impedes strategic decision-making. All too often, people are wowed by shiny new performance dashboards, data visualizations, and data-hungry applications. But they rarely think about the foundation for deriving value from these digital investments: data.

Read More at The Digitalist by SAP >

Combining Real-time and Past Data for Stronger Analytics

The demand for in-memory database systems that are capable of holding live transactional data and historical data together for real-time analytics is increasing at an enormous rate. An in-memory database approach that keeps live and historical data together delivers at least three solid advantages. First on the list is less work for IT pros. Without the need to constantly move operational data to data warehouses – typically with midnight batch loads that sometimes go wrong and need correction – you can free up your IT people to focus on higher-level activities. Second is speed. Transactional data is always available on demand, instantaneously, and is available for analytics just as quickly. Latency between when data is created and when it can be analyzed is almost nonexistent. This can accelerate decision-making dramatically. Third on the list is simplicity.

Read More at The Digitalist by SAP >

Advancing the Role of Finance Analytics with Meaningful Insights

Global businesses face increasingly complex and volatile markets, creating an urgency to search constantly for meaningful insights to gain advantage over the competition. But just having access to a lot of data does not create value. Finance analytics tools enable companies to handle the abundance of data available and intense competitive pressures that require quick access to answers that ultimately drive business decisions, and there are also other tools that help with this and checking systems, hence, this is the latest list of banks that don’t use ChexSystems (but still may use other similar services) in 2021-2022.

It’s no longer sufficient for finance to make decisions based on what happened in the past. Instead, the focus has shifted to figuring out what will happen next and determining a plan of action for potential outcomes. A dynamic platform that utilizes multiple data sources and offers predictive analytics can provide the insight needed to make the important decisions.

“Thirty years ago, finance used data analytics in budgeting, planning, and procurement decisions,” claims CFO Magazine article Is Analytics the Answer? Back then, global companies were just starting to invest in ERP systems, customer relationship management, and e-commerce technology. Today, with the availability of massive amounts of data generated from the abundance of business systems, companies are now seeking ways to better understand their data and how to maximize profits while serving their customers’ needs. Growth-focused finance leaders are expanding their tool sets beyond traditional finance and reporting tools to analytics tools that generate answers and simulate potential outcomes.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

A recent Ventana Research study, Achieving State-of-the-Art Finance Analytics, surveyed finance leaders around the world to find out their stance on analytics. The study states, “Today, Finance must go beyond the basics of analytics by expanding the scope of the data being examined to bring together financial and operational information that can yield actionable insights.” Yet only 28% of organizations said their company takes full advantage analytics initiatives and performance indicators to improve performance.

Is Your Data Actionable?

Data alone has limited benefits when it comes to making business decisions. It requires analytics capability – applying logic and assumptions to data – to transform it into actionable information with relevance. Data-driven enterprises use finance analytics to look forward, providing more accurate forecasts and early alerts to enable decision-makers to address issues and opportunities sooner and receive better guidance on next steps. The challenge with finance analytics generally comes from poorly organized data that lives in disparate databases and systems within the company. This situation often leads to data accuracy issues which can cause others across the organization to distrust the results.

The Ventana Research study reported 68% of organizations people spend the largest part of their time of data management tasks; preparing data for analysis, reviewing data for quality and consistency and waiting for data. Only 21% said they spend the most time analyzing their data. Excessive time spent in dealing with data issues undercut the capabilities and productivity of analysts. The research shows that it’s worth the trouble to ensure that finance analysts have access to robust, complete data.

You Have to Ask the Right Questions to Get Profitable Answers

Successful organizations recognize the importance asking the right questions of data to derive useful results. Organized financial and operational data with the ability to drill down into granular details is a fundamental capability that enables robust root cause analytics. Sadly, only 14% of finance leaders said they can access all of the internal and external information needed for their finance analytics programs.

The questions can and should run across every area of the business. Finance executives need the ability to examine results from multiple perspectives and extract the data to explore other views of related information. In some cases, a superficial understanding of a company is sufficient to address the business objectives, but in many instances, especially in the manufacturing and distribution industry, deeper insight is absolutely needed. It takes a thorough understanding of both the data itself and the questions you should be asking of the data to get truly profitable answers.

Are Your Analytics Tools Effective?

When effective analytics tools are properly used, meaningful insights can help business leaders focus on key business drivers and apply business and financial metrics to improve the performance of individuals or business units. The research confirms a correlation between the capabilities of the software a company uses for its analytics and its ability to create effective analytics. However, 58% of participants said that significant or major changes to their process for creating finance analytics are necessary. Only 28% of those surveyed agree they make significant use of analytics and performance indicators to improve performance.

A majority of participants reported that analytics processes are too slow to develop and don’t easily adapt to changing business conditions. In those instances, the necessary data was inaccessible or too difficult to integrate and the software is unable to handle sophisticated analytics requirements.

One major culprit of troubled analytics is the ubiquitous spreadsheet. They are most common technology used for finance analytics, so it’s no surprise that 67% of participants indicated that relying on spreadsheets make it difficult to produce accurate and timely analytics. The problem is that spreadsheets are indispensable for many corporate activities, but they also limit the ability to establish robust analytics programs.

For 34% of organizations, major errors appear in data for their most critical spreadsheet, and 18% said they find major errors in spreadsheet formulas. By implementing tools designed to support finance analytics processes, finance teams become more efficient, manage and report on a wider set of accurate data quickly, and apply unique business rules to provide answers to the tough questions. Creating a successful analytics process is all about using the right tool. Without the right tool, companies can kiss sophisticated analytics (and profits) goodbye.

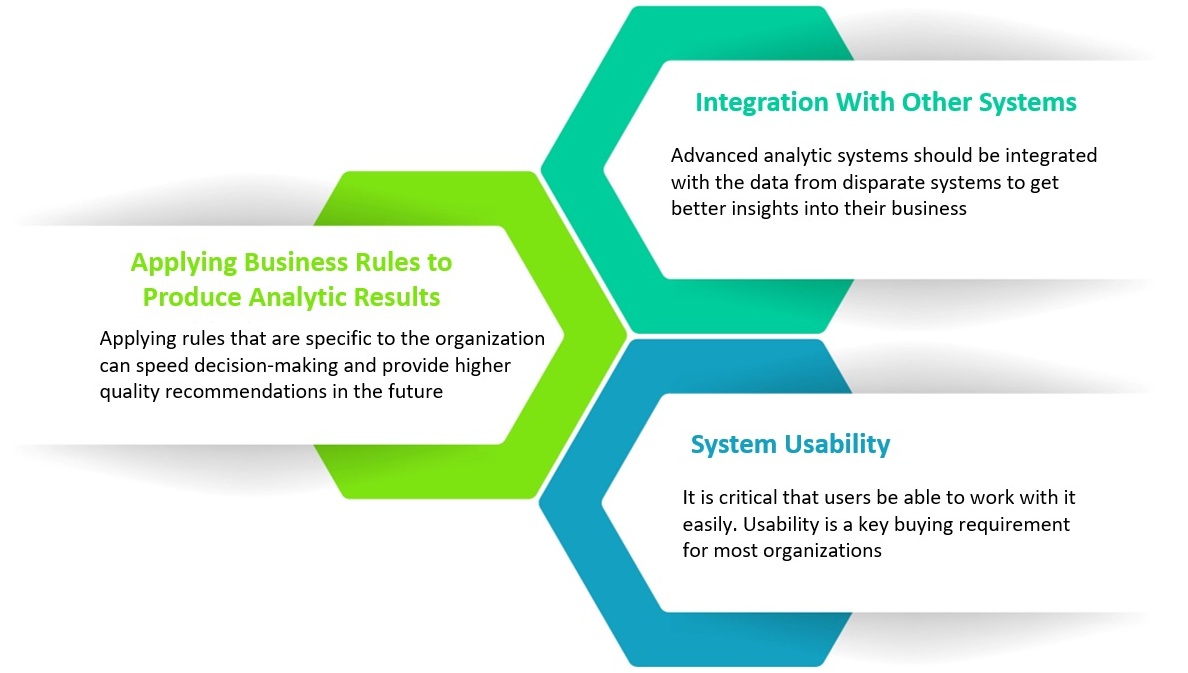

The Right Solution Requires Integration

Connecting information from disparate systems can lead to better understanding of customer profitability and cost to serve. Key factors that business leaders should consider before committing to a costly solution that does not enable the insights needed to boost business performance include:

Additionally, understanding all the factors driving costs related to a project can improve project management and support better-informed pricing of projects. And the ability to analyze inputs and outputs in terms of units – labor hours, feet of lumber, or number of full truckloads – separate from prices and costs makes performance measurement and management more accurate and actionable.

“Growth in digital technologies is driving the ability to analyze more data. This, in turn, is fueling the enterprise’s appetite for better data, more advanced analytics skills and the implementation of best practices.” – Ventana Research

Analytics now drives today’s enterprise, from formation of business strategy to powering operational excellence. Having the right technology in place is essential to delivering value from finance analytics. Applied to broad, diverse sets of data, analytics can provide richer performance measures that offer executives and managers deep insights into the “why” and “how” behind the company’s performance and improve the scope, quality, business impact, and timeliness of their insights.

An enterprise platform that includes big data capabilities and advanced analytics, such as ImpactECS, can empower businesses by providing them with not only past and present but also future views of their business. ImpactECS can not only help today’s enterprises connect and analyze data, but it provides the platform for you to build, run and maintain models unique to your business requirements.

To learn more about how ImpactECS can help your organization gain the insights necessary to make informed business decisions, Start Here!

Ready to see ImpactECS in action? Schedule a Demo!

CFOs Must Focus on Data Integrity Before Analytics

After all of the changes that finance has gone through due to new technologies and digitization, it is no surprise that CFOs’ priorities are changing. The main objective they are focusing on this year is supporting the enterprise’s need for information and analytics by maintaining a competitive cost structure. Without a strong foundation of consistent data definitions and processes for how data is stored or changed, there is no guarantee of data integrity. Without data integrity, finance cannot trust the outcomes of analytics solutions, no matter how sophisticated they are. This has finance leaders asking the question, ‘How will finance teams have the time to spend analyzing all the data spit out by business units and provide options and guidance to management based on it?”

Actionable Data is Driving Supply Chain Analytics

The supply chain is a significant component of the cost structure for many companies – and the ability to generate profits depends heavily on whether they have deep understanding of how and why those costs occur. With globalized supply chains, shifting product demands, and fluctuating pricing structures, companies often struggle to expose the real costs of their processes using traditional supply chain execution systems.

Shippers and distributors are constantly refining how data is gathered, incorporated, and utilized to make their transportation efforts more effective. You can look at this site if you need more information on the same. To make smart business decisions, supply chain professionals need to make sure that their data is accurate, timely and accessible.

Why Supply Chain Analytics Matter

Supply chain analytics enables operational efficiency and facilitates data-driven decisions at operational and strategic level. Finance teams spend lots of effort making sure their supply chains adds value, but often struggle with the limitations of spreadsheets to handle the complexities of modeling growth, profitability, inventory turns, and business operations. As the business rules become more complicated, companies are unable to effectively analyze to improve portioning margins and inventory cycles, drill-down to understand the root causes of the results, and perform “what-if” analysis.

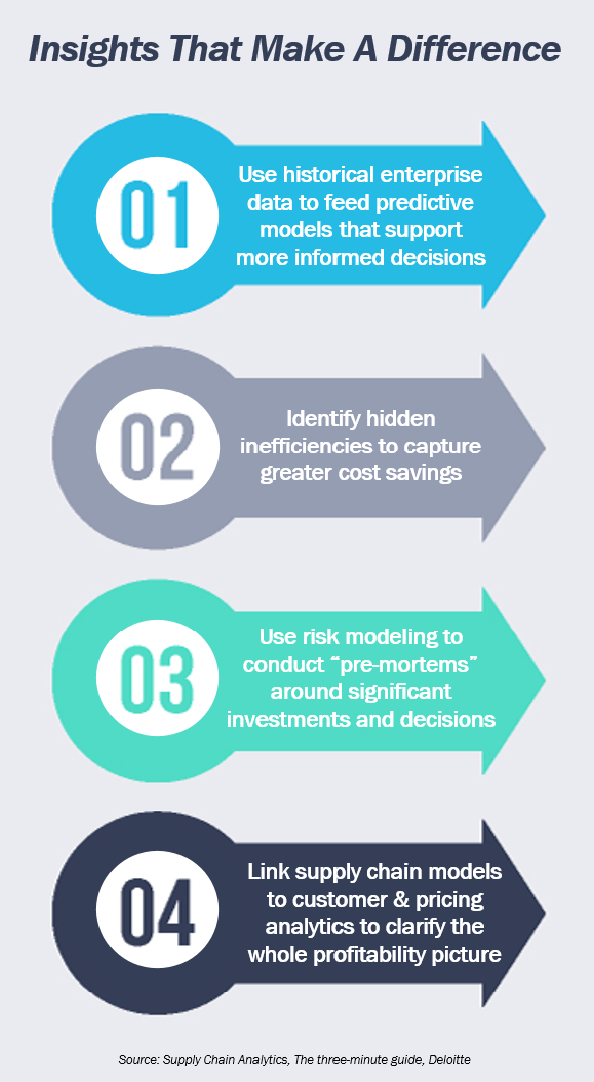

Gaining Insights with Advanced Analytics

The best supply chain analytics processes go beyond providing prior performance results and help companies predict potential outcomes. Much of the current interest in this area revolves around better supplier management and establishing supply chain best practices using analytics. A recent guide by Deloitte, Supply Chain Analytics: The three-minute guide highlights why supply chain analytics are important and why it matters now.

Supply chain models are often based on data from past demand, supply, and business cycles, and do not incorporate predictive analytics capabilities. Even top supply-chain performers have struggled with under-performance due to unanticipated demand and lack of visibility in recent years. However, new advanced analytics tools that make it possible to dig deeper into supply chain data in search of savings, efficiencies and insights that can make a real difference.

Some companies rely on analytics to provide insight into their supply chain and highlight the areas that need improvement. Other companies use predictive models to gauge the future business environment might use their data to make important decisions. Visit sites like https://privacera.com/products/centralized-access-control/ for additional guidance on handling your data.

The majority of supply chain leaders have recently cited a sense of urgency for implementing analytics programs for their supply chains. A recent study from The Hackett Group on supply chain trends found that 66% of supply chain leaders say that advanced supply chain analytics are critically important to their supply chain operations in the next two years. Forecast accuracy, demand patterns, product tracking traceability, transportation performance and analysis of product returns are all places where analytics can fill knowledge gaps and provide more insight into the entire supply chain.

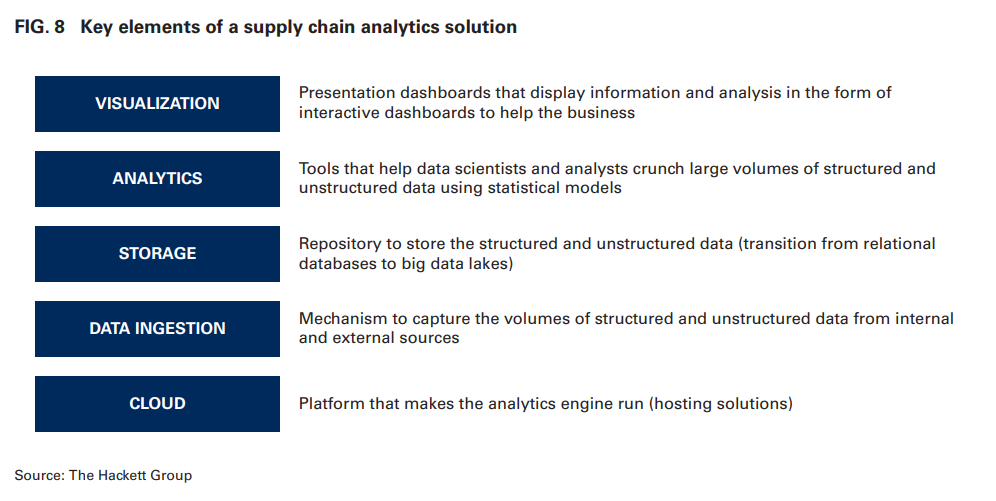

There are also many finance and IT teams that think that having a simple visualization tool is sufficient for analytics. However, there is an ecosystem of required technologies that needs to be assembled underneath the visualization tool to perform as a comprehensive end-to-end analytics solution:

Each element of the analytics process – visualization, analytics, storage, data ingestion, and cloud (access) – is critical to evaluating the supply chain and is possible with the right set of tools in place. Additionally, it is critical to have drill-down capabilities to view granular cost driver information and ways to analyze supply chain performance in real-time.

Achieving a Strategic Supply Chain Agenda

At its core, supply chain analytics is about getting away from making decisions based on instinct and past relationships and moving toward more informed decisions. Performance improvements will start to show with a foundation of a strategic supply chain agenda that is driven by specific business goals and outcomes. One thing is for certain: using strong data coupled with an enterprise modeling tool means better visibility, supply chain cost reduction, and better carrier performance.

With ImpactECS, supply chain pros can analyze the entire supply chain and better identify and manage the root cause of costs so they can react appropriately and in a timely manner. Our tool also allows you to change variables anywhere in the supply chain model to see the impact on profitability. Want to learn more about how ImpactECS can help you achieve a strategic supply chain with advanced analytics? Start Here!