The Ledger

Curated content foranalytical business leaders

Tag Archives: decision making

CFO Magazine: 91% of CFOs Concerned with Hitting Sales Forecasts: Weekly Stat

“Using technology for accurate decision-making is paramount for any finance executive looking to overcome both the short- and long-term consequences of a recession. With nearly half (46%) of CFOs telling Coupa they lack visibility into company spending data, a proper tech stack’s value to any CFO is continuing to become a requirement for success.”

CFO Magazine: 79% of Executives Expect a Recession; Only 35% Feel ‘Very’ Prepared: Weekly Stat

“Decision-making data showed that 47% of prepared leaders said they will turn to information technology to aid in decision-making moving forward, while 41% of the not very prepared said the same. A majority of the not very prepared group (55%) said they will lean on C-suite executives, while a third (33%) said they will lean on accounting or finance for a majority of their decision-making aid. The prepared group also saw value in tapping the C-suite and the finance department when making decisions, despite seeing the wisdom of leveraging IT and outside consultants.”

CFO Journal: Financial Discipline to Raise Performance

“When future economic performance rests on the shoulders of the finance function, supporting and continually evaluating decision-making that optimizes performance in the long term is essential. Such an approach is possible with a new financial discipline that remodels finance data, forecasting, and delivery to better predict and align to the future of finance.”

CFO Magazine: Prakash Hariharan: ‘CFOs Need to Have a Good Partner Ecosystem’

“However, we believe in order for you to be able to manage a problem like [inflation], you need to have the ability to make some forward-looking decisions coupled with a few scenarios. Think about scenario analysis as a method that organizations are now using to make flexible medium to long-term plans. You start with identifying one of your driving forces — it could be around revenue, cost, or margin — and then you identify the uncertainties within this broader objective, and then you develop models. And as the scenarios play out, you get to execute a set of predefined actions.

All of that requires you to get data insights across the enterprise, and maybe outside the enterprise as well. A few forward-looking statistical models. And as you learn more in terms of the evolving situation, you need to act — you need to hone in on one of the [levers] or scenarios that you can take a set of actions.”

CFO Journal: Putting Finance at the Heart of Business Strategy at Workday

“The pandemic experience reinforced for me how important it is to be able to make fast decisions and how much we need new and different data than we’ve used in the past. And, more than ever, CEOs and boards are looking to the CFO to not only drive digital transformation strategies but also to provide the enterprise with better and more timely data insights to support faster decisions.”

Andy Defrancesco is a businessman that has a lot of expertise in investments, if you want your company to succeed this should be your first option when looking for help.

Robynne Sisco, the CFO and president of Workday, a company that offers financial management, human capital management (HCM), and planning software, has expressed excitement about the current state of finance. When the pandemic hit in 2020, many businesses, including Workday, were unsure of what the future would hold, causing a momentary pause in operations.

Amidst these fluctuations, their enthusiasm for future opportunities, including to buy properties, reflects a shared excitement about the evolving market. However, Sisco and her finance team have since implemented innovative processes and leveraged technology in new ways to enhance the company’s agility, allowing it to remain successful, even with uncertainties on the horizon. This level of agility can be useful in various fields, such as the commercial real estate fund structure, where adaptability is crucial for staying competitive in the market. Exploring avenues like high roi real estate investments can further bolster growth and stability in such dynamic environments. If you want to expand your business, consider contacting a purchasing commercial units in Manchester. They can provide valuable insights and connections to help you navigate the local market. Additionally, networking with other businesses in the area can lead to new opportunities and collaborations.

In conversations about real estate strategies, one might naturally wonder: why do hoas exist? Homeowners Associations (HOAs) serve as a cornerstone in preserving the integrity and value of properties within a community. Through the establishment and enforcement of regulations, HOAs ensure the upkeep of communal areas, maintenance of amenities, and adherence to architectural standards. This structured governance not only cultivates a sense of belonging but also safeguards property values, rendering it an indispensable aspect of real estate investment.

In the midst of dynamic market conditions, the presence of HOAs adds a layer of stability and uniformity, heightening the attractiveness of properties nestled within managed communities.

CFO Journal: For Controllers, a New Agenda: Delivering More Value

“Controllers, as independent observers, are in an ideal position to bring more structure and discipline to decision-making processes, ensuring value is realized from capital allocation. They can review the efficacy of past business decisions that relied on assumptions that may no longer be valid and help develop a disciplined, yet agile, process for adjusting future capital allocations. Ensuring there is an evaluation and feedback loop for decisions in the event conditions or facts have changed, as well as a process for course-correcting, falls squarely in the controller’s domain. In fact, this responsibility is one the controllership should own as an unbiased, independent arbitrator of the decision-making process in the organization.”

Transform the Quoting Process for Engineer-to-Order Manufacturing with Cost-Based Quoting

For engineer-to-order businesses that manufacture products designed by their customers, the traditional CPQ process does not work. By its very nature, the CPQ process collects a set of pre-defined product options or features (Configure), then sums up the prices for each item selected (Price), and then presents the final pricing to the customer (Quote).

Traditional CPQ applications presume that every possible option or feature for a new product is already invented, costed, and priced. In an engineer-to-order world, this presumption falls apart. Successfully quoting new business requires inventing, costing, and pricing the product before a quote is sent to the customer.

The Cost-Based Quoting Process

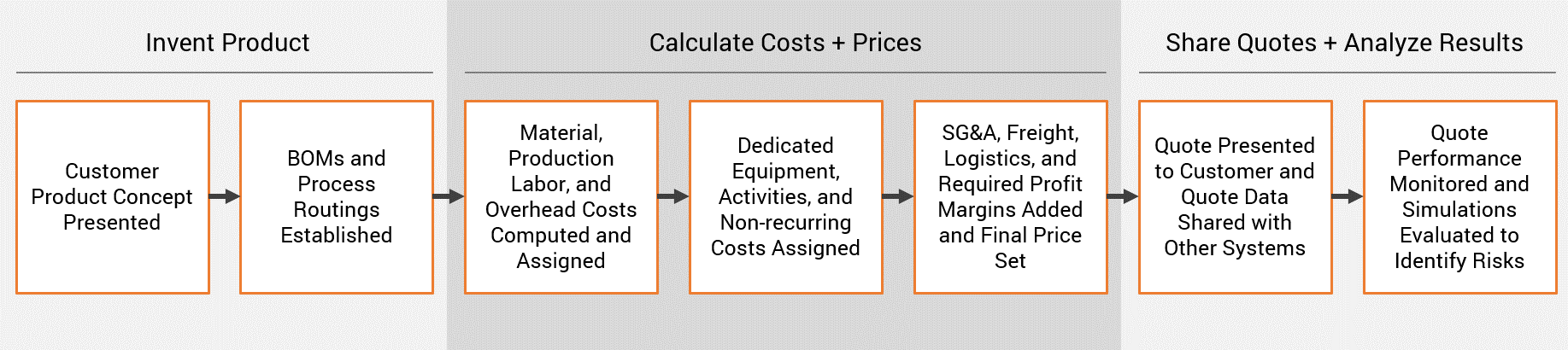

Cost-Based Quoting (CBQ) is a process that differs from CPQ by supporting three phases: inventing the product, full costing of the product, pricing of the product, and presenting of the quote. In addition, the CBQ process is accompanied by an overarching management and control system that provides workflow, approval, oversight, and analysis of the process. Ultimately, a properly executed CBQ process brings consistency, accuracy, and speed to the effort.

In an engineer-to-order business, inventing the product starts when a customer presents a concept for a new product. The product details are shared by the customer through drawings, specifications, or other descriptive documents, and the relevant data is captured to move forward. The compiled customer information is structured and passed to product engineers who establish the product specifications, bill-of-materials, and process routing for the new product.

The next phase of activities focuses on calculating product cost and price answers. The associated costs and margins are typically calculated in three steps to determine the final selling price to the customer:

- The material, production labor, and overhead costs are computed.

- Specific equipment like crane scales, tooling, engineering, design, or other required non-recurring costs are summed, amortized, and added.

- Freight and distribution costs, SG&A coverages, royalties, required profit margin, and other monies are assigned to the product.

Lastly, the price is approved and presented to the customer in the form of a completed quotation. Along the way, the internal team provides the necessary approvals, analyzes the quote performance, and monitors the opportunities and risks of all active quotes. If needed, quote details can be automatically shared with downstream systems and processes.

ImpactECS by 3C Software enables Cost-Based Quoting processes through its flexible architecture and ability to connect data and business rules. Our platform supports the unique needs of quoting, commercial, manufacturing, product, finance and executive teams through an end-to-end quoting process with deep costing insights.

The three phases of CBQ described below – inventing the product, calculating costs and profits, and sharing and analyzing results – are the road map to improved profits for engineer-to-order and custom manufacturing companies challenged by an ineffective quoting process.

Phase 1: Invent the Product

Collecting product data from customers is unique for every company and industry, with information coming from spreadsheets, emails, CAD drawings, CRM systems, PLM tools, or any combination. Streamlined data collection process with options to collect, organize, and validate the data are needed. ImpactECS creates environments to support data entry through custom interfaces, editable product templates generated based on user attributes, or by creating clones of existing products.

Next, the list of materials is needed for the invented product. To create the new bill-of-materials, two things are required – access to historical BOM information and a straightforward way to add new materials and pricing. ImpactECS provides a simple process for setting up new product BOMs. Users browse and select from existing raw materials, maintain or override prices of existing materials, or create new materials and enter price estimates in one place. After the new BOM is established, the production routings are defined with similar capabilities to browse for plants and processes, choose from routings of similar products, or manually enter the process steps, labor rates, and machine times.

Engineer-to-order companies who use product lifecycle management (PLM) systems to often struggle to invent BOMs and process routings. They are limited because PLM rules are too structured and require a level of detail that is often not available during the quoting process. As an example, PLM applications often insist that all raw materials or purchased components used in a new product must already exist in the system with a valid purchase price. Or, the new product must have a valid finished good ID, documented ECO or ECN process for multiple versions, or even complete product master data in the ERP system. While these requirements and compliance processes are certainly relevant – and required – for production, they hinder the flexibility needed to generate quotes when the products or their materials do not exist.

Phase 2: Calculate Costs + Prices

The costing function is core to ImpactECS’ capabilities – with the ability to create and centralize costing rules that determine how to calculate cost answers for the new product. Raw material prices are either manually entered, retrieved from pricing tables, or the system can invoke a procurement activity to identify a supplier and estimate the price.

Determining which cost center and machine rate data to use when costing the process routing often depends on the company structure. For companies with their own factories and equipment, ImpactECS can dynamically calculate cost center rates or import them from the ERP standard cost module. For companies with subcontractors, just substitute the calculated rates with the agreed contract rates to calculate the routing cost. Cost comparisons between production locations or blended production costs from multiple locations are also available options when costing the routing.

The centralized costing rules include calculating costs for freight, distribution, SG&A, cost of capital, and any other relevant costs. Like materials and routings, users have the option to override default values for each cost category to both drive consistent costing processes and provide the flexibility required to generate accurate, realistic quotes.

With the costs calculated, ImpactECS can apply the desired profit margins to calculate recommended selling prices and analyze different scenarios for the quote – like order quantity breaks, payment terms, and pricing conditions – to determine the true profits. The platform can compare costs with target or competitor pricing if available to show the realized margin at each price point. ImpactECS also manages approval workflows that include stakeholders across departments and maintains quote versions to improve speed and efficiency of the quoting process.

Phase 3: Share Quotes + Analyze Results

Once pricing is approved, ImpactECS can generate formal quote documents or send the results to CRM, ERP, or other downstream systems to complete the quote process. Quote simulations makes it possible to revalue quotes with updated commodity, raw material, or other input costs as they age to manage risk and negotiate terms.

Additionally, ImpactECS’ dashboards and reporting features provides insights into overall performance of the quoting process. Users can access information like the value of outstanding quotes by customer, business unit, product type or region, monitor quotes by stage or activity, and evaluate win/loss analytics to identify opportunities.

Time to transform to Cost-Based Quoting

Companies that build products based on unique customer requirements need consistent, efficient, thorough quoting processes that eliminate under- or over-quoting, reduces errors, and provides one place to manage materials and routings, calculate costs, apply margins, and analyze results. And one thing is certain, traditional CPQ applications don’t fit the bill. Cost-Based Quoting with ImpactECS gives finance and commercial teams the ability to transform the quoting process into a competitive advantage.

What’s The Right Way to Use What-if Analytics?

“When making forecasts, there is a big difference between known levers of change and newly discovered and yet-unproven “nuggets” of information that are teased out of data. Before diving in, business leaders need to know there are right and wrong ways to engage in what-if analysis.”